Withholding Tax Rates Ukraine

Other A 6 withholding tax is levied on freight charges. This advance payment can be later offset against CIT but not against other taxes.

Everything you need to know about taxes.

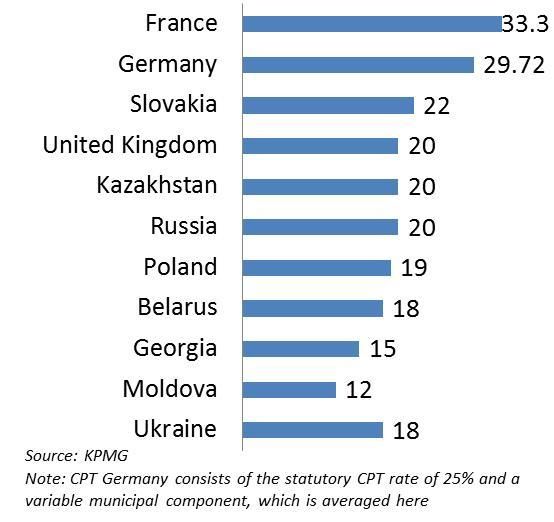

Withholding tax rates ukraine. A 20 surtax applies to payments to nonresidents for advertising services performed outside Ukraine. In other words the tax authoritys position was that if it did not agree with the economic reasonableness of the transaction with a non-resident and that the transactions principal purpose was to obtain the reduced withholding rate benefits under the treaty the taxpayer may be subject to a rate of withholding tax at 15 plus penalties. Dividends paid by Ukrainian company to another legal entity are subject to advance corporate income tax at regular rate 18.

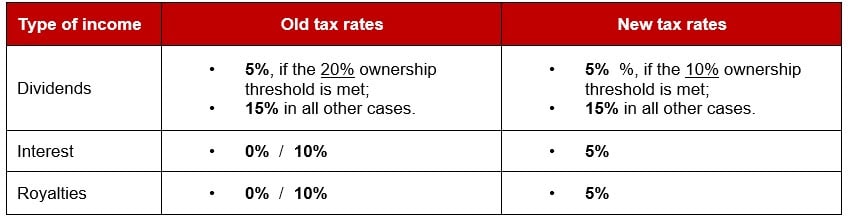

Dividends paid by non-residents mutual investment funds and non-payers of CIT in Ukraine are taxed at 9. On 30 October 2019 the Ukrainian Parliament finally ratified the long-awaited Protocol concluded in 2015 and ratified by the Cypriot Government in the same year amending the Cyprus-Ukraine Double-Tax Treaty CY-UKR DTT thereby marking the finalisation of formal internal procedures and thus enabling its entrance into force which is expected to happen on 1 January 2020. Income received by an individual is taxed at 18 9 5 or 0 rate depending on the type of income in some cases tax residency of the individual and other relevant factors.

Withholding tax rates of up to 12 apply on insurance payments to nonresidents. Ukraine and Austria have agreed to sign a protocol to their double taxation agreement to increase withholding tax rates on dividends interest and royalty income. Dividends paid by resident CIT payers except mutual investment institutions are taxed at 5.

The protocol increases the withholding tax rate for dividends and interest to 15 percent and five percent respectively. Other payments including payments for engineering services lease payments and agency and brokerage fees are also subject to 15 WHT but payments for most other services are not subject to withholding. There is no branch profits tax specifically imposed in the corporate income tax section of the tax code and the Ukrainian tax authorities generally agree that no tax should be withheld if there is a tax.

Dividends paid by one resident CIT taxpayer to resident company which is a CIT-payer are exempt of CIT. Nonresidents are generally taxed at 18 on all their income from Ukraine withheld at source. Clients with operations or sales in Ukraine should be aware that recent amendments to the Ukrainian Corporate Profits Tax Law provide that withholding tax rates on passive income and some types of active income of foreign legal entities cannot be reduced by application of double tax treaties.

New regulations adopted by the Ukrainian Cabinet dealing with withholding tax permit Ukrainian resident paying entities to apply privileged tax treaty rates without prior authorisation. Dividends that are not ordinary dividends are taxed like salary ie. Generally agree that no tax should be withheld if there is a tax treaty between the country of the head office of the branch and Ukraine.

International conventions and avoidance of double taxation withholding taxes. A 15 withholding tax is levied on dividends paid to a nonresident unless the rate is reduced under a tax treaty. Other taxes on corporations.

Income of individual persons. Previously non-resident taxpayers had to apply under Resolution No 825 to obtain advance clearance of a payment at privileged treaty rates or had to apply. The amounts loaned by the nonresident were generated from the issuance of Eurobonds listed on an international stock exchange recognized by the Cabinet of Ministers.

In 2016 the minimum monthly salary is UAH1450 US45 or UAH17400 544 for twelve months. Passive income dividends interest royalties from Ukrainian sources that is paid to non-resident entities is generally subject to 15 WHT. This section provides a detailed overview of the type of income and applicable tax rates for individuals in Ukraine.

The withholding tax rate on interest paid to nonresidents on loans made to Ukrainian residents is reduced from 15 to 5 if the following requirements are met. Re-examining the withholding tax rates applicable to payments covered by the Ukraine-Austria Tax Treaty Tax Treaty At the same time please note that the increase of withholding tax rates should not economically affect the taxpayers who can fully credit them against corporate or personal taxes paid in their country of residence.

.png)

The Protocol Amending The Ukraine Cyprus Double Tax Treaty Entered Into Force U S Ukraine Business Council Usubc

Creating Post Communist Tax Regimes And Measuring Tax Compliance Chapter 4 Taxes And Trust

Ukraine Market Profile Hktdc Research

Introduction Of The Exit Capital Tax Negative Short Run Fiscal Impact Necessitates Solid Budgeting Voxukraine

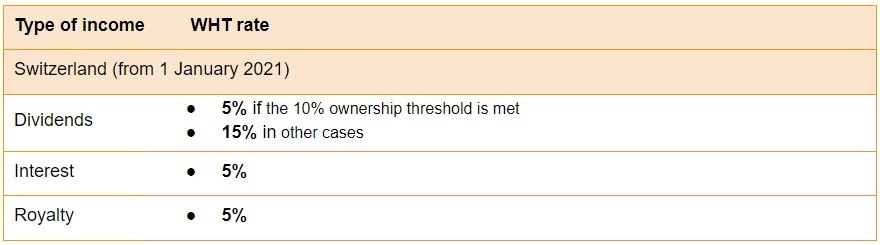

The Protocol Amending The Ukraine Switzerland Double Tax Treaty Entered Into Force

Https Www Pwc Com Ua En Publications Assets Tax Newsletter 2021 Ukrainian Tax Changes Pdf

Pandemic Of Tax Injustice In Ukraine Tax Justice Network

What You Need To Know About Payroll In Ukraine

The Tax Code Of Ukraine Datasets Resourcedata

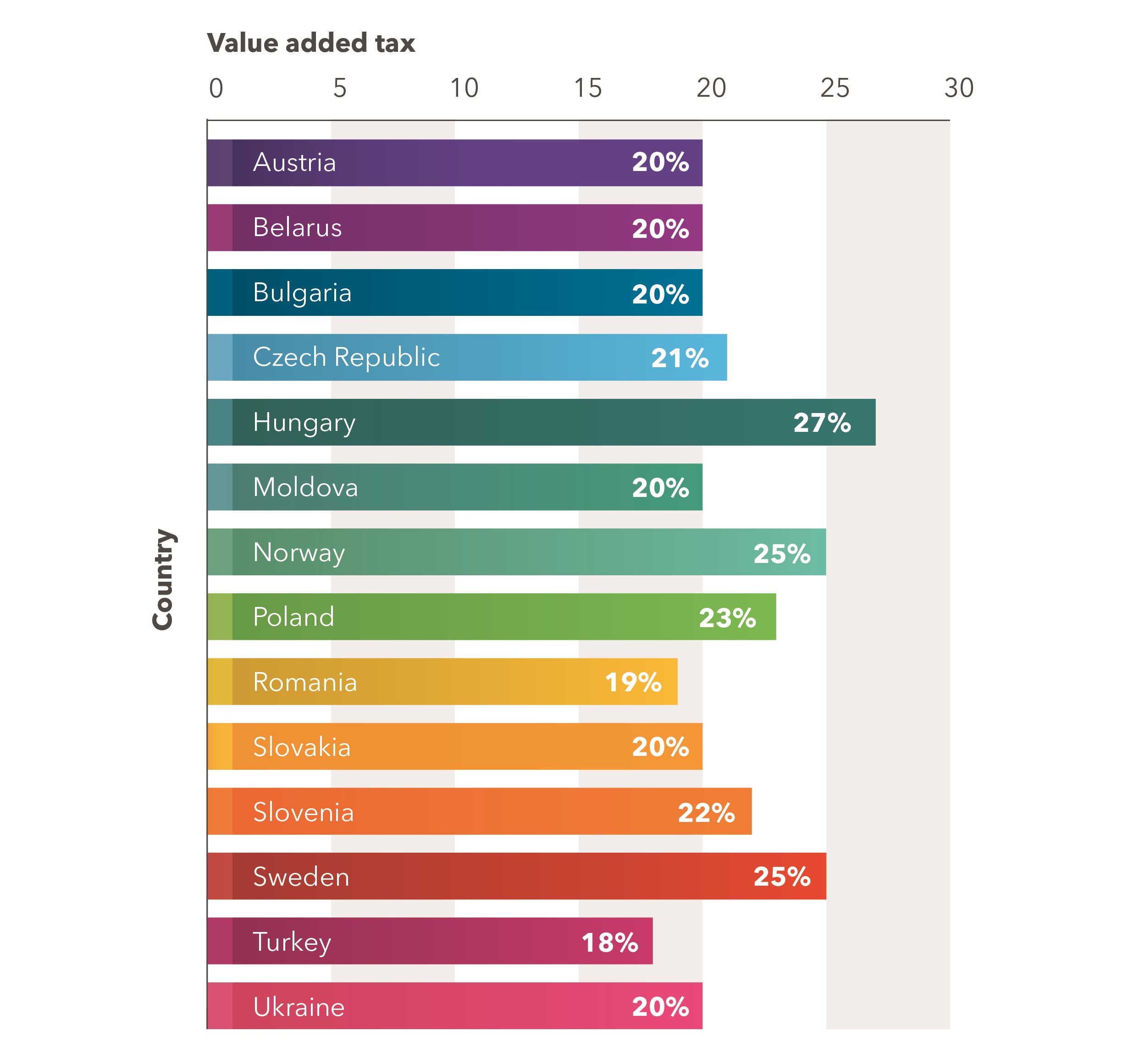

Tax System Of Ukraine Vat Single Social Contribution And Property Tax Dlf Attorneys At Law

Ukraine Technical Assistance Report Reducing Social Security Contributions And Improving The Corporate And Small Business Tax System In Imf Staff Country Reports Volume 2016 Issue 025 2016

Ukraine Technical Assistance Report Reducing Social Security Contributions And Improving The Corporate And Small Business Tax System In Imf Staff Country Reports Volume 2016 Issue 025 2016

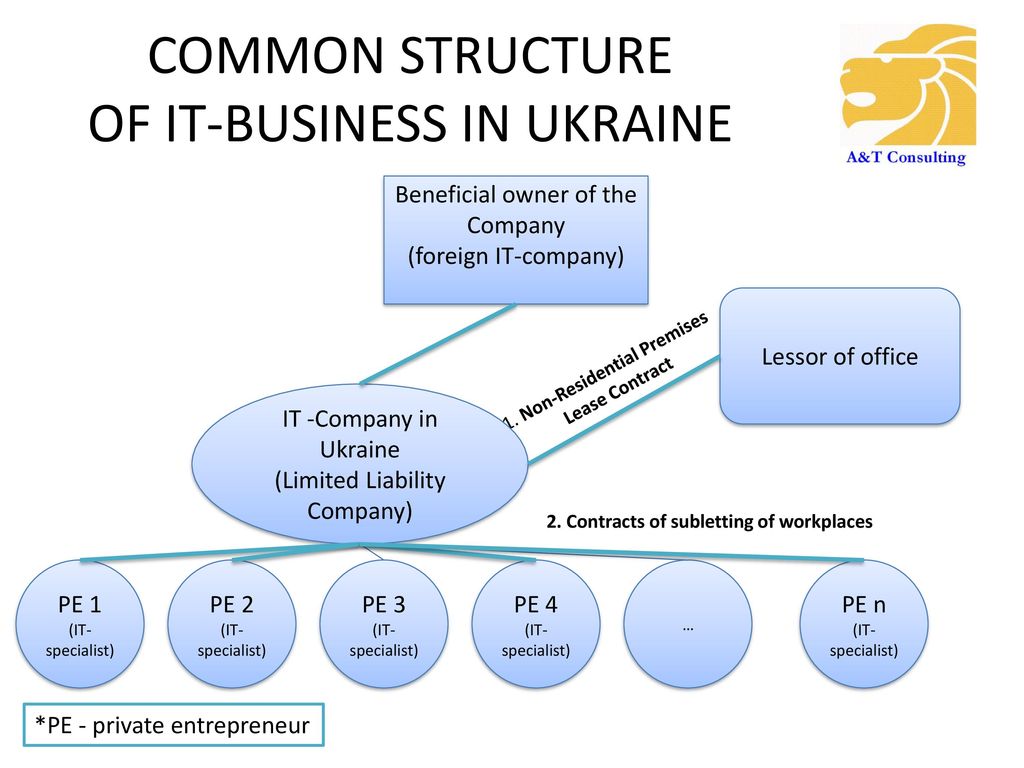

Tax Guide Of Doing It Business In Ukraine Ppt Download

Ukraine Ratification Of The Protocol To The Tax Treaty With Austria

Post a Comment for "Withholding Tax Rates Ukraine"