Withholding Tax Table Sap Vendor

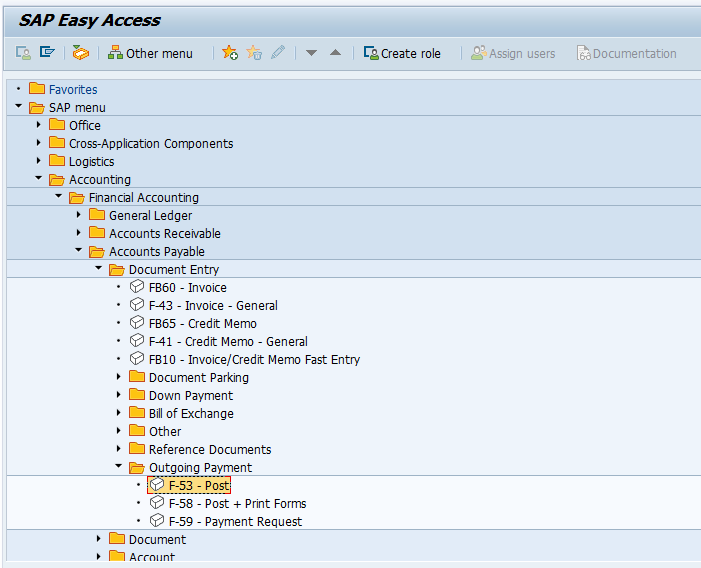

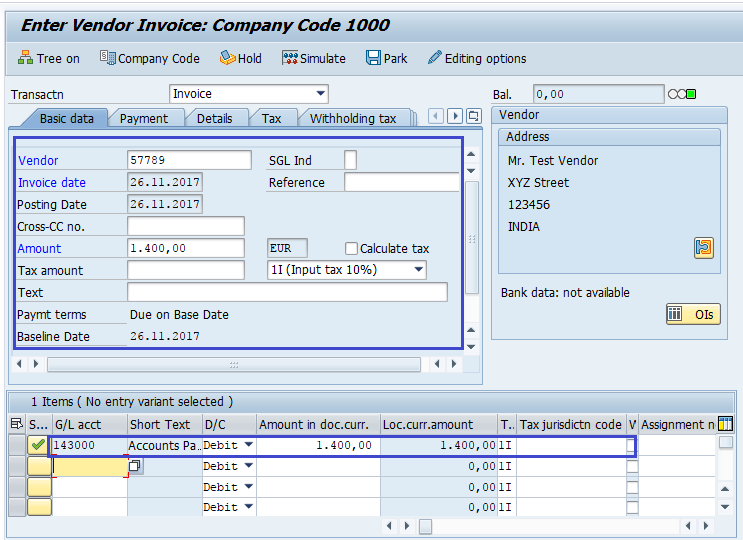

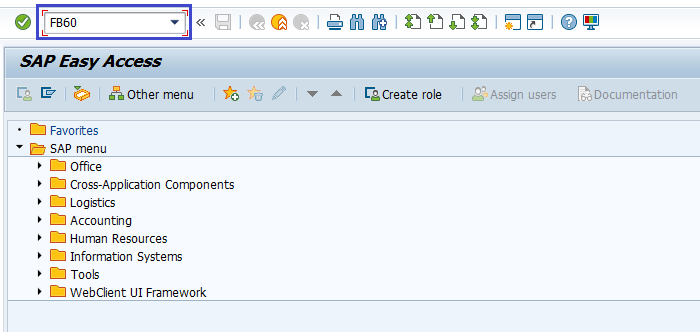

Vendor Master General Section LFA1. Step 1 Enter transaction FB60 in SAP Command Field.

Basic Sap Tax Overview Sap Blogs

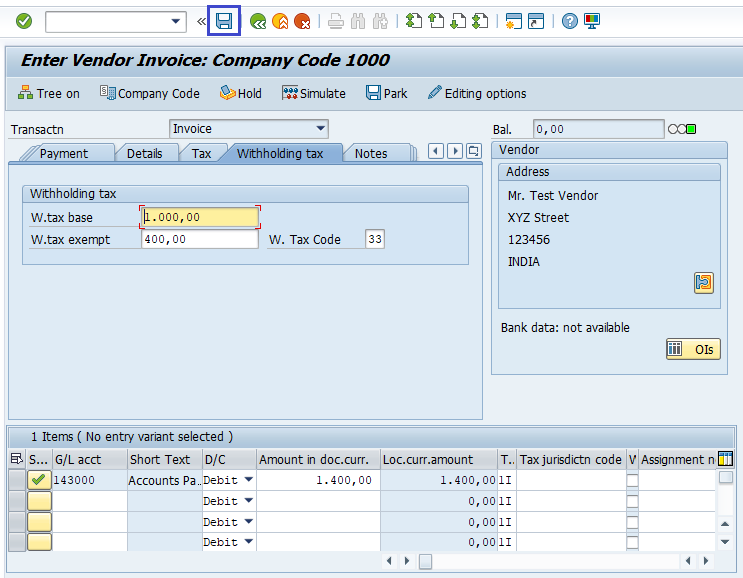

For this article I will talk about the vendor invoice creation process.

Withholding tax table sap vendor. Country Version Thailand comes with two standard variants for creating certificates one for domestic vendors SAP TH_CERTDOM and one for vendors from abroad SAP TH_CERTFOR. LFBW SAP table for Vendor master record withholding tax types X. Vendor master withholding tax accounting table is LFBW.

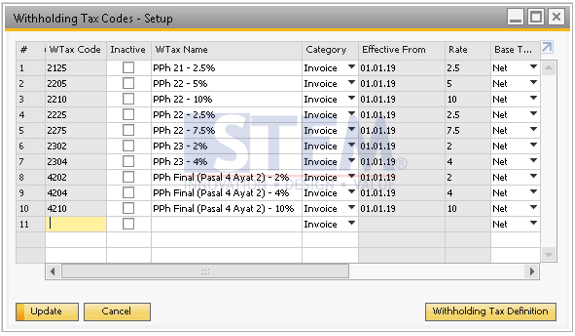

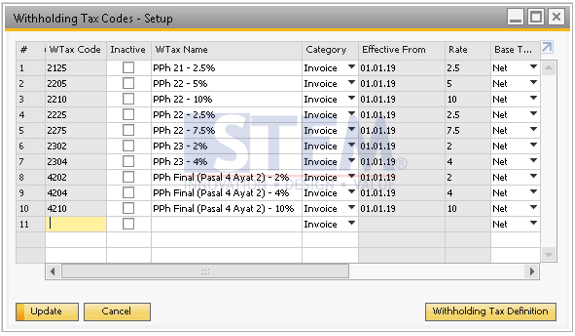

194C is to be created then under that Withholding Tax type is created one at the time of invoice and other at the time of payment and then based on the different rates prevailing in the Income tax Act different Tax Codes are to be created eg. Two ways to post withholding tax during invoice creation process. Demonstrated Design experience for World readiness World Wide TaxationRegulatory and Compliance Features IFRSGAAP and Global functionality such as Extended Withholding Tax Export and Import.

One or more can be assigned in the vendor master record. SAP Vendor Master Tables. Or in the Tax Number 2 field if it is an employer identification number EIN.

Enter the Vendor ID Withholding Tax Enabled of the Vendor to be Invoiced. The withholding tax Q is calculated now as follows. Vendor withholding tax master data in Transactional data.

Vendor master record withholding tax types X. For 194C 2. The SAP System uses withholding tax types to reflect this.

Below you can view the Table Structure columns fields SAP Wiki pages discussion threads related TCodes FMs ABAP Reports BW Datasources and Authorization Objects for LFBW. LFBW Vendor master record withholding tax types X T059Z Withholding tax code enhanced functions KNBW Customer master record withholding tax types X T059ZT Text table. Garnishments Other Withholding Documents April 2013 TABLE OF CONTENTS.

Step 3 In the next screen Enter the Following. The flow for the configuration is such that firstly the Withholding Tax Key eg. For generic information about withholding tax data in the vendor master see Defining Liability to Tax and Authorization to Deduct Tax.

View the full list of Tables for Vendor Master. In the United States certain amounts paid to vendors are subject to be reported to the Internal Revenue Service IRS. Update Tax Exemption detail in the vendor master.

While recording outgoing payment transaction FK53 or vendor invoice FB60. Withholding tax codes T059Q Withholding Tax J_1IEWT_CERTNO Number Ranges for Withholding Tax Certificates and more. The application of the percentage rate or formula The accumulation table contains a base amount WT_BSaa increased by b and a withholding tax amount WT_WTaa increased by q after document posting for posting month aa.

SAP FICO Training Tutorials for Beginners SAP FICO Define Account Group SAP FICO Reverse Clearing Document Foreign Currency Valuation Configuration SAP FICO User Exit for Vendor Master FICO Vendor Account Group Table SAP FICO Withholding Tax SAP FICO Dunning Area SAP FICO Cash Management Group Assessment Cycle vs Profit Center SAP FICO Asset. Map the Invoice time tax type tax code with Payment time tax type tax code in View V_FIWTIN_TDS_MAP. Personal property can also include equipment or any other asset of value.

The part of the vendor master record where you record information about which taxes you have to withhold from payments to a vendor. Step 2 In the Next Screen Enter Company Code you want to post invoice to. Wages sick leave or annual leave buyout vendor payments commissions bonuses and prize money.

Create a vendor first than add WH tax type and tax code in the vendor master. Vendor master record purchasing organization data. In which sap transactional table vendor witholding master data fk01- withholding tax data.

Like in OP world S4HC also have two ways to post the withholding tax. During creation of the vendor invoice and during payment posting. If you have had dealings with the same vendor or customer in more than one tax jurisdiction tax office the system prints a separate certificate for each tax office.

The IRS tax levy the notice and order to withhold and deliver and the mandatory payroll. Post Withholding Tax During Payment Posting. Vendor master dunning data LFB5.

Vendor Master Bank Details LFBK. The customer doesnt have a clue how to post withholding tax. Here we would like to draw your attention to LFBW table in SAPAs we know it is being mainly used with the SAP LO-MD Logistics Basic Data in LO component which is coming under LO module LogisticsLFBW is a SAP standard transparent table used for storing Vendor master record withholding tax types X related data in SAP.

To submit annual statements of withholding tax amounts to the Internal Revenue Service IRS and inform the affected suppliers print the required forms and generate DME files for all withholding tax reporting using the Generic Withholding Tax Reporting. 82 rows SAP Withholding Tax Tables. LFA1 Vendor Master General Section LFB1 Vendor Master Company Code LFBK Vendor Master Bank Details LFM1 Vendor master record purchasing organization data LFC1 Vendor master transaction figures LFBW Vendor master record withholding tax types X and more.

LFBW is a standard Basic Functions Transparent Table in SAP FI application which stores Vendor master record withholding tax types X data. Vendor master VAT registration numbers general section LFAS. The withholding tax type governs the way in which extended withholding tax is calculated and is defined at country level.

Several withholding tax types can be defined in the system. The system allows you to print out the certificates on different SAPscript forms for every tax office and every section of the Income Tax. I need where it is saved while posting Outgoing payment.

On the Vendor Master screen you must enter data in the following fields. Vendor Master Company Code LFB1. Q WT Bb - Q where WT is the calculation rule for withholding tax ie.

To print the withholding tax certificates for your vendors use the Generic Withholding Tax Report program. To access the vendor master on the SAP Easy Access screen choose Accounting. Taxpayer Identification Number TIN Enter the taxpayer identification number in the Tax Number 1 field if the number is a social security number SSN or an individual taxpayer identification number ITIN.

Maintain table for mapping the WH tax Type and codes TCode.

S P00 07000134 Sap Tcode For Generic Withholding Tax Reporting

Sap Fi Withholding Tax During Payment Posting

Massive Changes To Withholding Tax Code Using Cmd Ei Api Class Sap Blogs

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Lfbw Sap Table For Vendor Master Record Withholding Tax Types X

Sap Fi Withholding Tax During Vendor Invoice Posting

Withholding Tax Sap Help Portal

Sap Fi Withholding Tax During Vendor Invoice Posting

Tables With Tax Configuration In Sap Sap Expert

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

How To Post With Holding Tax During Vendor Invoice Posting Sapspot

Sap Fi Withholding Tax During Vendor Invoice Posting

How To Post With Holding Tax During Vendor Invoice Posting Sapspot

Post a Comment for "Withholding Tax Table Sap Vendor"