What Are The Tax Brackets For Oregon

It consists of four income tax brackets with rates increasing from 475 to a top rate of 99. That top marginal rate is one of the highest rates in the country.

The Kicker Is Coming How Much Oregonians Are Expected To Get Back At Tax Time Local News Kptv Com

Tax Bracket Tax Rate.

What are the tax brackets for oregon. In these cases Oregon does not impose any income tax on the business even the minimum excise tax of 150. The Oregon State Tax Tables below are a snapshot of the tax rates and thresholds in Oregon they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Oregon Department of Revenue website. Tax Bracket Tax Rate.

This isnt the total amount of tax you will pay. Tax brackets for long-term capital gains investments held for more than one year are 15 and 20. 5 rows The Oregon income tax has four tax brackets with a maximum marginal income tax of 990.

State and Local Property Tax Collections Per Capita. Tax Due Amount Below Column 2- Column 1 Tax Rate 1000000. If you held an investment for less than one year before selling it for a gain that is classified as a short-term capital gain and you pay the same rate as ordinary income.

Taxable Estate Equal to or Less Than. Property Taxes Paid as a Percentage of Owner-Occupied Housing Value. The Oregon tax calculator is designed to provide a simple illlustration of the state income tax due in Oregon to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202122 tax reform calculator.

Click for a comparative tax map. These rates range from 475 to 990. The entire tax system is not From Jesus to Adam Smith there is wide agreement that a fair tax system is one based on the ability to pay asking for a bigger share of a rich persons income than a poor persons.

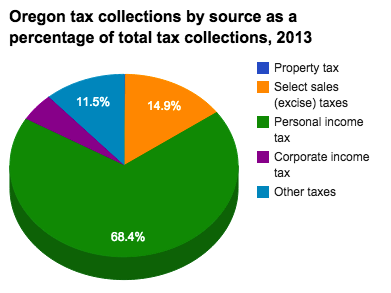

Marginal tax rate rates start at 5 percent and quickly rise to 7 percent and 9 percent as a taxpayers income goes up. Oregon has some of the highest tax burdens in the US. Thats called a progressive tax system.

Counties in Oregon collect an average of 087 of a propertys assesed fair market value as property tax per year. Oregon Property Taxes Go To Different State 224100 Avg. Corporate tax information and forms from Oregon Department of Revenue.

Oregon state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with OR tax rates of 475 675 875 and 99 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Oregon was one of the first Western states to adopt a state income tax enacting its current tax in 1930. An additional 38 bump applies to filers with higher modified adjusted gross incomes MAGI.

It starts at 10 and goes up to 16. Oregons personal income tax is progressive but mildly so. The state uses a four-bracket progressive state income tax which means that higher income levels correspond to higher state income tax rates.

Oregons personal income tax is mildly progressive. 4 rows Oregon has four marginal tax brackets ranging from 5 the lowest Oregon tax bracket. State Cigarette Tax Rate dollars per 20-pack 133.

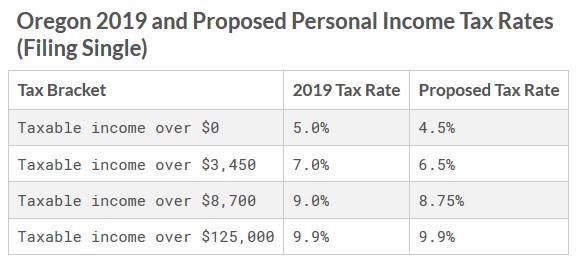

Here are the 2019 tax rates and tax bracket thresholds. 11 The business owner pays personal state income tax at ordinary rates based on which. The Oregon estate tax is graduated.

All brackets other than 5 will pay a set dollar amount in addition to the percentage of their income. 2020 tax y ear rates and tables. Personal income tax rates 2019 start at 5 rising to 7 on singlejoint tax returns with taxable income greater than 35507100 and then 9 on income greater than 890017800 up to 125000250000.

The chart below summarizes the marginal tax rates for Oregon. Oregon income tax rates The state has a progressive tax system with rates ranging from 5 to 99. 087 of home value Tax amount varies by county The median property tax in Oregon is 224100 per year for a home worth the median value of 25740000.

Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers. Full-year resident Form OR -40 filers. Oregon Income Taxes.

Click for a comparative tax map. Taxable Estate Greater or Equal to.

Personal Income Tax Oregon Office Of Economic Analysis

It S Time To Fix Oregon S Regressive Tax Structure Oregon Center For Public Policy

Oregon Diesel Taxes Explained Star Oilco

How Do I Pay My Oregon State Taxes Tax Walls

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State Of Oregon Blue Book Government Finance Taxes

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Oregon S Crazy Income Tax Brackets Editorial Oregonlive Com

Oregon S Capital Gains Tax Is Too High Oregonlive Com

2021 Portland Tax Changes Bluestone Hockley Portland Property Management

Oregon Average Property Tax Rate Ranking By County

Historical Oregon Tax Policy Information Ballotpedia

What Are The Tax Brackets H R Block

How Do I Pay My Oregon State Taxes Tax Walls

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Oregon Diesel Taxes Explained Star Oilco

How Do I Pay My Oregon State Taxes Tax Walls

Oregon Income Tax Brackets 2020

Big Kicker Likely Coming In 2020 Local State Bendbulletin Com

Post a Comment for "What Are The Tax Brackets For Oregon"