Self-employed Tax Rates Jamaica 2019

NIS Employee Rate 150000000. PAYE Income Tax Additional Rate 600000000.

The Dual Tax Burden Of S Corporations Tax Foundation

PAYE Income Tax Additional Threshold 8000000.

Self-employed tax rates jamaica 2019. Registered taxpayers should begin making the necessary adjustments to their systems in order to be ready for this change. Tax Administration Jamaicas TAJ RAiS is automatically imposing interest on overdue income tax. An extra charge of 3 applies to any self-employed income over 100000 regardless of age.

Self-employed persons are to contribute the full 6 as at April 2020. Over 65 Allowance 000. You pay your USC with your preliminary tax payment.

Since youre paying both portions for employer and employee of Social Security and Medicare the rate breaks down as follows. Senior Technical Specialist at Tax Administration of Jamaica TAJ Monica Walker said 25 per cent income tax will be applied to earnings from July to December 2016 between the effective threshold of 796 537 up to 6 million. The Income tax rates and personal allowances in Jamaica are updated annually with new tax tables published for Resident and Non-resident taxpayers.

Jamaica Tax Tables 2019 EmployeeEmployer Taxes. For 2020 the self-employment tax rate is 153 on the first 137700 worth of net income plus 29 on net income over 137700. Effective April 2019 with a contribution rate of 5 for January to March 2019 and 55 for April to December 2019 the Maximum contribution for 2019 will be 80625.

Each Income Tax Calculator has the same features and advanced tax calculations and outputs the calculations are simply based on different income and expense payment periods. The USC does not apply to social welfare or similar payments. Select a specific Income Tax Calculator to calculate your salary deductions based on your income period.

Jamaica Income Tax Rates and Personal Allowances in 2020. 2 on profits over 50270. Provided income from all sources in any year of assessment exceeds the tax free income threshold of 796536.

PAYE Income Tax Threshold. Rate for tax year 2021 to 2022. Self-employed persons are being reminded that the calculation of their personal income tax will change as at July 1.

The self-employment tax rate for 2018 is 153. Jamaica Income Tax Calculators 201920. The current tax year is from 6 April 2021 to 5 April 2022.

Ultimately for the self-employment tax 2019 youll have to pay both portions of employer and employee social security and Medicare which breaks down as follows. PAYE Income Tax Rate 150009600. This means that self-employed people pay a total of 11 USC on any income over 100000.

Employed persons with other income including pensioners Partners showing share of partnership profits - IT01. NHT contributions are made by employers at the rate of 3 while employees contribute at the rate of 2 on all taxable emoluments received from employment in Jamaica. Take charge of the situation by looking at these six important tax breaks that you will want to consider for 2019.

The tax rate can be divided into two with 765 making up the employer contributions and 765 the employee contributions. The completed form is to be accompanied by a copy of the Balance Sheet and Profit and Loss Account and such other subsidiary accounts as are necessary for a proper understanding of these accounts and a copy of the individuals income tax. Individuals are generally liable to income tax at the rate of 25 on their chargeable income not exceeding JMD 6 million per annum less an annual tax-free threshold where applicable.

Your tax-free Personal Allowance The standard Personal Allowance is 12570 which is the amount of income you do not have to pay tax on. You might drive to meet clients go out to. The current rate of interest is approximately 1604 per annum but this may be changed by the March 2020 filing date.

Self-employed persons also contribute at a rate of 2 of earnings. Mandatory e-filing of certain income tax returns for individuals. In summary the following are the proposed tax measures.

Form S04 - SELF EMPLOYED PERSONS ANNUAL RETURN OF INCOME TAXES AND CONTRIBUTIONS PAYABLE FOR YEAR ENDED 31 DECEMBER. No other GCT rate is impacted by this change. You can see National Insurance rates for past tax.

The IRS states that the self-employment tax 2019 rate is 153 percent on the first 132900 of net income plus 29 percent on the net income in excess of 132900. The Tax tables below include the tax rates thresholds and allowances included in the Jamaica Tax Calculator 2020. Effective April 1 2020 the standard general consumption tax GCT rate will be reduced from 165 to 15.

Year of Assesment 2016 Individuals are required to file a tax return by March 15. From this amount 124 accounts for Social Security and 29 goes towards Medicare. If you are self-employed you probably rely on your personal vehicle for many business related trips.

This form is to completed by all Self-employed Persons. Chargeable income derived in excess of JMD 6 million per annum is subject to income tax at a. 9 on profits between 9569 and 50270.

What Is Self Employment Tax And What Are The Rates For 2019 Workest

Completing Form 1040 With A Us Expat 1040 Example

Http Girlswhoventure Org Wp Content Uploads 2020 11 Jamaica Pdf

Doing Business In The United States Federal Tax Issues Pwc

Https Iris Paho Org Bitstream Handle 10665 2 49693 9789275120545 Eng Pdf Sequence 5 Isallowed Y

Jamaica Share Of Economic Sectors In The Gross Domestic Product 2010 2020 Statista

Completing Form 1040 With A Us Expat 1040 Example

Jamaica Measures In Response To Covid 19 Kpmg Global

2020 Income Tax Returns Kpmg Jamaica

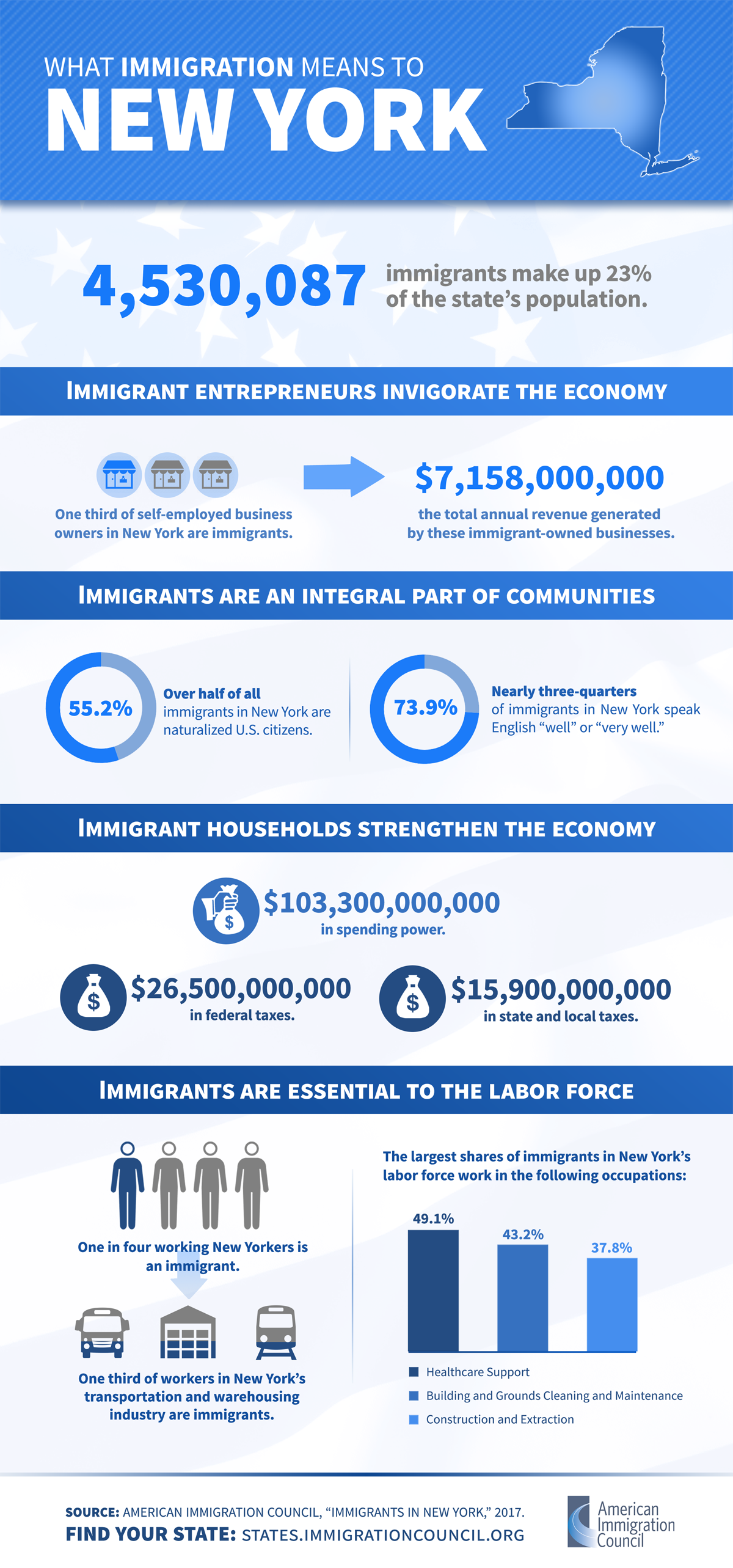

Immigrants In New York American Immigration Council

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

What Is Self Employment Tax And What Are The Rates For 2019 Workest

What Is Self Employment Tax And What Are The Rates For 2019 Workest

Post a Comment for "Self-employed Tax Rates Jamaica 2019"