Withholding Tax Rates By Country For Foreign Stock Dividends

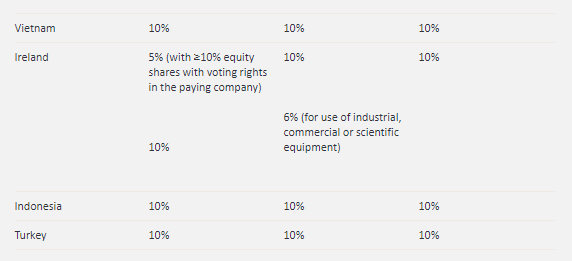

Among the high withholding tax rate countries. Income tax including the requirement that the income be remitted to your country of residence if that is a.

Cash Flow Statement Cash Flow Statement Investing Cash Flow

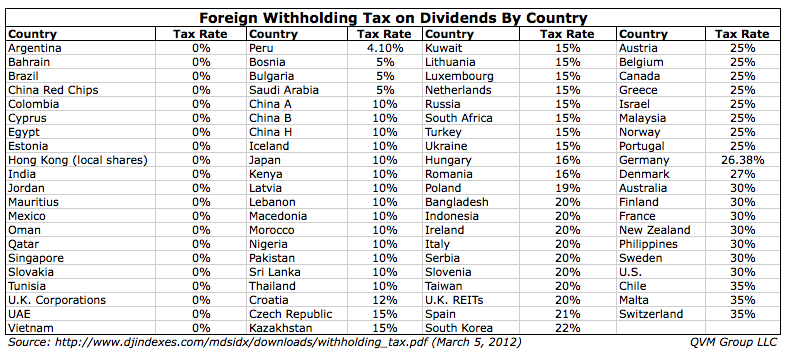

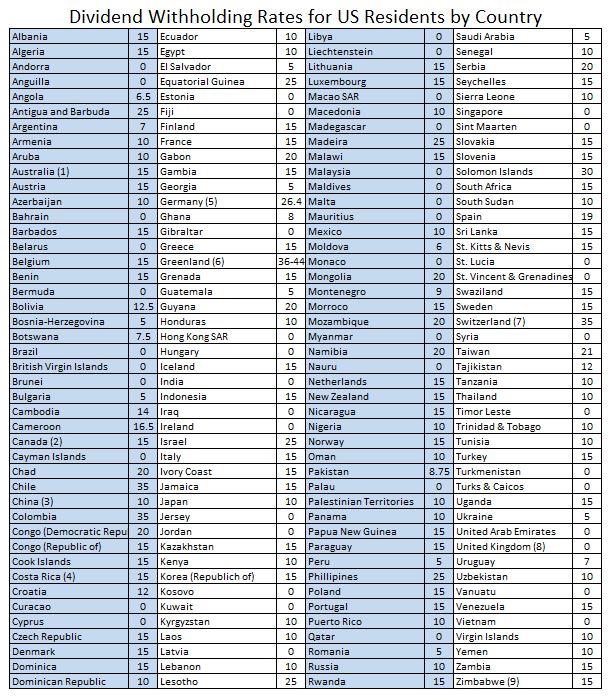

As you can see some nations are far friendlier to foreign dividend investors than others.

Withholding tax rates by country for foreign stock dividends. Assume further that Jill projects that ABC and DEF will experience similar rates. If payment source is from initial investment Mexican REITs will be subject to a withholding tax rate. Companies incorporated offshore and listed on the Hong Kong Stock Exchange and exchanges in the US.

So the 7 dividend yield paid out by a company can actually be significantly less if the country deducts a significant amount of withholding taxes. This simple one-page is useful to any investor holding foreign stocks and receiving dividend income. Dividends paid to non-residents may also be subject to dividends tax at a reduced rate lowest rate of 5 in accordance with the provisions of the relevant double tax treaty.

Dividend stocks are very popular in the United States because they provide investors with a steady stream of income over time. Have a nominal tax rate of 10. Many countries will tax dividends paid out to foreign investors at a higher rate.

For Dutch corporations for example the withholding rate is 15 percent. It does not show the rates for assets held in qualified retirement accounts. If the cash dividend paid by your Dutch company this quarter is 1 a.

You must meet all of the treaty requirements before the item of income can be exempt from US. While you dont have to file a US tax return that tax will be withheld. Domestic law provides for reduced rates and exemptions in certain circumstances.

This simple one-pager shows the updated withholding tax rates for each country. Stocks that pays an approximate 3 dividend qualifying for QDI treatment and 1 of the dividend is withheld for foreign income taxes. Others such as Colombia Mexico Thailand etc.

Dividend are paid from net income after taxes of course and then the withholding tax on US Dividend paying stocks held by non resident of the US. Germany charges 264 tax on dividends only on stocks held in taxable accounts. This table shows withholding tax rates for stocks held in regular brokerage accounts only.

South Korea Dividends paid to a foreign company by a South Korean company constitute South Korean-sourced income and are subject to corporate income tax CIT. For example in developed Europe Switzerland has a very high 35 withholding tax rate. Dividends royalties interest etc.

An investor must be careful when investing in foreign stocks because of certain tax implications. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35. For example the rate for Canada is shown as 25.

SP Global has published the 2019 version of the Withholding Tax Rates for Foreign Stock Dividends by country. Many countries withhold taxes from the dividends distributed by a foreign company which can decrease the effective dividend yieldsYet there are ways to offset these charges through US. The Dividend Withholding Tax Rates by Country for 2021 has been published by SP Global.

The applicable rate may further also be reduced under an applicable double taxation treaty. This rate does not apply to Canadian stocks. 15 10 0 but VAT 19 unless exempted.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. A 30 percent withholding tax applies to the payment of dividends royalties and interest. Are great for American investors since they do not charge withholding taxes for dividends.

Have a withholding tax rate of zero unless a 10 withholding tax rate is announced by the companies. Jill has decided that her portfolio should consist of 70 ABC Equity Index assume it pays an approximate 3 dividend qualifying for QDI treatment and 30 DEF Equity Index Fund a large fund tracking non-US. Some points to remember before investing in foreign stocks.

If your country has a double tax treaty with the United States you pay taxes based on the lower withholding rate. This simple table is highly useful for investors buying overseas stocks as withholding tax rates vary significantly among countries and high tax rates can cut a big chunk of the payouts. International dividend stock investment is trickier.

The withholding rate on dividends varies by country. When you invest in US dividend-paying stocks your dividends are subject to a 30 dividend tax withholding. The current tax rate is just over 26375Check out this link.

Certain countries such as Singapore UK excluding REITs etc. 15 10 30 unless rates. The Dividend Withholding Tax Rates by Country for 2020 has recently been published by SP Global.

WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain management and technical service fees and similar payments made by a Canadian resident to a non-resident of Canada.

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

What Joe Biden S Us Tax Plan Could Mean For Big Tech S P Global Market Intelligence

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Global Corporate And Withholding Tax Rates Tax Deloitte

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

Tax Implications For Foreign Mlp Investors Nasdaq

Things To Consider Before Investing In Foreign Dividend Stocks Seeking Alpha

How To Submit Bluehost Affiliate Tax Form For Indian Residents Royal Ecash Bluehost Affiliate Tax Forms Bluehost

How To Avoid Foreign Dividend Withholding Tax The Motley Fool

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Non Resident Nris Ocis Foreign Companies Dividend Taxation Shares Mutual Funds Nri Tax Services

Global Corporate And Withholding Tax Rates Tax Deloitte

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Fpis Stare At Higher Withholding Tax On Dividends Owing To Tax Treaty Business Standard News

Anti Base Erosion Provisions And Territorial Tax Systems In Oecd

Post a Comment for "Withholding Tax Rates By Country For Foreign Stock Dividends"