What Is Expanded Withholding Tax

Income taxes due are paid upon the filing of the quarterly and annual income tax returns. Withholding tax is calculated and posted to the appropriate withholding tax accounts at different stages depending on the legal requirements in each country.

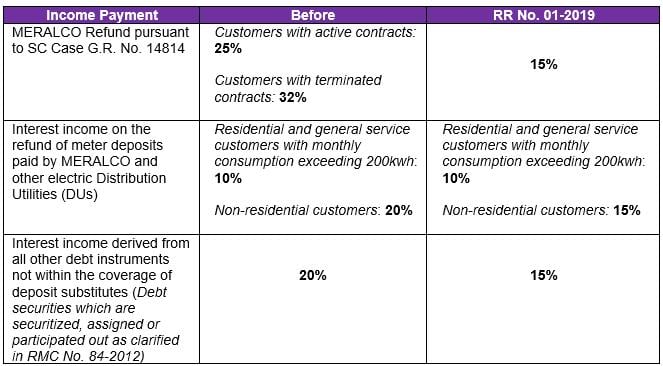

Updated Withholding Tax Rates On Meralco Payments And Interest On Loans Grant Thornton

In Accounts Payable the vendor is the person subject to tax and the company code is obligated to deduct withholding tax and pay this over to.

What is expanded withholding tax. If youre a withholding agent youre required to collect withholding tax on behalf of the government in order to avoid unnecessary penalties. Withholding Tax on GMP - Value Added Taxes GVAT -. With the issuance of RR No.

As said before a withholding agent is the one who physically should bring the expanded withholding tax return containing all the income tax deductions to the BIR from all the people under his control. 11-2018 amending RR Nos. ACCOUNTING ENTRIES FOR RECEIVABLE INCOME If a company pays to a beneficiary income which is liable to withholding tax the tax due is not to be charged to the debtor but rather it is the beneficiary who is taxed even if the tax is paid by the income debtorNormally the tax debt should be recorded on the date the actual income is paid to the beneficiary because the withholding.

Compensation - is the tax withheld from income payments to individuals arising from an employer-employee relationship. To calculate pay and report the withholding tax the SAP system provides two. Expanded withholding tax is to be paid by the withholding agent and should contain the accumulation of all the monthly funds taken from the tax payers income.

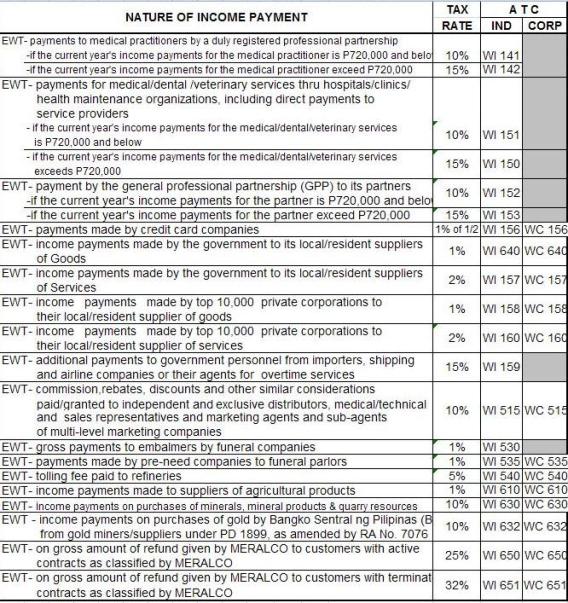

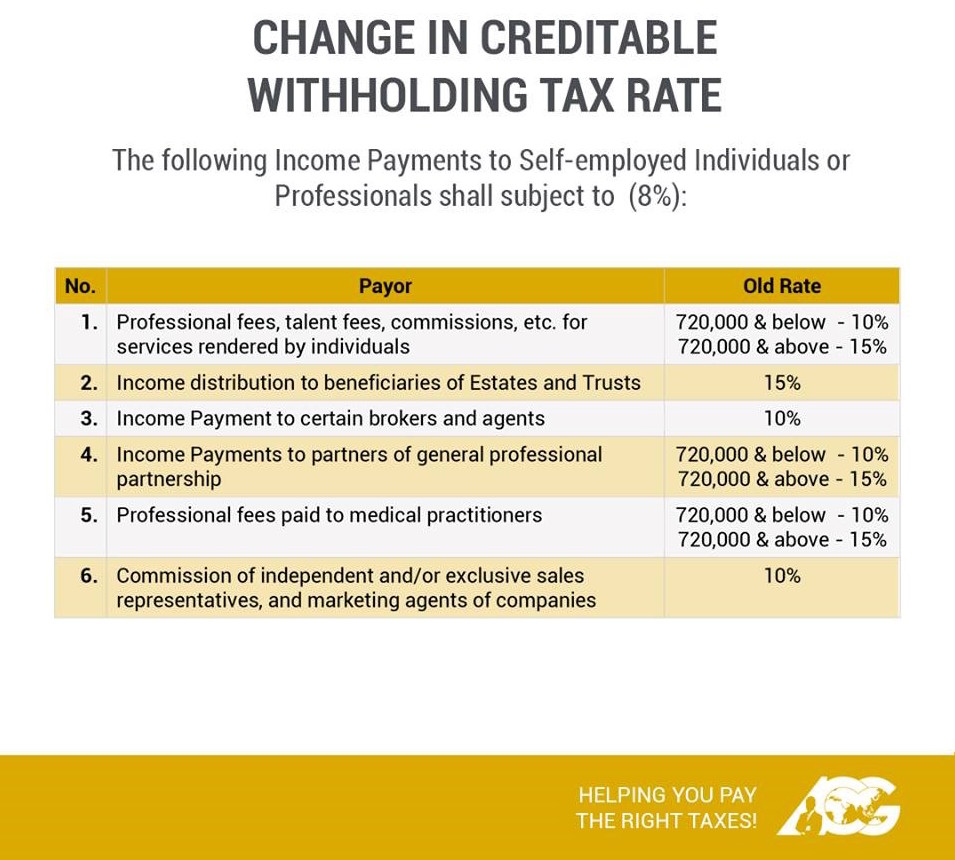

CPAs medical practitioners engineers architects real estate service practitioners etc and Supreme Court lawyers professional entertainers professional athletes directors and producers of movie and TV. 1 Individual engaged in business or practice of profession 2 Non-individual corporation association partnership whether engaged in. EWT- payments to medical practitioners by a duly registered professional partnership.

N Income payments by government offices on their purchase of goods and services from localresident suppliers other than those covered by other rates of withholding o Commission rebates discounts and other similar considerations paidgranted to independent and exclusive distributors medicaltechnical and sales representatives and marketing agents and sub-agents of multi level marketing companies. -if the current years income payments for the medical practitioner is P720000 and below. The company then remits this to the BIR on behalf of the employee.

Santosh kumar on Sep 21. SAP therefore recommends the use of extended withholding tax. Withholding tax is a tax on income that is withheld by the payor and is remitted to the government on behalf of the payee.

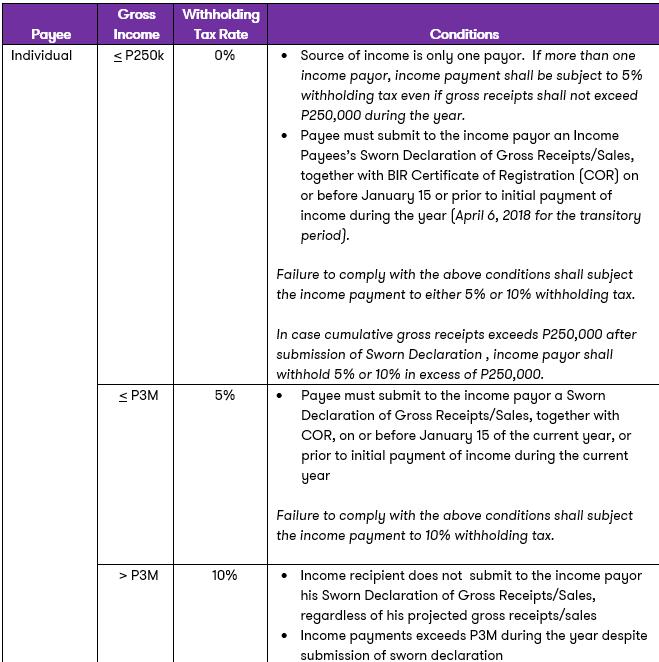

Distinguishing withholding tax from value added tax. As a rule withholding tax is posted at the same time that the payment is posted in other words the outgoing payment Accounts Payable or incoming payment Accounts Receivable is. 2-1998 17-2003 and 6-2009 taxpayers mandated to withhold the expanded withholding tax from their income payments to regular suppliers at 1 on goods and 2 on services are now identified as top withholding agents.

Expanded - is a kind of withholding tax which is prescribed on certain income payments and is creditable against the. Who needs to pay. The withholding tax system specifically that of the creditableexpanded withholding tax or EWT is a means of approximating and collecting in advance the income tax liability of a payee or income earner for certain types of income payments.

The most common example of this is in the employer-employee relationship where the company withholds a portion of the employees salary or income. Professional fees subject to expanded withholding tax in Philippines under TRAIN or RA 10963 covers those payments to licensed professionals under Professional Regulation Commission PRC eg. Expanded Withholding Tax is a kind of withholding tax which is prescribed only for certain payors and is creditable against the income tax due of the payee for the taxable quarter year.

Expanded Withholding Tax EWT is a kind of tax that is taken in advance by the buyer withholding agent from the sellers income on behalf of the government. -if the current years income payments for the medical practitioner exceed P720000. Every registered withholding agent on Expanded Withholding Tax which may include but not limited to the following.

With extended withholding tax you can process withholding tax from both the vendor and customer view. There is a need to draw attention to the fundamental difference between Withholding Tax WHT and Value Added Tax. Extended Withholding tax includes all the functions of classic withholding.

1 Withholding Tax At Source Revenue Regulations No

Askthetaxwhiz What Are The New Alphanumeric Tax Codes Under Train

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

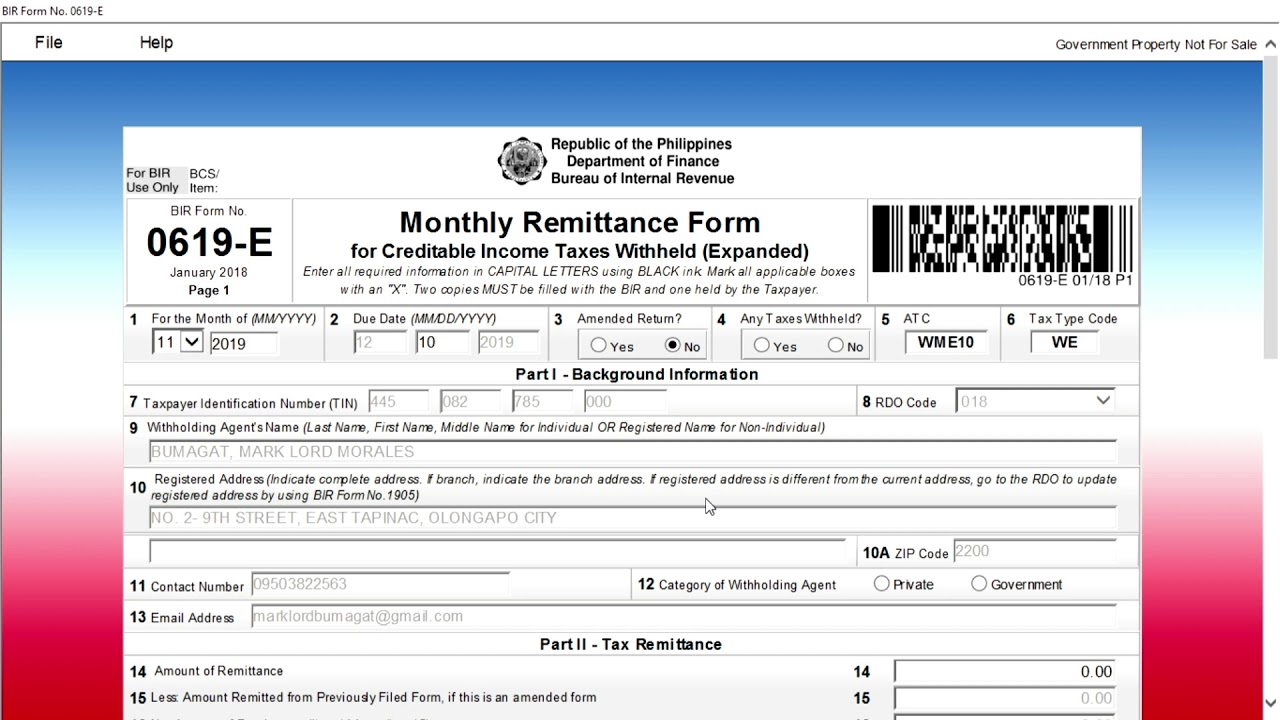

Video Tutorial How To File 0619 E Monthly Expanded Withholding Tax Return Step By Step Youtube

How To File And Pay Your Monthly Expanded Withholding Tax Using Bir Form 0619 E Part 7 Trailer Youtube

Expanded Withholding Tax Under Train Law Reliabooks

Expanded Rate Part 2 Business Tips Philippines Business Owners And Entrepreneurs Guide

Withholding Taxes Regulation Ppt Download

Welcome To The Withholding Tax System The Withholding

Withholding Tax At Source Ppt Video Online Download

Expanded Withholding Tax Ewt In The Philippines

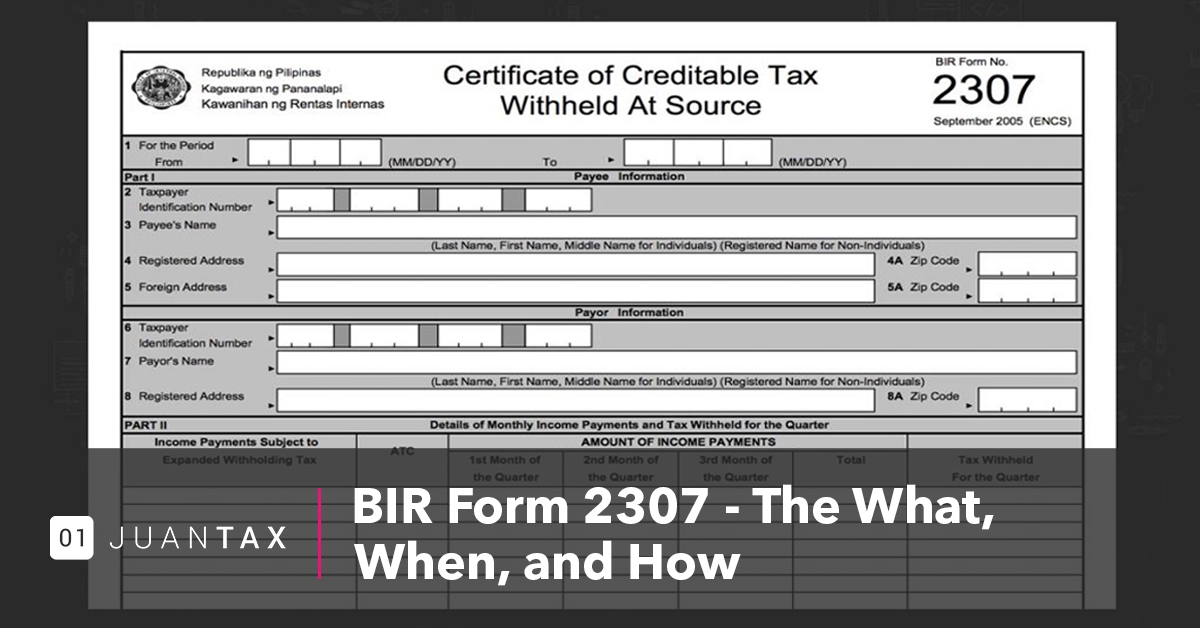

Bir Form 2307 The What When And How

Train Series Part 4 Amendments To Withholding Tax Regulations Zico Law

Orientation On Withholding Tax For Job Order Contractors

Ppt Withholding Tax On Government Money Payments Presented By Susan D Tusoy Cpa Mps Asst Chief Assessment Division Powerpoint Presentation Id 1677099

Indy Explains What The Expanded Child Tax Credit Means For Nevada Families The Nevada Independent

Train Series Part 4 Amendments To Withholding Tax Regulations Zico Law

Post a Comment for "What Is Expanded Withholding Tax"