Income Tax Rates On Rrsp Withdrawals

Financial institutions usually deduct the withholding tax at the time you withdraw funds. This is allowable for defined benefit pension.

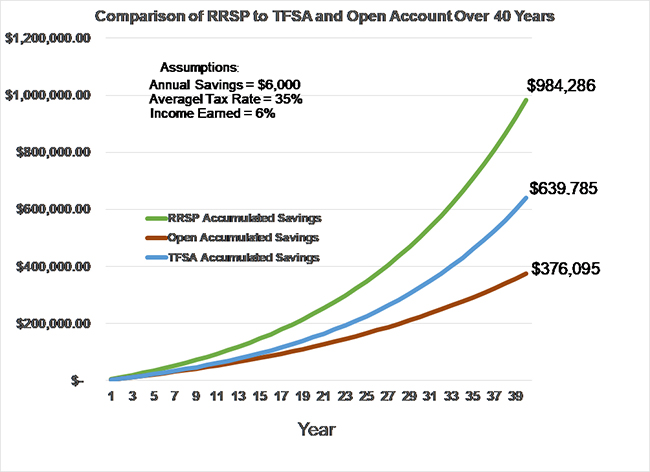

The Pros And Cons Of An Rrsp 5 Of Each The Financial Geek Make The Most Of Your Money

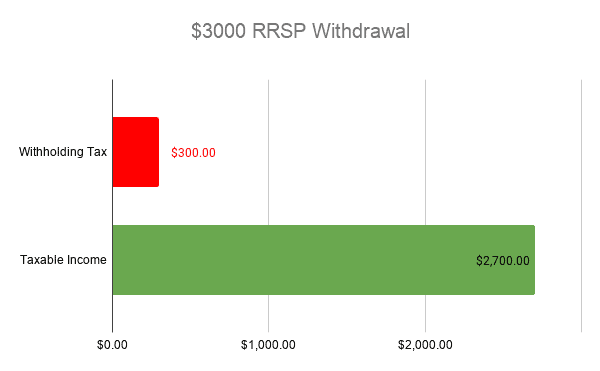

However if you were to take money out in five increments of 2000 you would only pay 10.

Income tax rates on rrsp withdrawals. However this rate can be reduced by virtue of a treaty between Canada and your country of residence. I assume that you are splitting your pension income on your tax returns so that 50 of your pension is taxable to your wife at her lower tax rate. In order to apply for a waiver the CRA form T1213 Request to Reduce Tax Deductions at Source for.

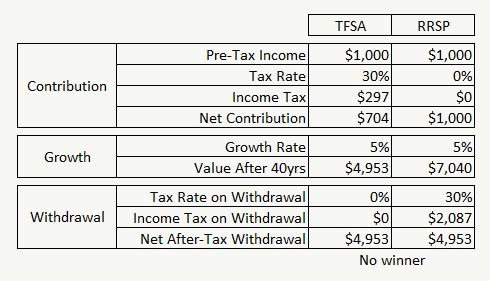

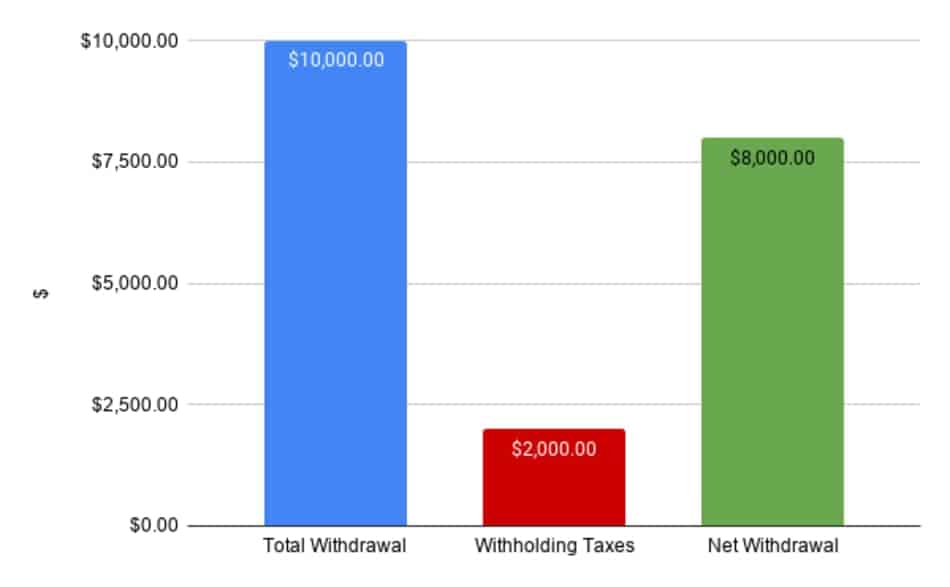

I understand the current rate of RRSP withholding tax is 10 for withdrawals up to 5000 20 for withdrawals between 5000 and 15000 and 30 for withdrawals. In practice when you withdraw from an RRSP the withdrawal is taxed by the Canadian government. 1 For a single withdrawal from RRSP funds held in the province of Quebec there will be 15 provincial income tax withheld in addition to the above 5 10 or 15 federal tax withheld.

From age 65 to 71 their taxable incomes would be about 19000 each and their marginal tax rate on their next dollar of income would range from 15 to 30. 5001 to 15000 20 10 in Quebec withholding tax. Withdrawals are made from the spousal RRSPRRIF.

However similar to top personal tax rates interest income earned in a corporation is taxed at a higher income tax rate than Canadian dividends and capital gains earned in a corporation are. The current rate of RRSP withholding tax is 10 for withdrawals up to 5000 20 for withdrawals between 5000 and 15000 and 30 for withdrawals over 15000. This withholding tax can be reduced to 15 if you elect to convert the RRSP to a RRIF and you take periodic payments from the RRIF or other similar annuity.

Depending on the amount you withdraw from your RRSP there is a different withholding tax rate. Up to 10000 can be withdrawn annually with a maximum lifetime withdrawal of up to 20000 if you meet the criteria. Tax rates on withdrawals When you withdraw funds from an RRSP your financial institution withholds the tax.

However assuming 4 annual growth for their RRSP accounts their 1000000 in RRSPs would grow to about 1316000 by age 72. If you withdraw RRSP funds under the Home. You must include the amount you withdraw on your tax return as part of your total income for the year.

But the tax liability doesnt stop with CRA. Retirement Tax Strategy 2 Order of withdrawal In order to maximize deferring taxes in retirement. A VRSP a PRPP or a RRIF.

In other words when you take an RRSP distribution here in the US you pay the higher of the 25 tax withholding or your US. The withdrawal is not taxable as long as the funds are paid back to your RRSP over a 10-year period typically starting five years after your first withdrawal. The rates depend on your residency and the amount you withdraw.

Generally speaking the withholding tax rate on RIF payments and RRSP payments made to a non-resident in Canada is 25. Learn what you should consider before withdrawing funds from your RRSPs. A lower withdrawal is subject to a lower withholding tax rate.

Tax form you deduct a foreign tax credit in the same. 10 5 in Quebec on amounts up to 5000 20 10 in Quebec on amounts over 5000 up to including 15000. This will probably increase the amount of income tax you must pay.

When you withdraw money from your RRSP it will be taxed as income and a withholding tax will apply at the time of the withdrawal. Withdrawals from RRSPs or RRIFs are done on a systematic basis at the high withholding tax rate and they make up the majority of your income. 58 rijen A 1500 gross withdrawal will deduct 1500 from the RRSP and the amount.

The tax rate depends on how much you withdraw and where you reside. For residents of Canada the rates are. When you declare the withdrawal on your US.

For example if you make a withdrawal of 10000 you would pay tax at a rate of 20. Tax bracket is higher than 25 you pay the same amount of taxes on the RRSP distribution as you do your US. On the Canadian side once you become a non-resident of Canada any withdrawals from the RRSP will be taxed under non-resident rules and will be subject to the CRA 25 withholding tax.

The amount you pay in RRSP withholding tax is dependent on the amount of your withdrawal. See Revenue Quebecs Payments from an RRSP. There are three tiers as follows.

For example a withdrawal of 5000 is subject to a withholding tax rate of 10. Their required minimum RRIF withdrawals would be 528 of the balance or about 69000 at age 72. If you are a resident of Canada the withholding rates are as follows as of publication.

Withdrawals up to 5000 will have a 10 5 in Quebec withholding tax. Tax bracket is under 25 you are paying higher taxes on the RRSP withdrawal.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Canadian Tax Return Check List Via H R Block Ca Http Www Hrblock Ca Documents Ta Business Tax Deductions Tax Prep Checklist Small Business Tax Deductions

Taxes Rrsps And You Wever Financial

Prosperiguide Tax Efficient Decumulation

Tfsa Vs Rrsp Picking The Right One Could Save You 100 000 In Tax Planeasy

28 Ways To Pay Less Tax Money Sense Filing Taxes Money

Pin On Infographics Financial Education

In My Experience Most Taxpayers Seem To Have A Pretty Good Understanding Of The Tax Consequences Of Making An Rrsp Co Tax Deductions Tax Lawyer Tax Accountant

How Is My Canadian Rrsp Taxed In The U S

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Calculator Infographic You Need Earned Income To Contribute To An Rrsp But The Finance Infographic Retirement Savings Plan Infographic

Rrsp Dividends Are They Taxable The Financial Geek Make The Most Of Your Money

Rrsp Rpp Withdrawals And Taxes 2020 Youtube

The Pros And Cons Of An Rrsp 5 Of Each The Financial Geek Make The Most Of Your Money

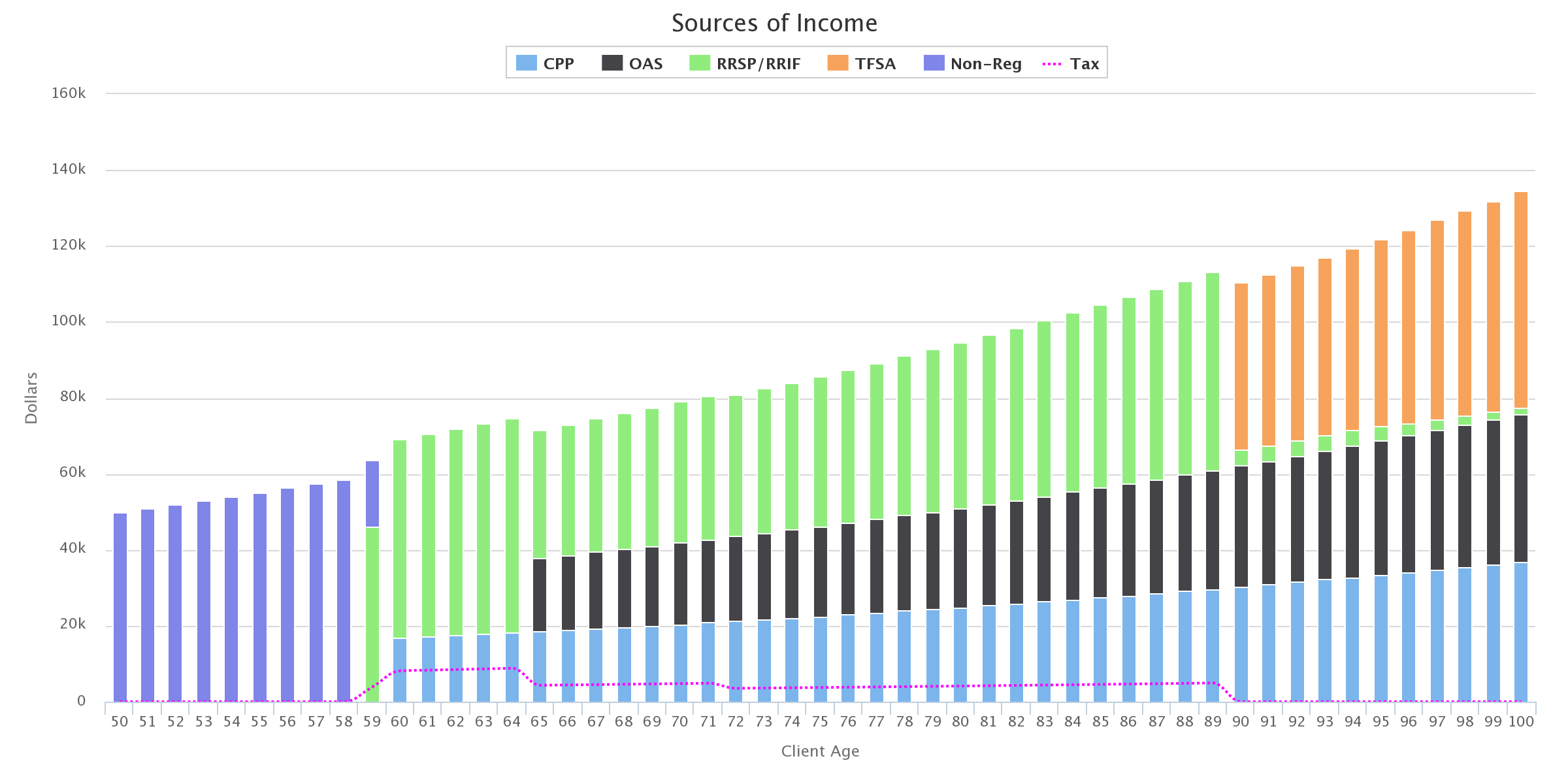

Retirement Income Start Drawdown With Rrsp Non Registered Or Tfsa First Planeasy

Graphic Overview Of Canada Income Tax Rrsp And Tfsa

Investments Are Eligible For Registered Rrsp Resp Tfsa Etc And Non Registered Funds Our Business Development Manager Investing Mortgage Tips Money Advice

Post a Comment for "Income Tax Rates On Rrsp Withdrawals"