Tax Withholding Table Definition

This table summarises WHT rates. What Does Wage Bracket Withholding Table Mean.

Professional Bookkeeping Accounting 4 Trial Balance More Bookkeeping And Accounting Business Analyst Investing

WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain management and technical service fees and similar payments made by a Canadian resident to a non-resident of Canada.

Tax withholding table definition. Federal and some state withholding amounts are at graduated rates so higher wages have higher withholding percentages. Withholding tax also known as retention tax is the tax usually deducted at source on income by the payer including people resident of another country on an employee of the domestic company as well as on interest income and dividend income as per the tax laws of the country charging withholding tax and remitted to the government of the country. Businesses figure out what to.

This will be effective starting January 1 2018 until December 31 2022. Also called payroll tax. Withholding tax synonyms withholding tax pronunciation withholding tax translation English dictionary definition of withholding tax.

Example sentences with withholding table translation memory. Those who have too much money. This is usually in the form of federal income tax Social Security and Medicare.

A portion of an employees wages or salary withheld by the employer as partial payment of the employees income tax. If you dont fully understand the table above we have made a simplified revised withholding tax table of BIR. Use an employees Form W-4 information filing status and pay frequency to figure out FIT withholding.

Wage bracket withholding tables are used to calculate the amount of income that the employer must withhold from each employees paycheck. Federal withholding tables determine how much money employers should withhold from employee wages for federal income tax FIT. The employer is required to withhold a certain amount of income from its employees and.

The amount of income tax your employer withholds from your regular pay depends on two things. People who are self-employed generally pay their tax this way. If you dont pay your taxes through withholding or dont pay enough tax that way you may have to pay estimated tax.

This money is then remitted to both the local and federal government on behalf of the employee. For employees withholding is the amount of federal income tax withheld from your paycheck. Revenue Canada did reflect the new higher rate in the withholding.

What is Estimated Tax. Tax rates and withholding tables apply separately at the federal most state and some local levels. If youre an employee your employer probably withholds income tax from your paycheck and pays it to the IRS in your name.

The money thats withheld by the employer acts as a credit against the employees annual income taxes. WITHHOLDING TAX ON GOVERNMENT MONEY PAYMENTS GMP - PERCENTAGE TAXES. Withholding tax is a set amount of money that employers take or withhold from an employees paycheck.

The tables below set out the rates of WHT applicable to the most common payments of dividends interest and royalties under UK domestic law where such a liability arises and the reduced rates that may be available under an applicable DTT. Distribution of withholding tables to employers. Canada is continually renegotiating and extending its network of treaties some with retroactive effect.

Withholding Tax on Government Money Payments GMP - Percentage Taxes - is the tax withheld by National Government Agencies NGAs and instrumentalities including government-owned and controlled corporations GOCCs and local government units LGUs before making any payments to non-VAT registered taxpayerssupplierspayees. If your employees filled out a 2020 or later W-4 it is important to note that they. Withheld income taxes are treated by employees.

Withholding tax agreement. A federal tax withholding table is a table or a chart that helps employers figure out how much income to withhold from their employees. What are income tax withholding tables.

It also may include state income tax depending on the state in which the business is located. Under the revised withholding tax table issued by the bureau employees who are earning P685 per day or P20833 per month will be exempted from withholding tax. Employers have the option to use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s specifically for tax withholding purposes.

Tax tables with an asterisk have downloadable look-up tables available in portable document format. The IRS and US tax laws require employers to withhold employees for income tax purposes. Withholding table in English translation and definition withholding table Dictionary English-English online.

A tax withheld calculator that calculates the correct amount of tax to withhold is also available. The amount to be withheld is based on both the amount wages paid on any paycheck and the period covered by the paycheck. What is Withholding Tax.

Please refer to specific treaties to ensure the values are up-to-date and ensure you have considered the potential impact of the Multilateral Instrument. The federal withholding tax table that you use will depend on the type of W-4 your employees filled out and whether you automate payroll. The amount you earn.

We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees. Withholding tax basic rate. What is Tax Withholding.

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

April 2020 Business Due Dates Due Date Dating Filing Taxes

What Are Employee And Employer Payroll Taxes Ask Gusto

Opinion The U S Job Market Is Still In Very Bad Shape Just Wait Until The Fiscal Time Bomb Goes Off In 2020 Marketing Jobs Job Chart Job

Mazuma S Year End Business Accounting Checklist Small Business Accounting Small Business Finance Bookkeeping Business

Quickbooks Unable To Calculate Payroll Taxes Easy Method That Works For All Quickbooks Payroll Quickbooks Payroll

How Many Tax Allowances Should I Claim Community Tax

How Should Progressivity Be Measured Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

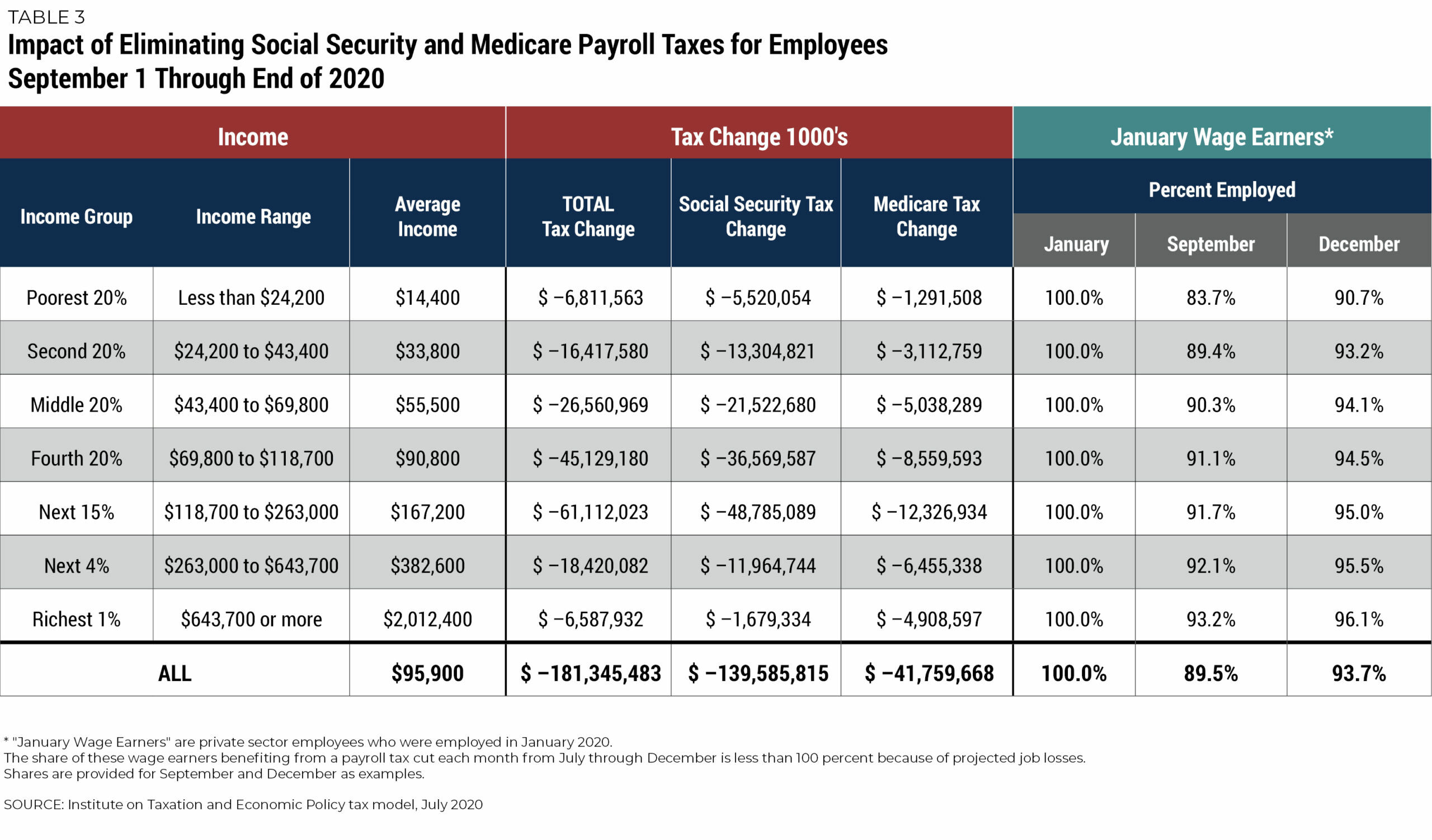

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

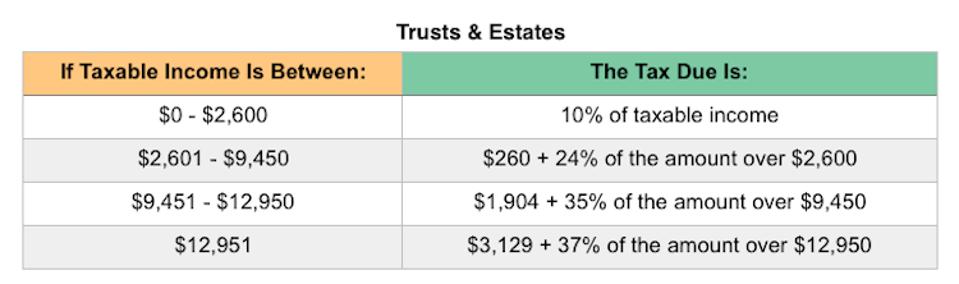

What Tax Breaks Are Afforded To A Qualifying Widow

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

The Full Stack Hr Professional Josh Bersin Full Stack Digital Learning Professional Development

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

Post a Comment for "Tax Withholding Table Definition"