Withholding Tax Expanded Rates-philippines

The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. An Expanded Withholding Tax is a tax prescribed on income payments and is creditable against the payors income tax due.

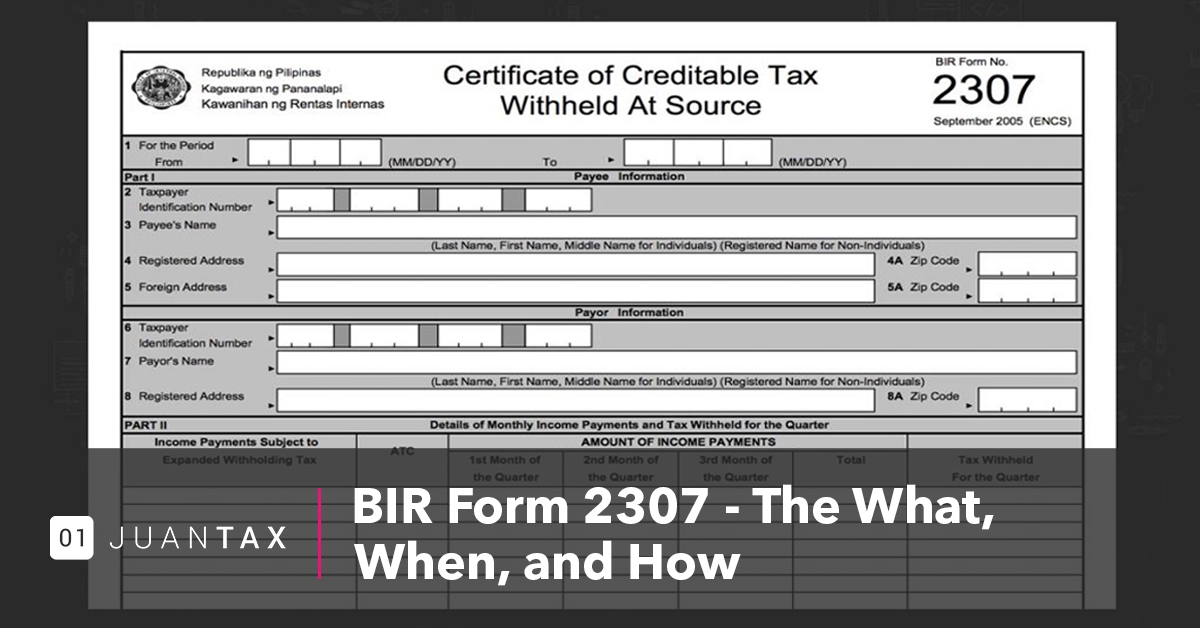

Bir Form 2307 The What When And How

In 2018 updates on capital gains from the sale of shares of stock not traded in the stock exchange were subject to fifteen percent 15 of the final tax.

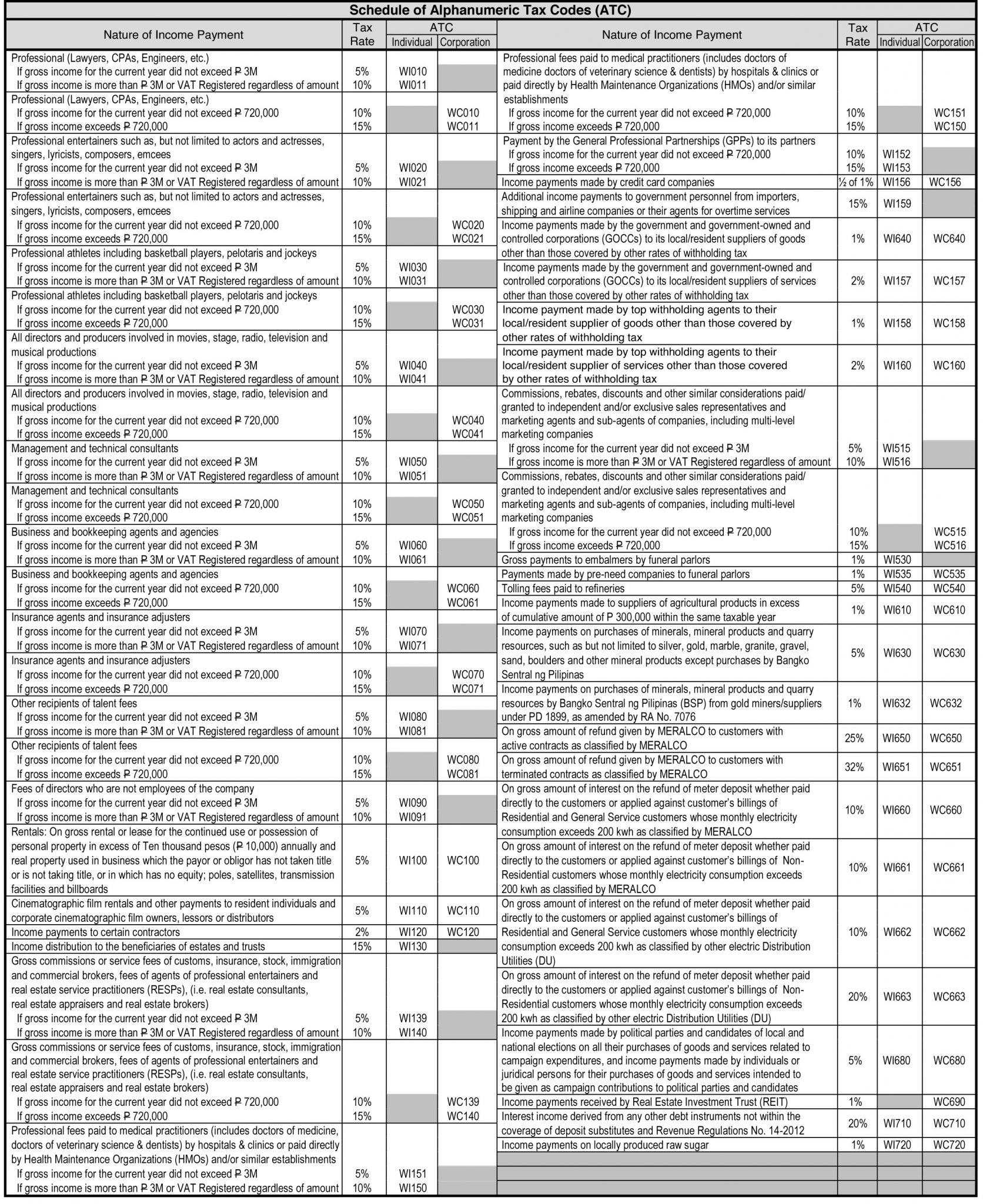

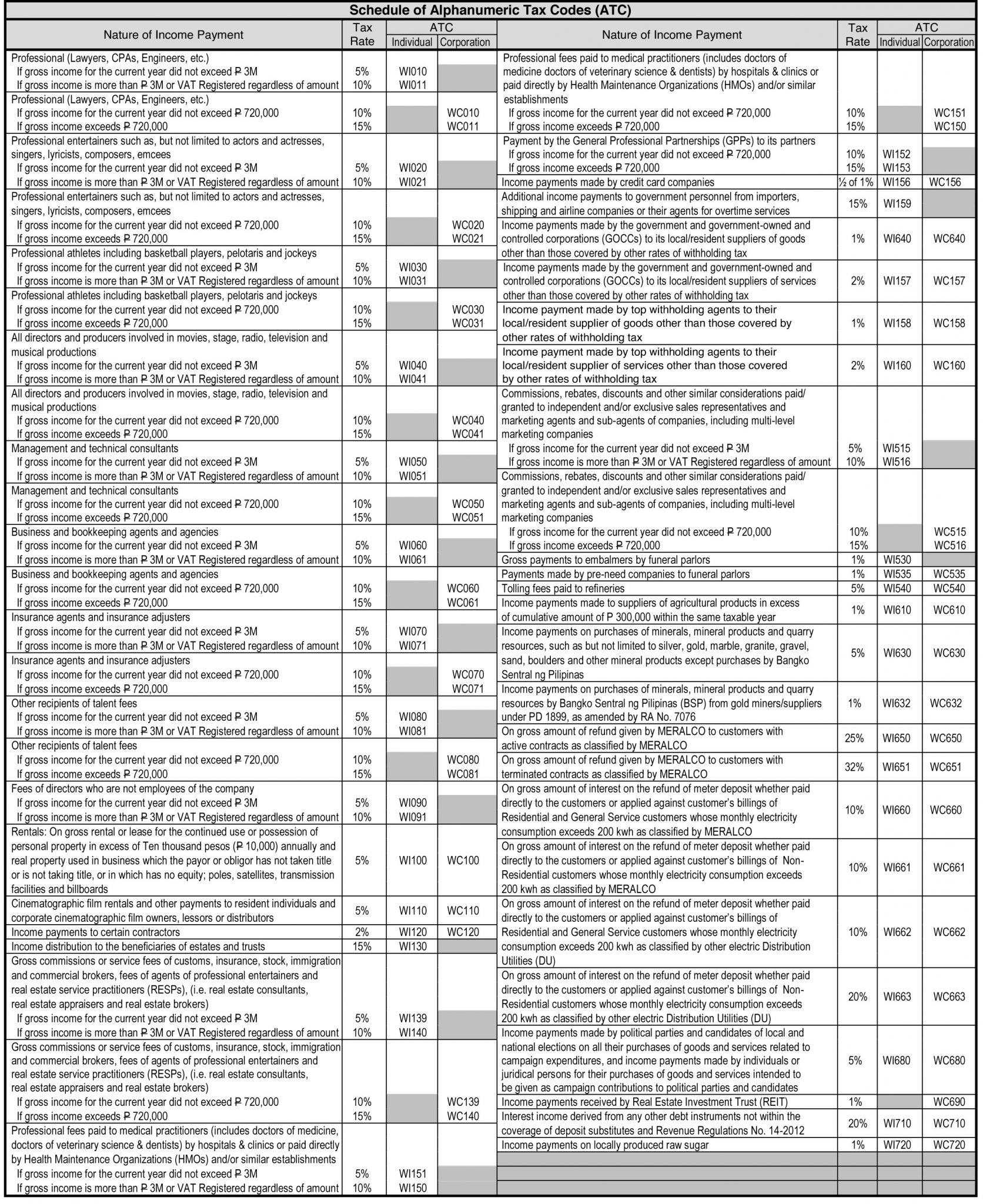

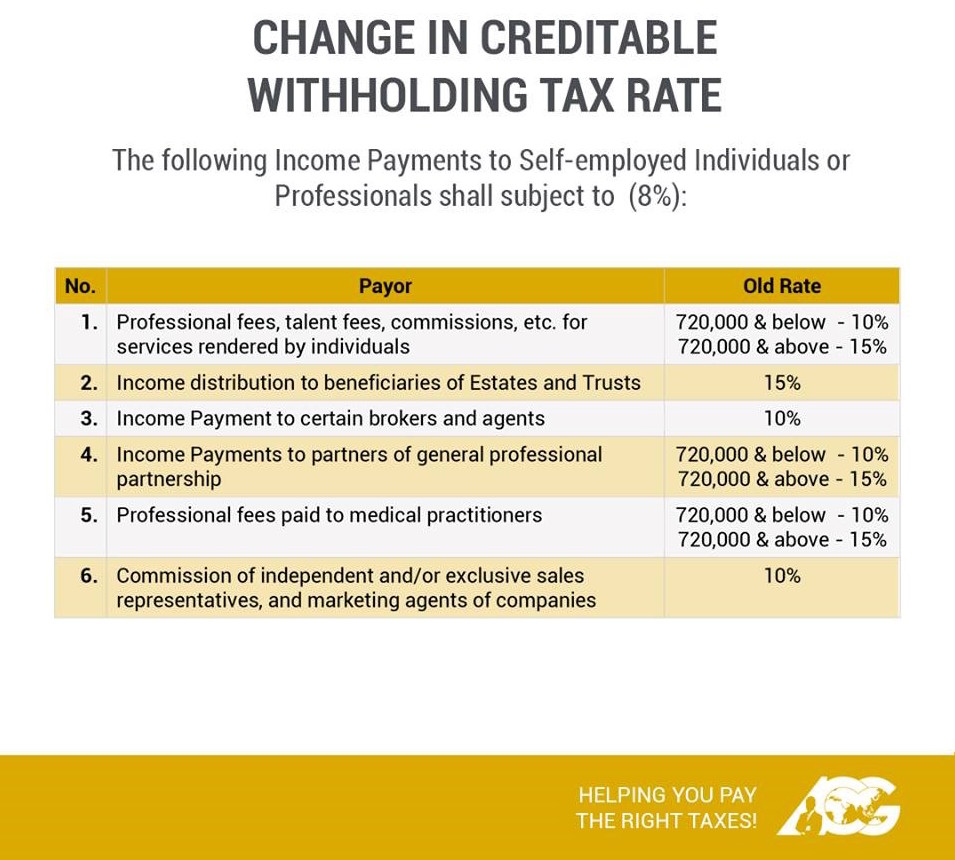

Withholding tax expanded rates-philippines. 25-50 surcharge based on tax unpaid. By implications of the tax reforms under TRAIN RA 10963 in Philippines withholding tax on professional fees is now 5 of gross income if annual income not exceeding PhP3M otherwise 10 of gross income for individuals while professional fees to juridical entities is 10 of gross income if annual gross income or receipts does not exceed P720K otherwise 15. EWT P50000 x 5.

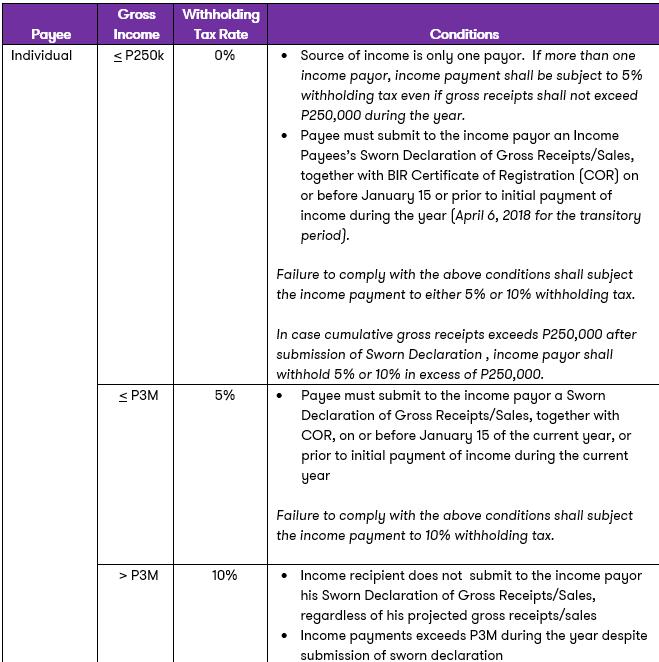

Anyone earning less than that amount is exempted automatically. Non-individuals have a lower income bracket but have higher withholding rates. Expanded Withholding Tax or EWT Tax is a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of the payee for the taxable quarteryear in which the particular income was earned.

The 10 withholding tax rate shall be applied in the following cases. The following income payments are subject to Expanded Withholding Tax. Compromise Penalty P1000 25000 every time you fail to withhold.

21 rindas Every officer or employee of the government of the Republic of the Philippines or any of its. Prior to the 2018 RR only Top 20000 private corporations duly informed by the BIR as such were required to withhold 1 and 2 EWT rates on their regular purchases. Expanded withholding tax rates are dependent on the annual salary of the individual.

The different types of working individuals included are. EWT Income payments x tax rate. Or 2 the income payment exceeds 3 million despite receiving the sworn.

Sample Computation of Expanded Withholding Tax. The rates range from 1 to 15 theres even an effectively 05 rate for a transaction taxed at 1 computed on one-half of the income payment amount. In 2018 RR No.

If your company is paying a gross monthly rental of P50000 for the office space you rented the monthly tax that should be withheld and remitted to the BIR by you is computed as follows. 10 Withholding Tax on Commission Fee or 15 Withholding Tax on Professional Fee. 1604-E Annual Information Return of Creditable Income Taxes Withheld ExpandedIncome Payments Exempt from Withholding Tax.

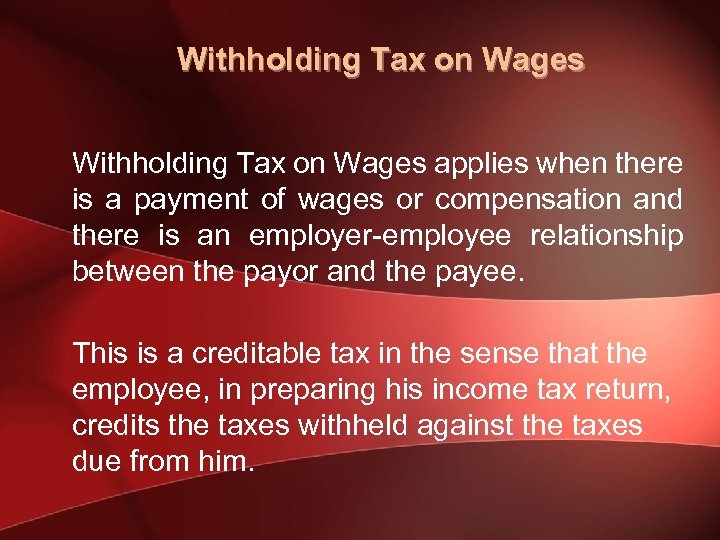

If the gross income for the year does not exceed P720000 then a 10 withholding is required. The current creditable withholding tax rules under Section 2572 of the RR has 27 subsections each imposing a different requirement to withhold creditable tax on certain income payments. There are different types of withholding taxes for corporations and individuals in the Philippines namely the Expanded Withholding Tax Withholding Tax on Compensation and Final Withholding Tax.

If the withholding agent fails to withhold expanded withholding tax heshe will need to pay penalties amounting to. 12 annual interest based on tax unpaid. Withholding Tax on Compensation deducts and withholds taxes from employees receiving compensation income while Final Withholding Tax.

Subject to 5 withholding tax. The only employees liable to pay withholding tax are those earning at least 250000 pesos per year. Late last year the tax authorities issued a notice to the public identifying the top withholding agents TWAs who are mandated to withhold expanded withholding tax EWT equivalent to one percent 1 on purchase of goods and two percent 2 on purchase of services from local or resident suppliers including non-resident aliens engaged in trade or business in the Philippines.

Insurance agents and distributors. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. Generally all incomes realized by the non-resident alien individual not engaged in trade or business within the Philippines are subject to final withholding tax.

Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents generally at the rate of 25 in the case of payments to non-resident foreign corporations and for non-resident aliens not engaged in trade or business see the Income determination section for discussions about WHT on resident corporations. 1 the payee failed to provide the income payorwithholding agent of such declaration. Tax exemption for individuals earning less than P250000.

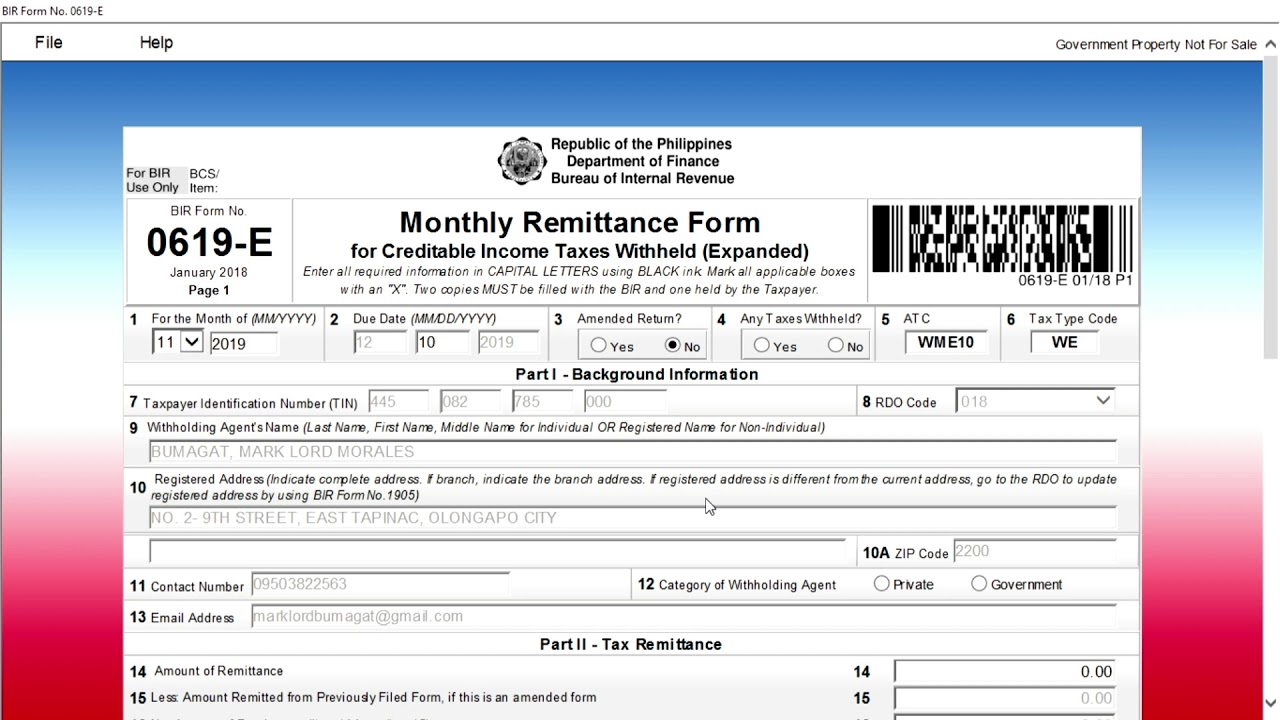

What is expanded withholding tax. The list of all income recipients-payees in this Subsection shall be included in the Alphalist of Payees Subject to Expanded Withholding Tax attached to BIR Form No. 11-2018 introduced the TWA classification which expanded the scope to include Medium Taxpayers and those taxpayers under the Taxpayer Account Management Program TAMP.

What income payments are subject to Expanded Withholding Tax. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied.

Welcome To The Withholding Tax System The Withholding

1 Withholding Tax At Source Revenue Regulations No

Understanding Withholding Taxes In The Philippines

Welcome To The Withholding Tax System The Withholding

We Re Changing Lives Withholding Taxes 1 Nature

Welcome To The Withholding Tax System The Withholding

Withholding Tax Rates Malawi Withholding Tax Taxes

Expanded Withholding Tax Ewt In The Philippines

21 Items Subject To Expanded Withholding Tax Under Train Ra 10963 Tax And Accounting Center Inc Tax And Accounting Center Inc

How To File And Pay Your Monthly Expanded Withholding Tax Using Bir Form 0619 E Part 7 Trailer Youtube

Expanded Withholding Tax Under Train Law Reliabooks

Welcome To The Withholding Tax System The Withholding

Expanded Withholding Tax Under Train Law Reliabooks

Revised Withholding Tax Table For Compensation Tax Table Withholding Tax Table Tax

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

Welcome To The Withholding Tax System The Withholding

Expanded Withholding Tax Ewt Business Software Computes For Ewt

Post a Comment for "Withholding Tax Expanded Rates-philippines"