Withholding Tax Rates By Country 2018

The interpretation of these graphs often leads to confusion. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends.

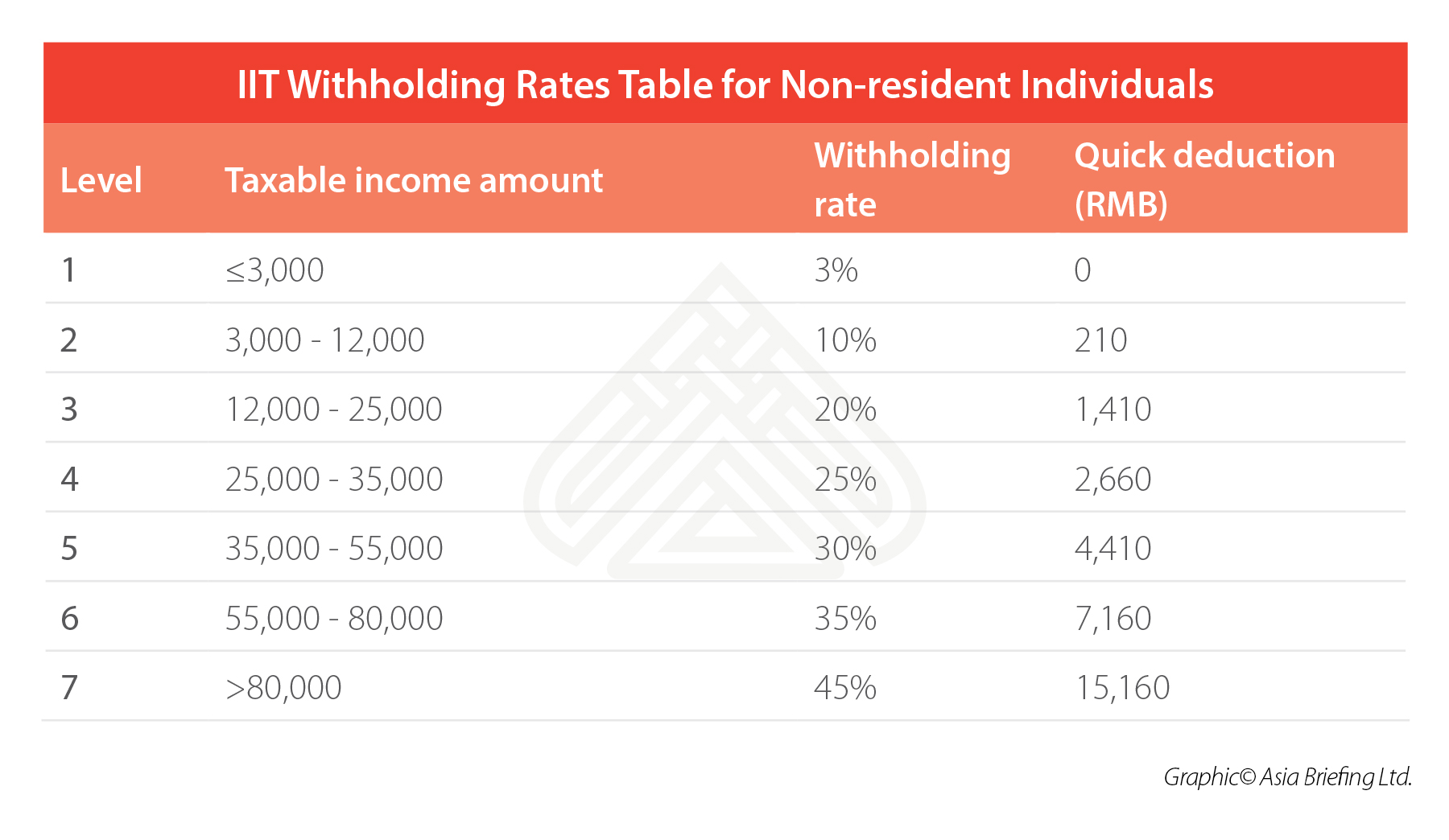

How To Calculate And Withhold Iit For Your Employees In China

4 Non-Resident Withholding Tax Rates for Treaty Countries Non-Resident Withholding Tax Rates for Treaty Countries 135 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Serbia 10 515 10 1525 Singapore 15 15 15 25 Slovak Republic 10 515 010 1525 Slovenia 10 515 10 0101525 South Africa 7 10 515 610 25.

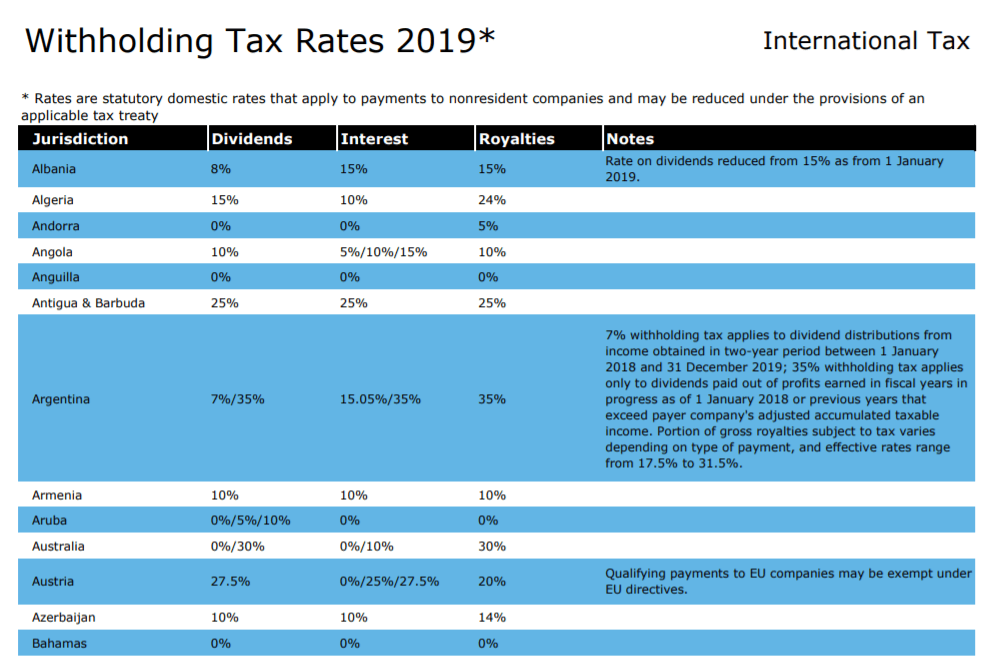

Withholding tax rates by country 2018. 3 Further to Frances second Amended Finance Act 2012 entering into force on 18 August 2012 the 30 WHT on dividend payments to foreign investment funds. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Corporate Tax Rates 2021 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax.

The list focuses on the main indicative types of taxes. As some countries change the withholding tax rate every year this list can be a valuable tool for investors holding or planning to invest in foreign stocks. Update For the latest rates go to.

Dividend Withholding Tax Rates by Country for 2018 in pdf Related. A common mistake is to interpret the top marginal tax rate as the effective rate of taxation applied to the rich. WHT rate of 16695 0 from 1 January 2018 foreign non-UCITS funds should therefore be entitled to benefit from a comparable effective tax rate on their Belgian source dividend income.

Corporate - Withholding taxes. 2020 Global Withholding Taxes. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income.

25 0 0 The Parliament has adopted a 15 withholding. You can view the complete list of withholding tax rates for every country here. Dividend Withholding Tax Rates by Country for 2018.

Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15. As you can see some nations are far friendlier to foreign dividend investors than others. Dividends paid to a foreign entity are subject to withholding tax at a rate of 25 percent 35 percent if paid to a resident of a black-listed country or if paid or made available in accounts in the name of 1 or more holders acting on behalf of undisclosed 3rd parties.

Dividends are not subject to withholding tax in the case of qualified participations. This is incorrect because the top marginal rate applies as the. SP Dow Jones Indices.

Data are taken from Form 8975 - Country-by-Country Report and Form 8975 Schedule A - Tax Jurisdiction and Constituent Entity Information Tax Year 2018 Country-by-Country Report Data Sources and Limitations PDF Statistical Tables The following tables are available as. This guide presents tables that summarize the taxation of income and gains derived from listed securities from 123 countries as of December 31 2020. The top five are Germany 393 Belgium 393.

The Withholding Tax Rates for Foreign Stock Dividends for 2017 are shown in the table below. Income tax including the requirement that the income be remitted to your country of residence if that is a. As we can see the sharp trend of reducing top marginal tax rates after the 1980s was a global phenomenon expanding both developed and developing countries.

You must meet all of the treaty requirements before the item of income can be exempt from US. Since this tax can take a huge chunk of dividends sometimes it is important to review the tax. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate.

2019 Global Withholding Taxes. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35. This is a simple and quick reference table to identify the withholding tax rate for a country.

List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual. The withholding tax rate may be reduced under a tax treaty. Lets look at the countries with the highest all-in average personal income tax rates at the average wage for a single person with no children.

Income Tax Withholding Rates For Tax Year 2017-18 Income Tax Withholding Rates Filer Non-Filer Dividends from privatized power projects or companies set up for power generation or companies supplying coal exclusively to power generation projects 750 750 Dividends received by a company from a collective investment scheme REIT scheme or a mutual fund other than a stock fund 25. The withholding tax rates for dividends by country has been updated by SP Dow Jones for 2018. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Is Dividend Withholding Tax Important In Investing Investment Moats

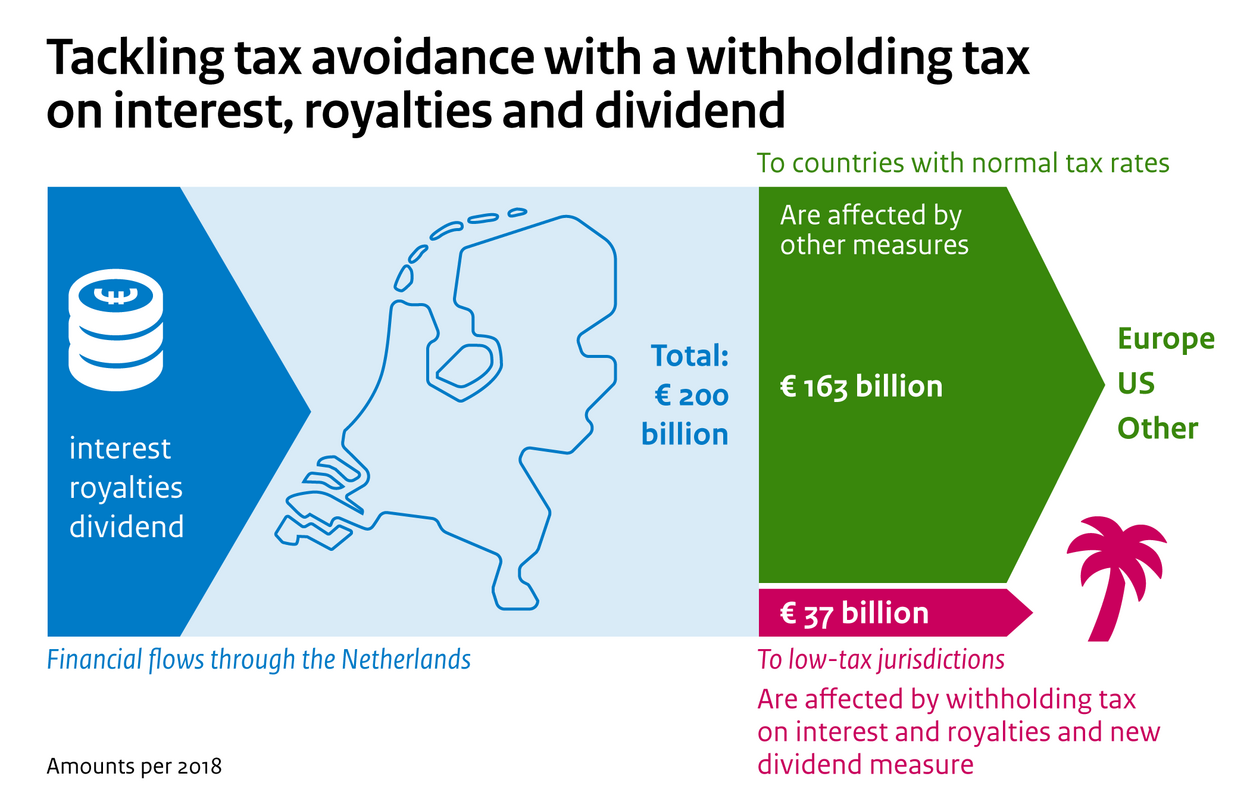

Conditional Withholding Tax On Dividend Payments Proposed Deloitte Netherlands

Dividend Withholding Tax Bill Submitted News Item Government Nl

Conditional Withholding Tax On Dividend Payments Proposed Deloitte Netherlands

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Global Corporate And Withholding Tax Rates Tax Deloitte

Countrywise Withholding Tax Rates Chart As Per Dtaa

Tax Changes 2019 Withholding Tax Vgd

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Global Corporate And Withholding Tax Rates Tax Deloitte

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

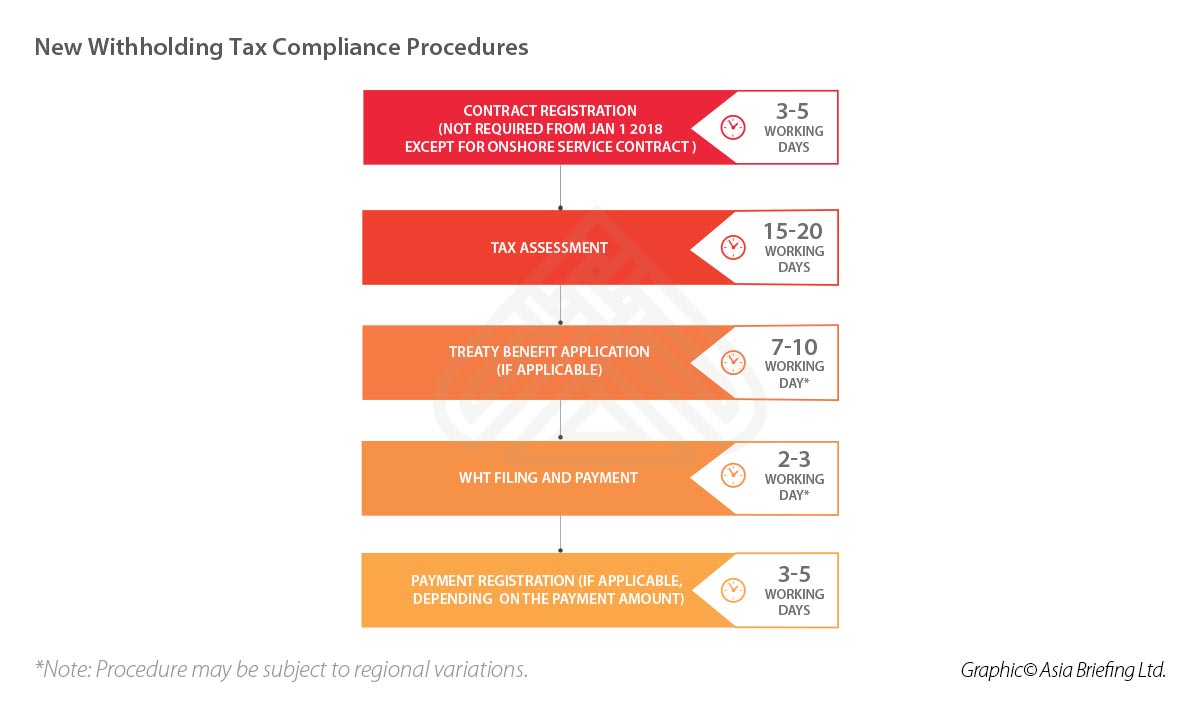

Withholding Corporate Income Tax In China China Briefing News

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

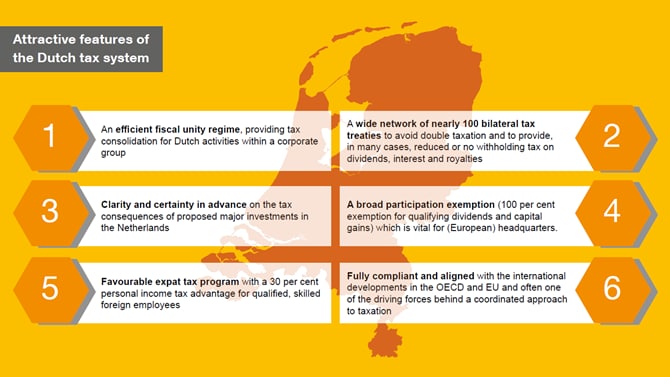

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Post a Comment for "Withholding Tax Rates By Country 2018"