Income Tax Withholding Rates For Tax Year 2019-20

Marys County 3. Withholding Tax Rates Applicable Withholding Tax Rates.

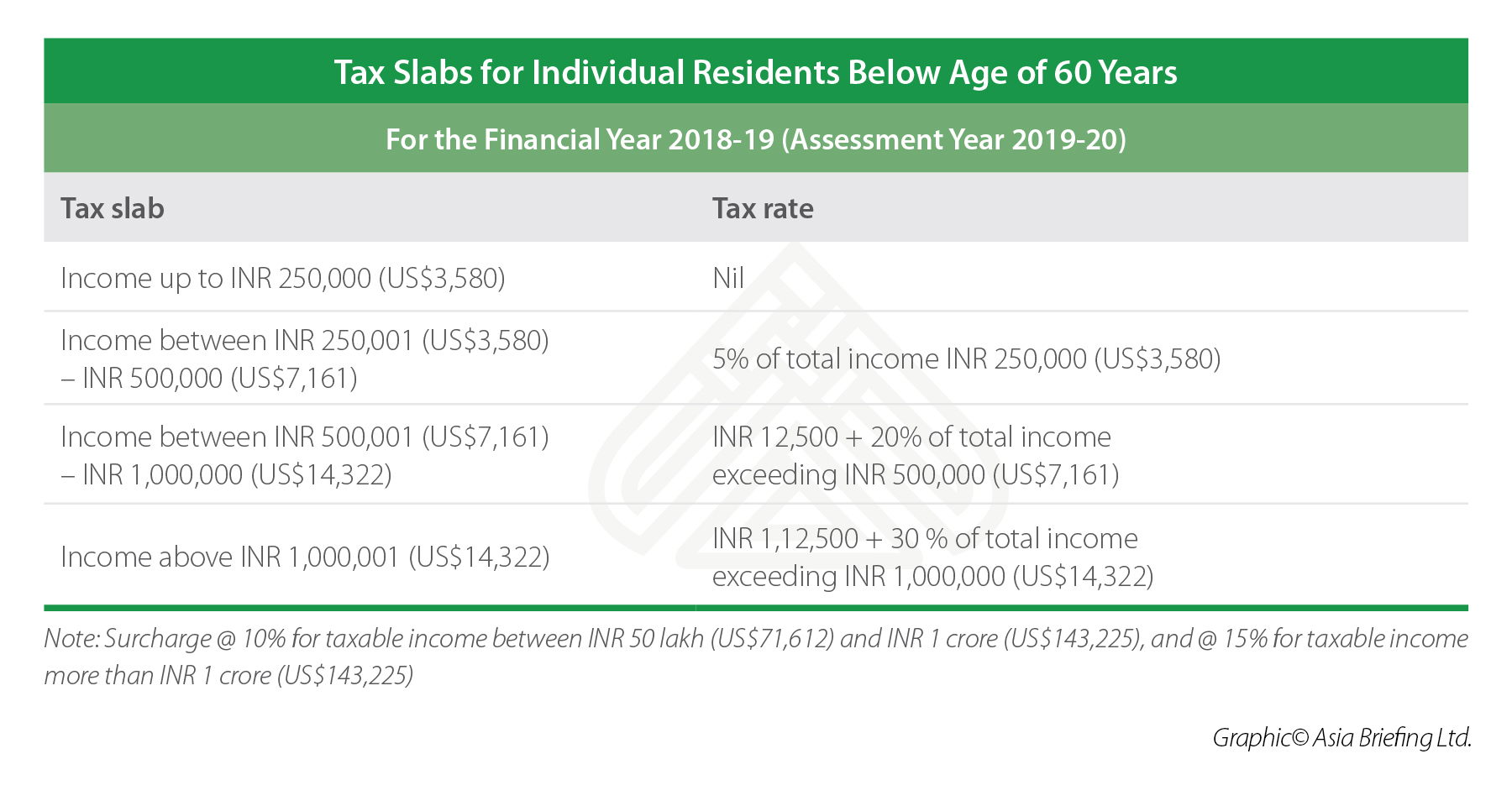

Current Income Tax Rates For Fy 2019 20 Ay 2020 21 Sag Infotech

19 20 010 004 000 000 000 000 000 000 000 000 000.

Income tax withholding rates for tax year 2019-20. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. Your Estimated 2019 Tax Return Forms Needed Based on the Information you entered on this 2019 Tax Calculator you may need the following 2019 Tax Year IRS Tax Forms to complete your 2019 IRS Income Tax Return. Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS.

Withholding Formula and Tables for 2019 and After. 2019 Percentage Method Tables and Wage Bracket Ta-bles for Income Tax Withholding. Federal Board of Revenue FBR has issued rate of withholding tax to be collected on income from property during Tax Year 2019.

In 2019 the IRS collected more than 35 trillion in Federal taxes paid by individuals and businesses. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Legislation was passed in October 2019 that extended the concessional tax treatment of genuine redundancy and early retirement scheme.

Local Tax Rate Changes - For tax year 2019 Caroline County has increased its rate to 32. The tables include federal withholding for year 2019 income tax FICA tax Medicare tax and FUTA taxes. Virginia Income Tax Withholding Table For Wages Paid After December 31 2018 IF WAGES ARE- AND THE TOTAL NUMBER OF PERSONAL EXEMPTIONS CLAIMED ON.

1038 available at IRSgovirb 2018-51_IRBNOT-2018-92 provides that until April 30 2019. The withholding agent is responsible for collecting under Section 155 of Income Tax Ordinance 2001 from recipient of rent of immovable property at the time the rent is actually paid according to withholding tax card for tax year 2019 issued by. Schedule 13 Tax table for superannuation income streams NAT 70982 Schedule 4 Tax table for return to work payments NAT 3347 Age limits for genuine redundancy and early retirement scheme payments.

Income taxes in the United States are imposed by the federal government and most statesAccording to a 2019 study by the Tax Foundation Local income taxes are also imposed by 4964 taxing jurisdictions across 17 states with a heavy concentration in Rust Belt states particularly Ohio and Pennsylvania The income taxes are determined by applying a tax rate which may increase as income. State Forms are not listed here. Individuals accounted for about 56 of.

Anne Arundel County 281 Baltimore County 32 Dorchester County 32 Kent County 32 St. Notice 2018-92 2018-51 IRB. 2019 federal income tax withholding.

For assistance contact us at 8043678037. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. No income tax is applicable for annual rent income which is equal to or less than Rs 200000- In case the tenant is withholding agent for tax purpose he will deduct tax according to the following slab at.

This Rate Card may be downloaded from Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 1 DIVIDEND INCLUDING DIVIDEND IN SPECIE. 15 if the 37 mandatory flat rate withholding applies or if the 22 optional flat rate withholding is being used to figure income tax withholding on the supplemental wage payment. Most Pennsylvania cities tax income with Philadelphia leading the way at 389.

It is rare that an employee would wind up having withholding and a tax liability that match exactly. Once you register for a household employers withholding tax account you must file a Form VA-6H for each year that you keep the account open even if you have no tax to report. Steves employer will use the 2019 withholding table for the entire year.

Ohio has more than 550 cities and towns that tax personal income. The following payroll tax rates tables are from IRS Notice 1036. For tax year 2020 the following have increased its rates.

In this very simple scenario the employee is pretty close. Total withholding for 2019 will be 4390. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

For example while there are seven tax brackets. Please note the rate on 2019 Form PV. 620 for the employee and 62 for employer.

Scranton checks in at 34. Withholding Information - Maryland Office of the Comptroller. Failure to file could result in penalties of up to 30 of the tax due.

Rounding To figure the income tax to withhold you may reduce the last digit of. The New 2019 Federal Income Tax Brackets and Rates for Capital Gains Capital gains are taxed at different rates from ordinary income. Amendment made in income tax law through Finance Act 2019 results in addition of more slab rates applicable to rental income of property.

Updated up to June 30 2021. How Tax Brackets Add Up. The top marginal income tax rate of 396 percent will hit taxpayers with taxable income of 418400 and higher for single filers and 470700 and higher for married couples filing jointly.

The U S Federal Income Tax Process Income Tax Income Tax Return Federal Income Tax

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

How To Calculate Income Tax Slab Rate For Individuals Basics Of Inco

Income Tax Rate On Private Limited Company Fy 2020 21 Ay 2020 21

How To Calculate Income Tax In Excel

India Income Tax Calculator For Ay 2019 20 India Briefing News

Things That You Absolutely Must Know If You Have Received A Notice Under Section 139 9 For Itr Rectification From The Income Income Tax Return Income Tax Tax

Income Tax Deductions Exemptions Fy 2019 20 Wealthtech Speaks

Income Tax Return Filing Income Tax Return Income Tax Tax Return

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Income Tax 2019 20 Pw Accountants Ltd

Income Tax Rates For Financial Year 2019 20 And 2020 21

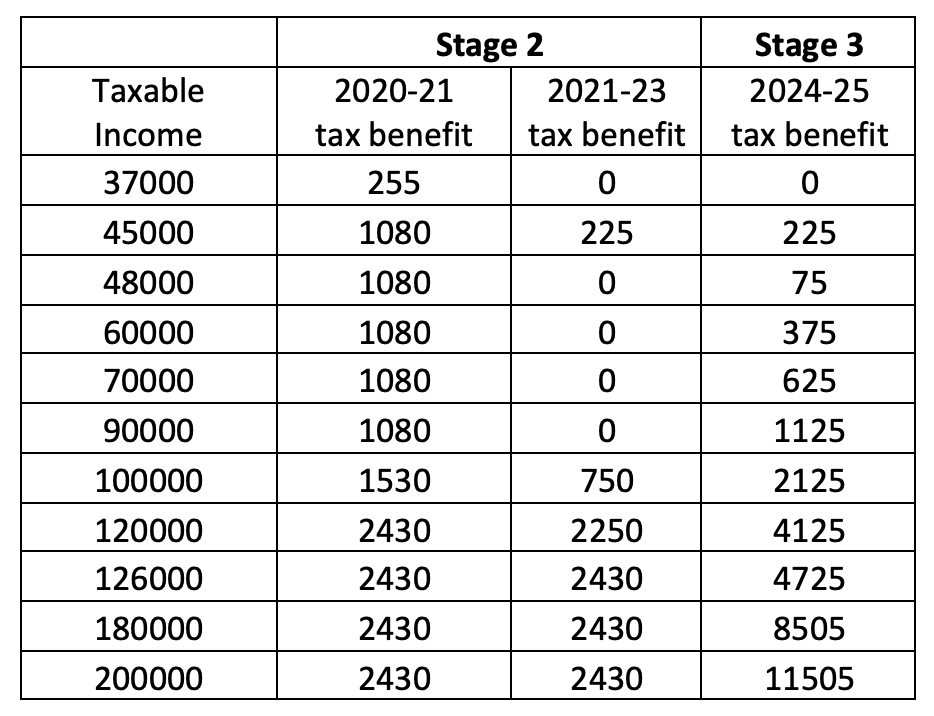

Budget Forum 2020 Progressivity And The Personal Income Tax Plan Austaxpolicy The Tax And Transfer Policy Blog

Latest Tds Rate Chart Fy 2019 20 Ay 2020 21 Basunivesh Dividend Income Chart Tax Deducted At Source

2021 E Calendar Of Income Tax Return Filing Due Dates For Taxpayers In 2021 Tax Saving Investment Income Tax Income Tax Return

Post a Comment for "Income Tax Withholding Rates For Tax Year 2019-20"