Withholding Tax Rates Egypt

The application of this tax had been suspended for two years as of May 17 2015. - Suppliescontracting 05 -.

Global Corporate And Withholding Tax Rates Tax Deloitte

Service fees excluding transport or freight shipping and training and royalties paid to non-residents in countries which do not have a double tax treaty with Egypt are subject to a 20 withholding tax.

Withholding tax rates egypt. Offshore Payments A tax rate of 20 shall be applied to the amounts paid by the individual companies or any legal entities resident in Egypt to non-residents free zone companies were not clearly mentioned in the law without any deductions. 10 in general and 5 if the beneficial owner is a company other than a partnership which holds directly at least 25 of. In Egypt withholding on local payments of a value more than EGP 300 per invoice will be applicable the amount of which will vary depending on the type of activity as follows.

91 of 2005 which will be implemented with immediate effect. Tax Rates Online An online rates tool produced by KPMG that compares corporate indirect individual income and social security tax rates within a country or across multiple countries. These rates and credits are applied.

Capital gains realised from the sale of listed Egyptian shares by both resident and non-resident shareholders are subject to 10 withholding tax. 05 on contracting and supplies. This number can be either the exemption certificate number or the permit number or the tax card number.

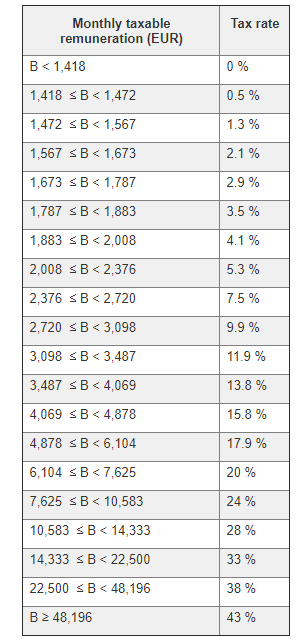

25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. The withholding tax would applies to payments in excess of EGP 300. Personal income tax is deducted at source every three months at the same rates and brackets.

Such profits are taxable in Egypt if the non-resident enterprise carries on business in Egypt through a PE and the profits are. 5 or 10 NA NA. However profits from business activities are not subject to withholding tax.

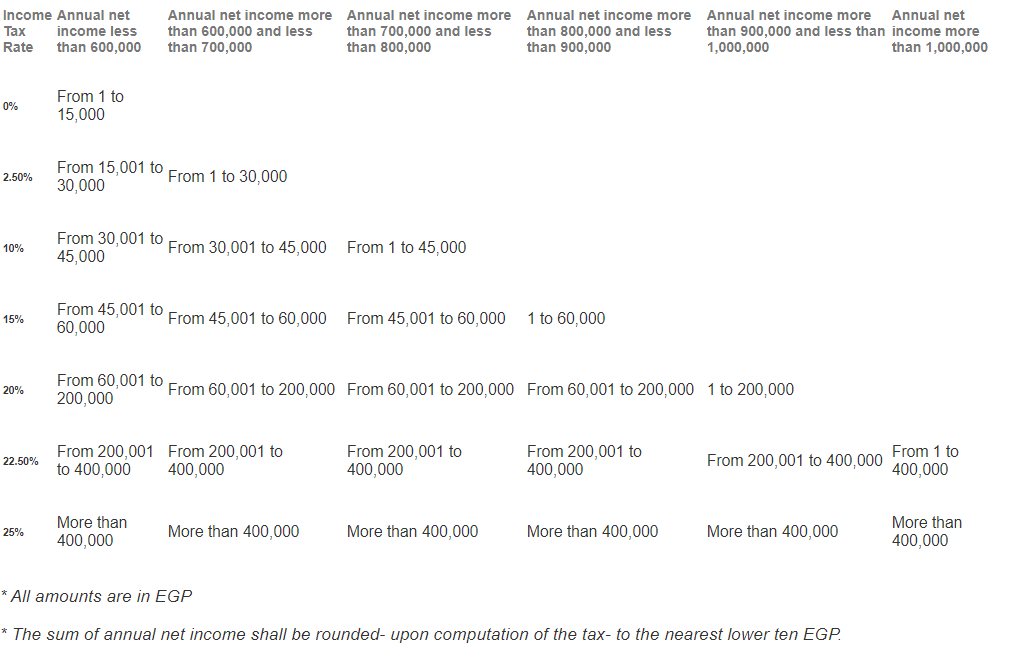

In the absence of a tax treaty unilateral tax relief is available by way of deduction rather than by a tax credit. The rates are 2 on services 05 on supplies contracting activities and 5 on commissions brokerage fees. The net taxable income of above EGP 1 million is not eligible for the 0 25 10 15 and 20 tax brackets.

Egypts Ministry of Finance announced on 22 February 2019 that Egypts president has signed into law amendments to the Income Tax Law No. Deloitte International Tax Source Online database providing tax rates including information on withholding tax tax treaties and transfer pricing. 10 for interest and 12 for royalties.

For the local WHT an Egyptian entity has a liability to withhold tax against any payments in excess of LE300 1686 that are made to any local contractor or supplier of goods or services at the time of payment. Egypt Withholding Tax Name of Vendor _____ Address of Vendor _____ Vendor id_____ Exempt vendor definition for Egypt. Dividends paid to nonresidents are not subject to withholding tax under Egyptian domestic law.

Withholding tax WHT rates WHT rates DividendsInterestRoyalties Resident. Typically the withholding tax is treated as a payment on account of the recipients nal tax liability. Withholding tax rates under the tax treaty are.

Withholding Tax on Domestic Transactions. At the back of this Tax Guide you will find a list of the names and codes for all. Note that Egypt does not levy withholding tax on dividends so its tax treaties provide reduced withholding tax rates only for interest and royalties.

With some variation the topics covered are taxes on corporate income and gains determination of trading income other significant taxes miscellaneous matters including foreign-exchange controls debt-to-equity rules transfer pricing controlled foreign companies and anti-avoidance legislation and treaty withholding tax rates. It is directly transferred to tax authorities by the employer as follows. The annual net taxable income ranging between EGP 900000 and EGP 1 million is not eligible for the 0 25 10 and 15 tax brackets.

Beyond 40000 Egyptian pounds - 20. However such suspension was extended for a period of three additional years ending on May 16 2020. Withholding Taxes at Source.

Sources of Fiscal Information. This includes changes in the taxation of interest income on treasury bills and bonds so that such income is included in a separate basket from all other income resulting in the inability to deduct costs incurred in relation to such interest income for corporate tax. The maximum rates of withholding tax are.

A taxpayer who derives foreign-source income which is subject to foreign as well as to Egyptian taxes will be allowed to deduct. Download the treaty in Spanish. 5001 to 20000 Egyptian pounds - 10.

5 or 10 20 20. 20001 to 40000 Egyptian pounds - 15. 0 to 5000 Egyptian pounds - 0.

The rates of WHT applicable to local payments for local services and supplies are as follows.

Https Www Sap Com Mena Docs Download 2019 10 8c06c92f 6f7d 0010 87a3 C30de2ffd8ff Pdf

Https Assets Kpmg Content Dam Kpmg Rs Pdf 2020 05 Rs Sb Tax Card Eng Online 2020 Pdf

Pin On Teaching Social Studies

India Pakistan News Pakistan News Urdu News

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Tax Guide Ecovis Egypt Consulting

Russia S Double Tax Treaty Agreements Russia Briefing News

Tax Iftao The International Financial

Https Www Sap Com Mena Docs Download 2019 10 8c06c92f 6f7d 0010 87a3 C30de2ffd8ff Pdf

Egypt Amends Progressive Individual Income Tax Rates And Penalties Applicable On Tax Return Differences Ey Global

Germany Taxing Wages 2021 Oecd Ilibrary

Global Corporate And Withholding Tax Rates Tax Deloitte

Https Www Loyensloeff Com Media 479149 L L Holding Regimes 2020 Pdf

Fiapeg Txclr Clear Withholding Tax And Stamp Tax Liabilities Egypt Sap Fiori Apps

Understanding Your Form 16 Income Tax Return Income Tax Filing Taxes

Https Www Sap Com Mena Docs Download 2019 10 8c06c92f 6f7d 0010 87a3 C30de2ffd8ff Pdf

Https Www Sap Com Mena Docs Download 2019 10 8c06c92f 6f7d 0010 87a3 C30de2ffd8ff Pdf

Tax Flowchart Do You Have To File A Return Flow Chart Law School Humor Flow Chart Template

Post a Comment for "Withholding Tax Rates Egypt"