Self-employed Tax Rates Ireland 2020

8 on income over 70044 per annum. Free Tax Calculators BIK Tax Calculator.

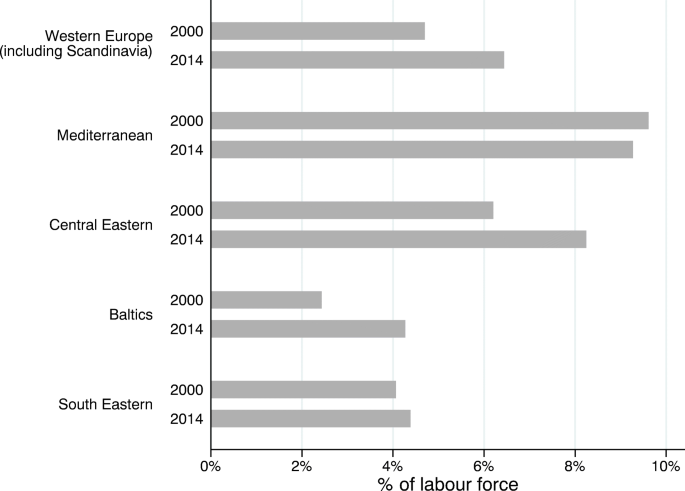

Self Employment Statistics Statistics Explained

Self-employed people can have their 2020 losses and certain unused capital allowances carried back and deducted from their profits for 2019 to reduce the amount of income tax.

Self-employed tax rates ireland 2020. 0 BIK on electric cars extended to 2022. Personal circumstances 2021 2020 2019 2018. The tax measures presented in the budget 2020 include.

If both are working this amount is increased by the lower of the following. Tax rates and rate bands. Youre a non-resident landlord.

No changes to individual personal tax rates or bands. However the Social Security portion may only apply to a part of your income. You must file an Irish tax return if any of the following apply.

The 2021 PRSI rates are as follows. So for example tax on income earned in 2019 is due on 10 December 2020. You receive income in addition to PAYE eg.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. Tables show the variuos tax band and rates together with tax reliefs for the current year and previous four years. Youre a landlord or host Airbnb in Ireland.

6th April 2020 to 5th April 2021. 150 increase in earned income credit for the self-employed to 1500. The Universal tax rates range from 1 7 and the applicable rates depend on the annual income.

Investment portfolio rental income income from a construction trade capital gains consulting contracting or if you receive any other untaxed. Self Employed Income Tax Calculator. Irish Rental Income Calculator.

Guide to 10 Tax Deductions for the Self Employed in Ireland. Personal income tax rates. Self-employed persons whose income from all sources is less than EUR 5000 for 2021 are not liable to PRSI.

An individual who is resident but not domiciled in Ireland is liable to Irish income tax on Irish-source income foreign-employment income earned while carrying out duties in Ireland and on other foreign income to the extent that it is remitted into Ireland. If youre self-employed or receive income from non-PAYE sources you must register for self-assessmentSelf-assessment is where you calculate the income tax you owe for the tax year yourself and it needs to be done every year when you file your tax. 202021 Tax Rates for Self Employed in the UK.

Pension Contributions Tax Relief Calculator. Youre a contractor or sub-contractor. The tax that you pay is based on the income you earned during the previous tax year.

A non-resident individual is generally liable to Irish income tax on Irish-source income only. First 12012 with a 05 rate Next 7360 with a 2 rate Next 50672 with a 475 rate. Foreign Earnings Deductions.

1000 visit this page Trading Allowance. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. 1000 visit this page Property Allowance.

The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare. For 2020 the self-employment tax rate is 153 on the first 137700 worth of net income plus 29 on net income over 137700. Rate bands and tax reliefs for the tax year 2020 and the previous tax years.

20 12501-50000 Higher Tax Rate. 50 on income between 18773 and 70044 per annum. If you earn less than 5000 from self-employment in a year you are exempt from paying Class S PRSI but you may pay 500 as a voluntary contributor.

Your tax-free Personal Allowance The standard Personal Allowance is 12570 which is the amount of. How much is self-employment tax. 05 on income up to 12012 per annum.

Insights Podcast Press releases Webcasts. 100 increase in the home carer credit to 1600. The rates and thresholds for self-employed individuals in 2017 are as follows.

1000 visit this page 202021. For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. Thats because of the Social Security wage base.

Since youre paying both portions for employer and employee of Social Security and Medicare the rate breaks down as follows. Income tax loss relief for self-employed. The self-employed PRSI contribution rate is 4 which is in line with the rate applicable to employees.

25 on income between 12013 and 18772 per annum. Rates and bands for the years 2017 to 2021. In 2020 the standard rate cut off point for a married couple or civil partner is 44300.

Capital Gains Tax CGT Calculator. Self Employed Income Tax Calculator This Calculator is designed for people with PAYE and additional Self Employed Income. Review the 2020 Ireland income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Ireland.

In the self-assessment system tax is due to be paid on or before 31 October each year 10 December 2020 due to the coronavirus pandemic. 40 50001-150000 Personal Savings Allowance. The current tax year is from 6 April 2021 to 5 April 2022.

Calculating your Income Tax gives more information on how these work. A temporary income tax relief has been introduced for self-employed people who were profitable in 2019 but who will make a loss in 2020 due to the COVID-19 pandemic. One of a suite of free online calculators provided by the team at iCalculator.

Share Options RTSO1 Tax Calculator. Class S PRSI contributions are paid at a rate of 4 on all income or 500 whichever is the greater. When you register with Revenue you are automatically registered for Class S PRSI.

14 Tax Tips For The Self Employed Taxact Blog

Self Employed Tax In Portugal A Guide For Freelancers Expatica

What Are Allowable Expenses When Self Employed

Coronavirus Further Self Employment Considerations Low Incomes Tax Reform Group

Employed And Self Employed Tax Calculator Taxscouts

![]()

Self Employment Tax On Foreign Income Explained 2021 Online Taxman

Analyzing The Changing Education Distributions Of Solo Self Employed Workers And Employer Entrepreneurs In Europe Springerlink

Self Employment Statistics Statistics Explained

Freelance Tax In Spain For Self Employed Expats Expatica

Self Employment Statistics Statistics Explained

Self Employment Statistics Statistics Explained

Tax And Self Employment Visual Artists Ireland

Self Employed Tax Codes What You Need To Know

Self Employment Statistics Statistics Explained

Coronavirus Seiss Fourth Grant Low Incomes Tax Reform Group

Self Employment Statistics Statistics Explained

Taxes In Belgium A Complete Guide For Expats Expatica

Post a Comment for "Self-employed Tax Rates Ireland 2020"