How Much Withholding Tax In Pakistan

Withholding Tax Regime is a global phenomenon and in Pakistan the major source of the Federal revenue collected on national level. Sales tax rates in Pakistan.

Softax Private Limited Day Long Workshop On Withholding Tax Under Incometax Federal Provincial Salestax Laws Network Marketing Provincial Income Tax

Corporate - Withholding taxes.

How much withholding tax in pakistan. WHT Withholding Tax. The standard sales tax rate in Pakistan is 17. Exporters and certain providers of financial services may apply for a Sales Tax suspension.

If 1 to 30 PKR 70. According to the income tax slabs for FY 2021-22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600000- per annum. ISLAMABAD AFP A photo of a document shared thousands of times in multiple Facebook posts in Pakistan purports to show a tax law amendment introduced in March 2019 which means any cash withdrawals exceeding 25000 rupees will be subject to a 06 percent tax down from 50000 rupees previously23 2019 .

If 100 to 200 PKR 930. In general payments made on account of dividend interest royalty and fee for technical services income derived from Pakistan sources are subject to a 15 withholding tax WHT which tax has to be withhelddeducted from the gross amount paid to the recipient. According to withholding tax card for tax year 2019 the Federal Board of Revenue FBR said that profit on debt paid by banking company or financial institutions on account or deposit maintained shall collect withholding tax rates as per following.

On the services of cash withdrawal a new Withholding tax rates in Pakistan 2021 has finalized now. For example 55 withholding income tax is applicable on commercial imports and is payable at the import stage. At the present time usually people in Pakistan are well aware of this Tax.

Withholding tax applies to employment income. Now lets learn more about the latest tax. On purchase of a car or similar vehicle a tax-filer will pay only 800 to 10000 Rupees for annual token tax.

Out of total Direct Taxes collection of Rs 740 b for financial year 2012 Rs 422 b with percentage share of 57 came from various Withholding Taxes which are characterized by. The withholding tax rate shall be 06 percent under Section 231AA 1 to be collected by banking companies at the time of sale against cash of any instrument including demand draft payment order CDR STDR RTC any other instrument of bearer nature or on receipt of cash on cancellation of any of these instruments where sum total of transactions exceeds Rs 25000 in a day for persons not. In simple words we can say that a portion or a part of the employees tax liability paid by the employer directly to the government.

After purchasing a vehicle the withholding tax for registration fo that vehicle the tax-filer will pay between 15000 Rupees to 250000 Rupees which vary from vehicle to vehicle. Withholding Tax is referred to the amount of money that is taken in advance from employees income in order to pay some of the tax that they will owe. If 30 to 100 PKR xx.

How much will I be taxed if I withdraw cash in Pakistan. Calculated at 20 of the sales tax withholding regime there is an anti-fraud. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 231A Cash Withdrawal from a Bank Every Banking Company cash withdrawal in a day exceeding Rs 50000- for persons not appearing in the Active TaxpayersList 06 234 Tax on Motor Vehicle Person collecting motor vehicle tax Rs.

By ali sial January 3 2021. WHT on payments of royalty and FTS when royalty or FTS is not attributable to a PE in Pakistan is 15 or a lower treaty rate of royalty or gross fees. The collection as well as dependence on Withholding Taxes is on the rise over the years.

Payment for advertisement services to a non- resident person relaying from outside Pakistan Any Other payment except payment to foreign news agencies syndicate services non-resident contribution having no permanent establishment in Pakistan PAYMENT TO NON-RESIDENTS 151 Nature of payment Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART. The tax withheld is deemed to be the final tax liability of the non-resident. The withholding tax rate on dividend is 125 percent where the recipient is a filer of Pakistan tax return and 20 percent where the recipient is a non-filer.

It is for the guidance that it is a kind of income tax that is applicable by. Last reviewed - 01 January 2021. Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan.

Latest Income Tax Slab Rates in Pakistan. If 200 to 350 PKR 970. Imports of some basic foodstuffs and agricultural supplies are exempt from import Sales Tax.

In the case of a non-resident where royalty or FTS is. Previously this salary slab was not included in the income tax deduction bracket. 236A Sale by auction Every person.

This 55 withholding tax will be considered as minimum tax and Corporate Tax is also applicable whichever is higher will be the tax liability on this business. Register for Income Tax. If 350 to 500 PKR 3000.

Many jurisdictions also require withholding tax on. A non-filer will pay between 1200 to 30000 Rupees for annual token tax. 10 percent of the gross yield paid.

Withholding Tax Rates in Pakistan 2021 on Cash Withdrawal Services. Royalties and fees for technical service paid to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 15 percent. 25 per kg of the laden weight for filers.

The Withholding Tax System In Thailand Lorenz Partners

Step By Step Document For Withholding Tax Configuration Sap Blogs

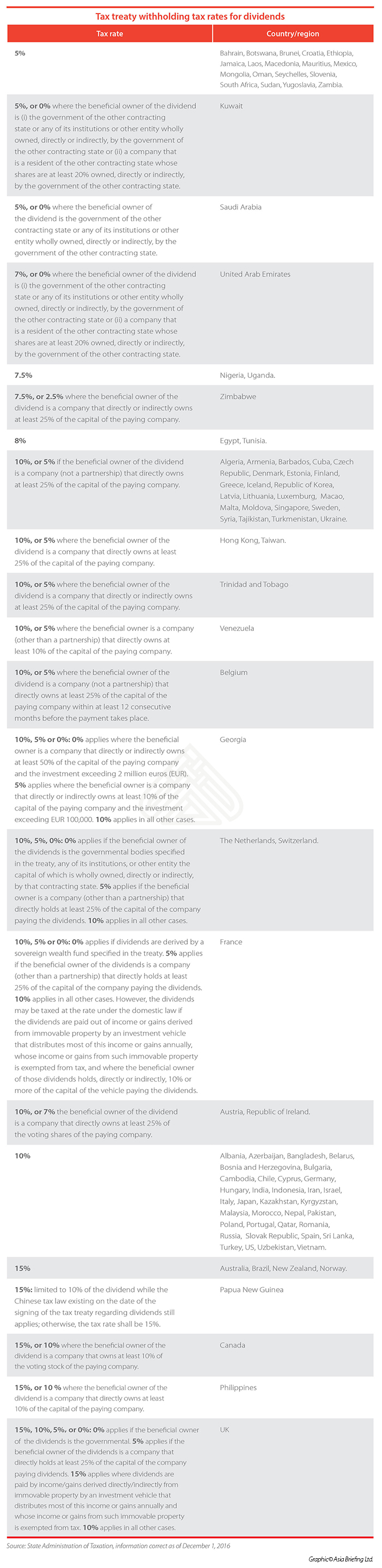

Withholding Tax In China China Briefing News

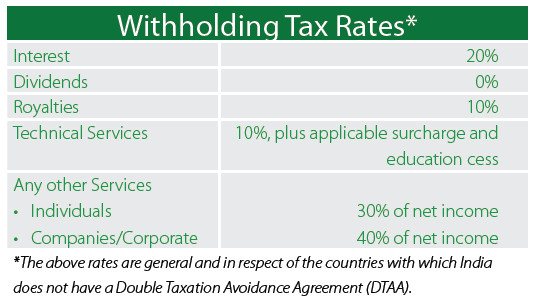

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Manage Withholding Taxes Odoo 14 0 Documentation

Softax Pvt Ltd Workshop On Withholding Tax Under Income Tax Federal Provincial Sales Tax Laws With Amendments Made B Provincial Federation Audit

153 1a Withholding Tax On Goods How To Deduct Tax On Payment Of Goods In Pakistan Fbr 2021 Youtube

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

Step By Step Document For Withholding Tax Configuration Sap Blogs

Tax Excellence Team Workshop On Advance Withholding Income Sales Tax Call Now For Enroll Today 02134329107 To 109 03343223 Tax Services Income Solutions

Manage Withholding Taxes Odoo 14 0 Documentation

How To Get Jazz Withholding Tax Certificate In Whatsapp Tax Deductions Certificate Income Tax Return

Countrywise Withholding Tax Rates Chart As Per Dtaa

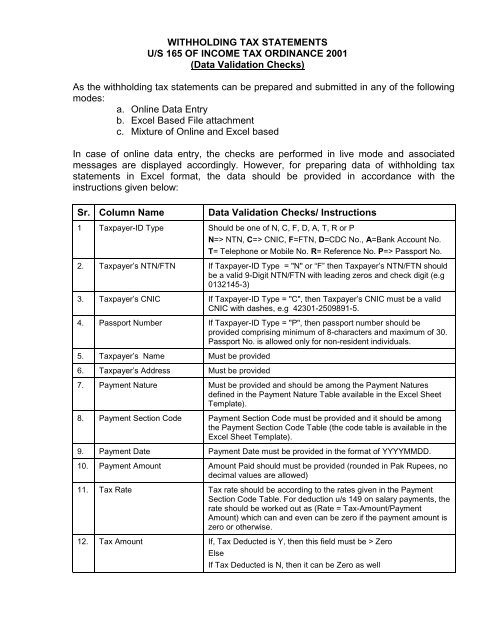

Withholding Tax Statements U S 165 Of Income Tax

Smt Consulting Group Offers Comprehensive Corporate Training One Day Workshop Withholding Tax Under Federal And Provin Provincial Serena Hotel Workshop

Effects And Influences Of The Withholding Tax

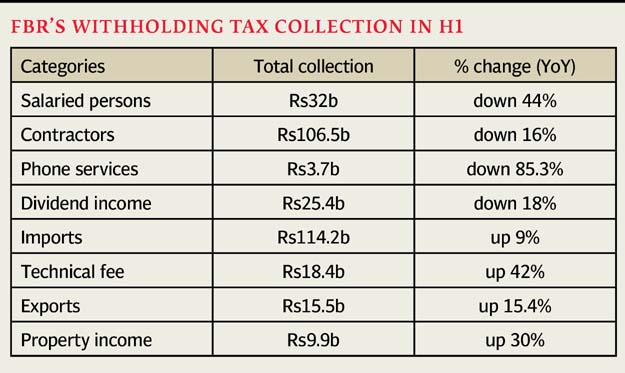

Withholding Tax Collection Drops 9 In First Half

Step By Step Document For Withholding Tax Configuration Sap Blogs

Post a Comment for "How Much Withholding Tax In Pakistan"