Withholding Tax Rates 2020-21

By Federal Withholding Tables. Since the rate is per thousand of assessed value the assessment must be divided by 1000 before being multiplied by the rate.

Federal Income Tax Withholding Method.

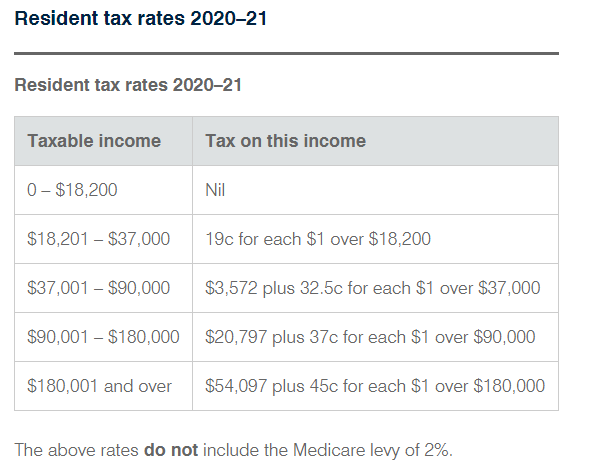

Withholding tax rates 2020-21. There are seven federal tax brackets for the 2020 tax year. The amount of income tax your employer withholds from your regular pay depends on two things. Your bracket depends on your taxable income and filing status.

The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rate. August 21 2021 by Kevin E. The 2021 New York State personal income tax rate schedules have been revised to reflect certain income tax rate reductions enacted.

The purp ose of this document is to summarize activity-wise rates and treatment of withholding income tax taking into account the amendments vide. And at the time NY. 10 10 10.

Wage Bracket Technique The 2021 Payroll Tax Table And Rates can be used after you follow the method to determine the federal tax withholding. Applicable July 01 2019 to June 30 2020 as updated vide the Finance Act 2019 WHAT THIS DOCUMENT AIMS AT. 10 12 22 24 32 35 and 37.

2130 2020 1900 1790 1680 1560 1450 1340 1220 1110 1010 2190 2080 1960 1850 1730 1620 1510 1390 1280 1170. You are responsible for reporting such withdrawal on your tax return beginning in the year of distribution. Withholding Tax Rates Applicable Withholding Tax Rates.

The amount you earn. For help with your withholding you may use the Tax Withholding Estimator. The bill would also amend Tax Law 671b to require withholding on gambling winnings in New York when such winnings would be subject to withholding under IRC 3402.

721 New York State Withholding Tax Tables and Methods Effective July 1 2021. Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2020-2021 federal income taxes. Or ii the related member paid the royalty during the same tax.

20 20 10 The above are to be enhanced by. Your withholding is subject to review by the IRS. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

This year of 2021 is additionally not an exception. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. 2021 Federal Tax Brackets The full instructions of Federal Income Tax Withholding are released by the IRS Internal Revenue Service annually.

School taxes are issued in September and payable by October 15th. CRDs will be included in your income ratably over 3-years beginning with tax year 2020 unless you otherwise elect to be taxable fully in tax year 2020. The taxable assessment is multiplied by the tax rate to produce the tax bill.

Based on your annual taxable income and filing status your tax bracket determines your federal tax rate. The information you give your employer on Form W4. CRDs are subject to federal income tax withholding at the rate of 10.

Tax Law 2089o2 provided that a taxpayer paying a royalty to a related person was not required to add-back to entire net income any deduction for such payment if i the related members were part of a combined report combined reporting exception. December 2020 Department of the Treasury Internal Revenue Service. Give Form W-4 to your employer.

Updated up to June 30 2021. The bill would amend Tax Law 631b to include New York gambling winnings in excess of 5000 as taxable New York source income to New York nonresidents. The FBR said that every prescribed persons as per Section 155 of Income Tax Ordinance 2001 shall collect deduct withholding tax from recipient of rent of immovable property at the time the rent is.

In 2021 seven percentage groups continue to be applied because the tax prices starting from 10 12 22 24 32 35 to the biggest one 37. View federal tax rate schedules and get resources to learn more about how tax brackets work. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

Federal Biweekly Tax Tables 2021. New Yorks income tax rates range from 4 to 882. Federal Withholding Tables.

These are the rates for taxes. Categories Federal Tax Withholding Tables Tags 2021 federal tax withholding tables biweekly are there new tax tables for 2021 federal biweekly tax table 2021 what is the federal tax rate for 2021 what is the federal tax table for 2020. The FBR updated the withholding tax card 2020-2021 after incorporating amendments to Income Tax Ordinance 2001 made through Finance Act 2020.

2021 Federal Tax Brackets. For heads of household the threshold is 1616450 and for married people filing jointly it is 2155350.

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Marketing Cost

China S Individual Income Tax Everything You Need To Know

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Mbv Taxation Accounting 2020 2021 Tax Rates Great News For Next Tax Season Providing Tax Withheld Amounts By Your Software Provider Don T Change You Should Get A Greater Refund

China S Individual Income Tax Everything You Need To Know

2020 21 Tax Tables Lcl Accounting

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

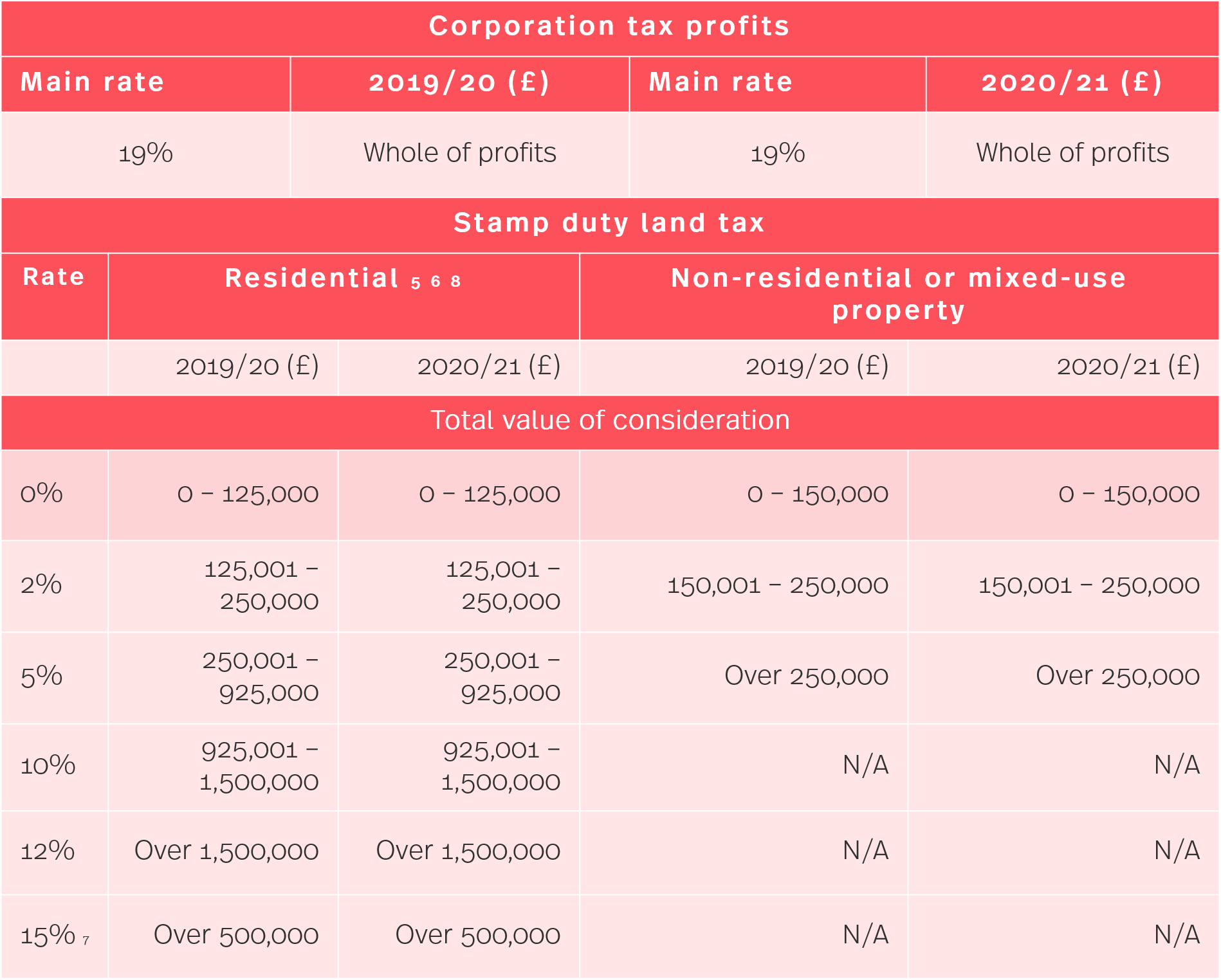

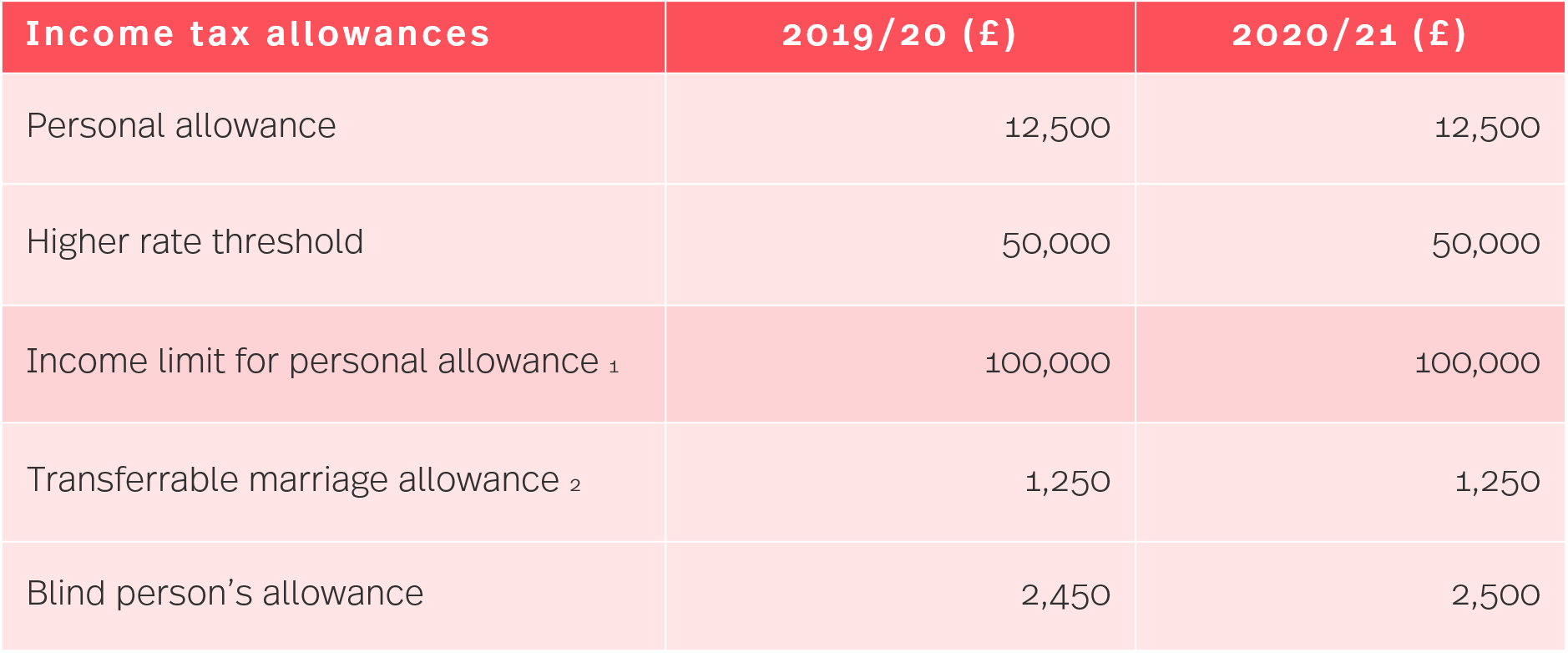

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Missouri Income Tax Rate And Brackets H R Block

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Techdrivenpakistan Pmiklaunchestechzones In 2021 Enterprise Incentive Technology

Post a Comment for "Withholding Tax Rates 2020-21"