New Withholding Tax Rates In Kenya 2019

PAYE tax rates for individuals for the year 2019 are as follows. Where the treaty rate is higher than the non-treaty rate the lower rate applies.

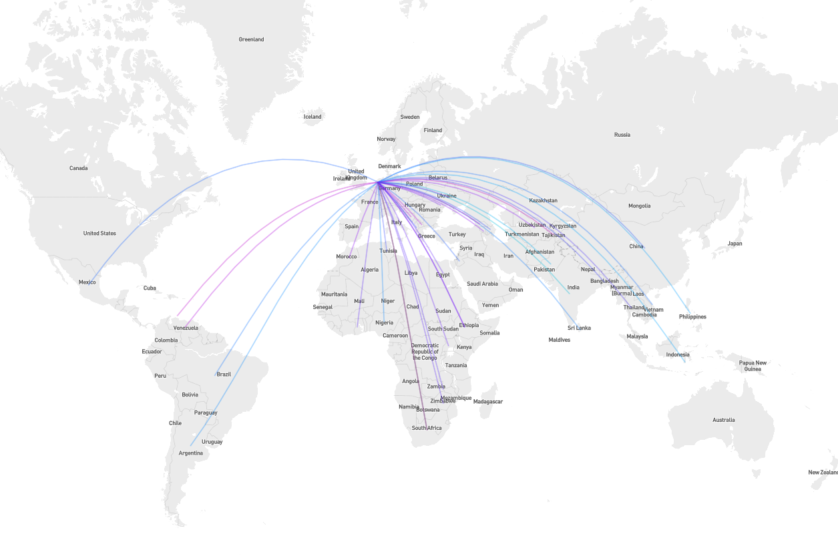

Have The Netherlands Tax Treaties With Developing Countries Become Fairer Ictd

This is to ensure that non-residents who provide such services to a Kenyan resident are subject to tax in respect to income earned in or derived from Kenya.

New withholding tax rates in kenya 2019. The Finance Bill 2019 787 7. KRA Withholding Tax rates This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA. Country-wise Income Wise Withholding Tax Rate Chart for Financial Year 2021-22.

Withholding tax at the rate of 20 on payments made to a non-resident entity in respect of sales promotion marketing advertising services and transportation of goods excluding air transport services has been introduced. While insurance premiums paid to non-resident insurers are already subject to withholding tax there was some confusion as to whether this covered reinsurance premiums paid to. The Finance Act introduces withholding tax at the rate of 5 on re-insurance premiums paid to non-resident insurers without a permanent establishment in Kenya but excludes payments for aircraft reinsurance.

However the KRA has in the past taken the position that the management or professional fees would fall on the Article on other income and should therefore be subject to withholding tax at 20. Importing Exporting Imposition of fringe benefit tax. Capital gains tax to be introduced on the transfer of property by general insurance companies.

Pay As You Earn PAYE Motor Vehicle Import Duty. 20 on interest royalties intangible services. What is exempt from Withholding Tax.

Paye Tax Rates in Kenya 2019. You can also pay via Mpesa. Either 5 of the tax payable or twenty thousand shillings whichever is higher.

The good news on VAT is that the withholding VAT regime is to be changed reducing the current percentage of the taxable value from 6 to 2. Consultancy and agency from 1 July 2003 5 20. Withholding VAT has created a significant burden on taxpayers and should in our view never have been introduced.

Deducted and remitted on or before the 20th of the following month. Where a business is carried on or exercised partly within and partly outside Kenya by a resident person the whole of the gains or profits from that business are deemed to have been accrued in or derived from Kenya. Withholding tax is tax that is deducted at source and remitted to KRA.

Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125. Income tax is chargeable on gains or profits from a business for whatever period of time carried on. 12C 1 Notwithstanding any other provision of this Act a tax to be known as turnover tax shall be payable by any resident.

This is probably the most positive announcement made. Section 32 Section 4a. The Income Tax Act is amended by repealing section 12C and replacing it with following new section Repeal and replacement of s.

Read an October 2019 report PDF 205 KB prepared by the KPMG member firm in Kenya. It also aligns well with recent proposals under the Finance Bill 2019 to reduce the withholding VAT rate from 6 to 2. Turnover and presumptive tax.

KRA Withholding Tax rates. In Uganda real GDP growth was an estimated 53 in 2018 up from 50 in 2017. Budget 2019 Kenya 13 June 2019 8 Regionally Rwanda posted the highest GDP growth rate at 86 per cent supported by services 41 and industrial production 15 particularly manufacturing.

Withholding tax Value Added Tax Tax Procedures Excise Duties Miscellaneous Fees Levies Miscellaneous Contacts. Payment for demurrage charges made to non-residents persons to be subjected to withholding tax at the rate of twenty 20 per cent. Kenya Budget Insights 201920 4 Capital gains tax rate to be increased from 5 to 125 The measure The Bill seeks to increase the Capital Gains Tax CGT rate from the current 5 to 125 Who will be affected Transferors of property When Effective 1.

One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. On the supply side industry growth 97. The percentage deducted varies between incomes and is dependent on whether you are a resident or non- resident.

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

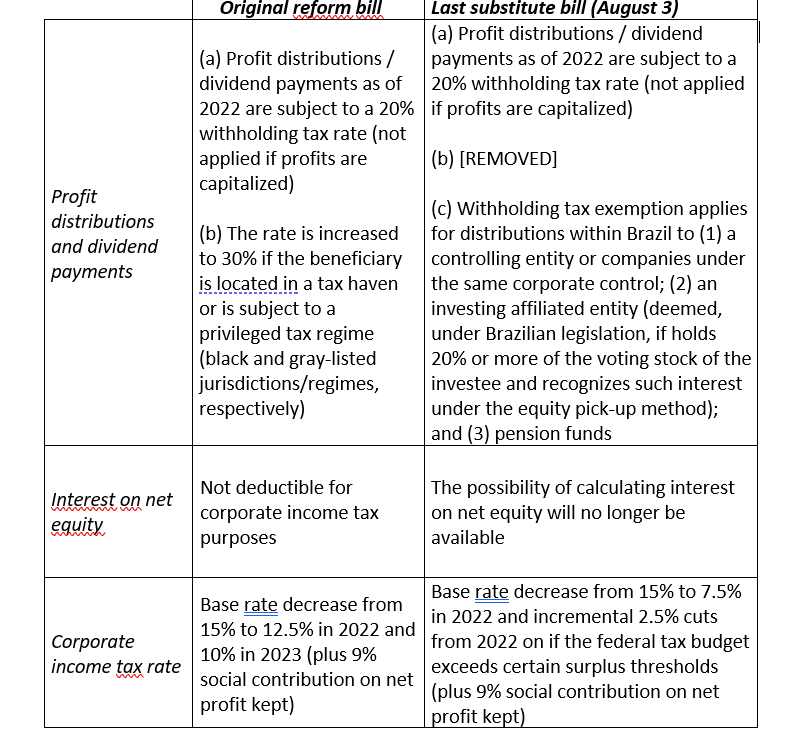

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Global Corporate And Withholding Tax Rates Tax Deloitte

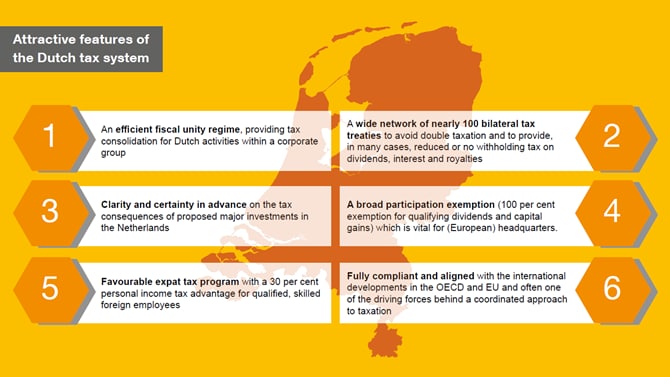

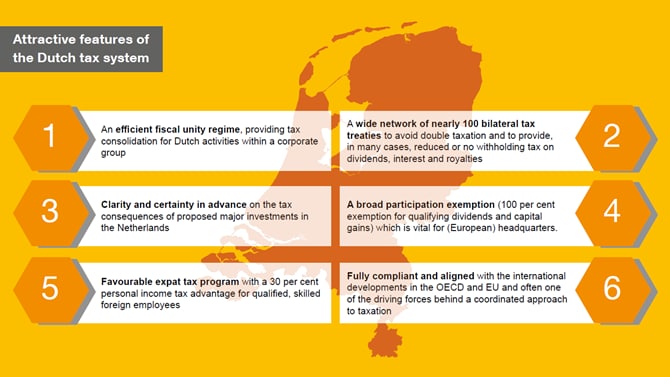

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Panama Tax Treaties Tax Panama

Dutch Cabinet Announces Additional Withholding Tax On Dividend Payments Pwc Tax News

Germany Taxing Wages 2021 Oecd Ilibrary

Corporate Income Dividend Withholding Tax Outline

Quick Overview Of Dutch Real Estate Rsm Audit Tax Consulting

Global Corporate And Withholding Tax Rates Tax Deloitte

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Design Tax Policy In Fragile States In Imf How To Notes Volume 2019 Issue 004 2019

Internet Consultation On Conditional Withholding Tax On Dividends Launched Pwc Tax News

Corporate Income Dividend Withholding Tax Outline

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

Post a Comment for "New Withholding Tax Rates In Kenya 2019"