Self Employed Tax Rates Germany

Personal income tax rates. The non-taxable portion of your income will be very generous in 2021.

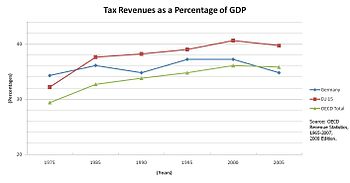

Progressiveness Of Taxes Informative Facts Tax

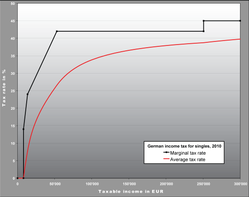

The German income tax progression is very steep - it tops out at a marginal rate of 42 plus 55 of your tax burden as unification tax so 44 effectively at 52552.

Self employed tax rates germany. More information regarding tax deductions for self-employment income can be found in this article German article. There is also a solidarity levy Solidarittszuschlag equivalent to 55 of your income taxIndividuals affiliated with a religious community which charges taxes are also obliged to pay church tax which is based on your income tax bill - 8 in Bavaria and Baden-Wrttemberg 9 in other parts of Germany. As a general rule trade tax is higher in urban areas.

For an interim period between 1 July 2020 and 31 December 2020 the rates were reduced to 16 and 5. If you have been present in Germany for over 183 days. They will increase the basic allowance from 9408 to 9744 EUR.

Workers who fail to file their German income tax. Freelancers will need to pay this tax on a quarterly basis. For example unemployment insurance attracts a maximum deduction of 2800 for self-employed people.

Tap on a progress bar to view more. 5 rows Self-employed tax fines in Germany. In Germany self-employed workers are subject to the same 9744 allowance as other workers but they also get a 2800 allowance for health insurance.

A solidarity surcharge of 55 is also included in this tax. Germany has a relatively relaxed visa policy that encourages foreign workers to set up shop. Changed burden of income tax for individuals including freelancers and the self employed.

Germany has a base rate of 14 of the income tax which can go up to 42. Freelancers and self-employed persons also have different tax obligations. Most countries require you to be employed or have an employment offer from a native company to obtain a worker visa.

Another way self-employed workers can reduce their tax bill is to offset work-related outgoings against their overall tax bill. Solidarity surcharge Solidaritaetszuschlag capped at 55 of your income tax. The total income after deductions in each category which may be further reduced by lump-sum deductions or within limits by actual payment for special expenses defined by tax law represents the taxable income.

Each community has its own multiplier for trade tax. The tax rate of 42 applies to taxable income above 57051 for 2020. The increase in the basic tax-free allowance ie.

Do I need a special visa to freelance from Germany. You can offset a part of the paid trade tax deductible multiplier is 350 as expenses in your income tax return. Tax Rates Income tax in Germany is progressive starting at 1 and rising incrementally to 42 or for very high incomes 45.

However a tax free-threshold of 972 applies to the solidarity surcharge. There must also be a commercial use of 90 or more so you can save the largest possible amount. Germany has progressive tax rates ranging as follows 2021 tax.

The base rate for trade tax is 35 which is multiplied by a municipal tax rate Hebesatz anywhere between 200 and 580 resulting in a total trade tax rate of somewhere between 7 and 203 depending on location. Maybe you are not used to it after 2020 but here is some good news. Dsseldorf has a multiplier of 440.

This solution is for EU nationals or those having the right to work. The tax authorities allow employees a range of tax deductions on their income. Where the contractor wishes to work independently then the self-employed solution is applicable.

If your use exceeds this 90 all expenses are deductible as income-related expenses including interest fuel and insurance. An entrepreneurial taxpayer generally is entitled to deduct the VAT charged on input from. As trade and business sole proprietor you have to pay trade tax when the profit is exceeding 24500.

In Germany for tax purposes you are either a resident or a non-resident. The rate depends on how much you make. Self-employed income tax allowances in Germany.

As a freelancer or self-employed in Germany you have to pay about 14 to 45 of your earnings on income tax. Church tax 8 9 if you are a member of a registered church in Germany. Although the tax office will deduct 1000 amount automatically for this it is limited and if you exceed the set amount you must submit a.

Self-employed persons can also deduct the company car from their taxes. The solidarity surcharge is paid by all self-employed persons and amounts to 55 of income tax or corporation tax. Proceeds of sales and services provided in Germany are subject to VAT under the common system of the European Union EU at the standard rate of 19 7 on certain items such as food and books.

This means for every euro you earn above 52552 the tax man takes 44 -cents.

German Tax System Taxes In Germany

U S Individual Income Tax Tax Rates For Regular Tax Highest Bracket Iittrhb Fred St Louis Fed

Personal Income Tax Rates 2019 Taxable

On Average 2 2 Of Workers In Oecd Are Self Employed Women W Staff How Does Your Country Compare Self Employment Primary Activities

Personal Income Tax Rates 2019 Taxable

Pin By Enterslice On Company Registration In Germany Germany Company Registration

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Your Bullsh T Free Guide To Taxes In Germany

U S Individual Income Tax Tax Rates For Regular Tax Highest Bracket Iittrhb Fred St Louis Fed

Tax Revenue Statistics Statistics Explained

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

Tourism Related Taxes Across The Eu Internal Market Industry Entrepreneurship And Smes

Tax Revenue Statistics Statistics Explained

Oecd Ulkeleri Bordro Ve Gelir Vergisi Income Tax Payroll Payroll Taxes

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

Post a Comment for "Self Employed Tax Rates Germany"