What Is The Unemployment Tax Rate In Massachusetts

SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. Massachusetts Hikes Unemployent Tax Rates Again.

Youth Unemployment Intereconomics

Despite a relatively healthy UI trust fund and national trends lowering UI tax rates the Massachusetts Department of Unemployment Assistance has confirmed that Tax Rate Schedule E will officially be enacted as of January 1 2019.

What is the unemployment tax rate in massachusetts. Employers are subject to a 0056 contribution rate in 2020. All employers contribute to the fund at the same rate. Federal taxes under the Federal Unemployment Tax Act 26 USC 3301 et seq sets a standard rate of 6 of the first 7000 paid during a calendar year.

This schedule will effectively raise employer contribution rates with the minimum rate being94 previously83 and the maximum rate at 1437 previously 1265. Employers receive a tax credit of up to 54 of the state tax paid on the federal UI tax for an effective rate of 06 if. In a statement released by the MA DUA yesterday it was intimated that the revised 2021 rates would more closely align with the 2020 rate calculation in most cases but that has yet to be confirmed.

Established employers are subject to a lower or higher rate. The tax rate for new nonconstruction employers is to be 242 in 2020 unchanged from 2019. 030 142 including solvency surtax California.

Massachusetts requires that you pay UI taxes up to a fixed maximum amount of each employees wages. The FUTA tax is more commonly known as the unemployment tax and only employers have to pay this tax not employees. 065 68 including employment security assessment of 006 Alaska.

You can also see Massachusetts unemployment compared to other states. Nonresidents are subject to Massachusetts income tax on unemployment compensation that is related to previous employment in Massachusetts. Employer Medical Assistance Contribution EMAC.

Employer SUI contribution rates are assigned depending on which rate schedule is in effect for the year and the employers experience rating. Part-year residents are subject to Massachusetts income tax on unemployment received while a Massachusetts resident whether related to employment inside or outside of Massachusetts. That amount known as the taxable wage base is 15000.

Note that you can claim a tax credit of up to 54. 1 2020 unemployment tax rates for experienced employers are to be determined with Schedule E the department said on its website. 050 employee share 15 59.

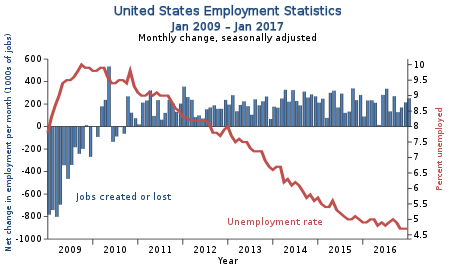

Tax rates are to range from 094 to 524 for positive-rated employers and from 703 to 1437 for negative-rated employers. The unemployment rate in Massachusetts peaked in April 2020 at 164 and is now 103 percentage points lower. Information on labor force employment unemployment and unemployment rates in Massachusetts and local areas.

Employers are subject to a 0056 contribution rate in 2020. The Massachusetts Department of Unemployment Assistance has set the rate at 923 which is an approximate 1500 increase from last years rates. Here is the press release from Governor Bakers office.

An employer may also be required to pay the Solvency Assessment andor the Workforce Training Contribution. On April 1 2021 Governor Baker signed legislation which allows taxpayers with household income up to 200 of the federal poverty level to deduct up to 10200 of unemployment compensation from taxable income on their Massachusetts tax return. Standard rate 257 207 employer share.

15 62 emergency 15 surcharge. Wage Base and Tax Rates. The uniform solvency assessment is designed to cover the cost of benefit payments not directly chargeable to individual employers.

The amount is subject to change in future years. The current newly subject employer rate for employers in the non-construction industry is 242 according to UI Tax Rate Schedule E in effect for 2019 and 2020 This rate is subject to change any time the rate schedule changes. The UI tax rate for new employers which recently has been just above or below 2 also is subject to change.

The deduction may be claimed by each eligible. The state unemployment rate was 03 percentage points higher than the national rate for the month. Schedule E is to continue to be in effect for 2021 Employers are to be assessed a surtax rate ranging from 01 to 076 Massachusetts unemployment tax rates were prevented from increasing for 2021 and a surcharge rate was established under a measure that was signed April 1 in part by Gov.

Find information on labor force employment unemployment and unemployment rates produced by the Local Area Unemployment Statistics LAUS program for the Commonwealth New England city and town areas NECTA labor market areas LMA workforce. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. The legislation would freeze the rate schedule in 2021 and 2022 settling the average per-employee cost at 635 in 2021 and 665 in 2022 according to the Associated Industries of Massachusetts.

All employers contribute to the fund at the same rate. The DUA also stated that until employers receive their revised 2021 unemployment tax rate in late July employers are advised to use their 2020 tax rates retroactive to January 1 2021.

Youth Unemployment In The Mena Region Determinants And Challenges By Masood Ahmed Director Middle East And Central Asia Department Imf Dominique Guillaume Deputy Division Chief Imf Davide Furceri Economist Imf

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

Youth Unemployment Intereconomics

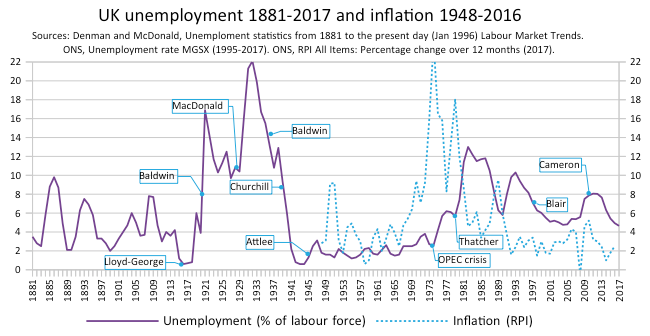

Unemployment In The United Kingdom Wikipedia

Unemployment In The United Kingdom Wikipedia

Ecb Economic Bulletin Issue 3 2017

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Citylab Bloomberg Geography Federal Income Tax Economy

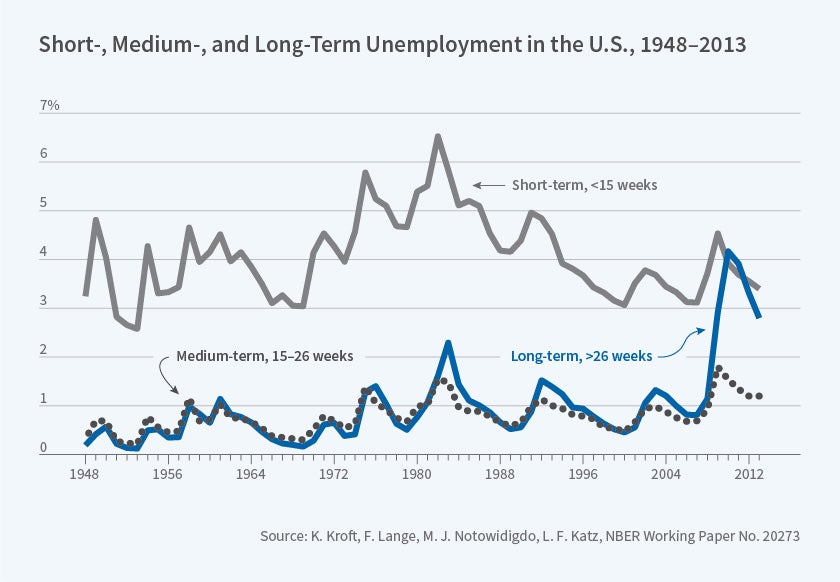

Long Term Unemployment And The Great Recession Nber

Https Www Jstor Org Stable 26477700

Causes Of Unemployment In The United States Wikipedia

Human Capital And Unemployment Dynamics Why More Educated Workers Enjoy Greater Employment Stability Cairo 2018 The Economic Journal Wiley Online Library

Signs Favor Optimism For The Economy The Boston Globe Changing Jobs Optimism Be Optimistic

Unemployment During The Pandemic How To Avoid Going For Broke Siepr

Addressing Labour Market Challenges In Belgium Ecoscope

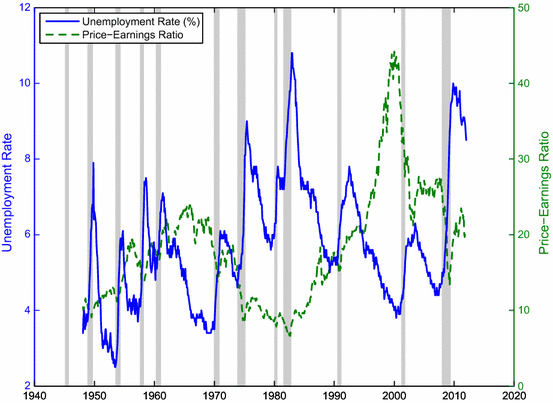

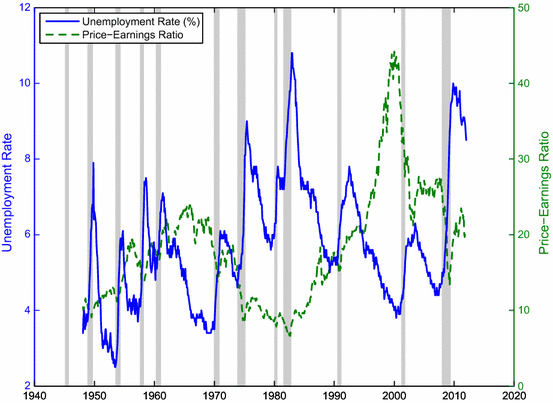

Stock Market Bubbles And Unemployment Springerlink

Usa Unemployment Rate Tax Rate Unemployment

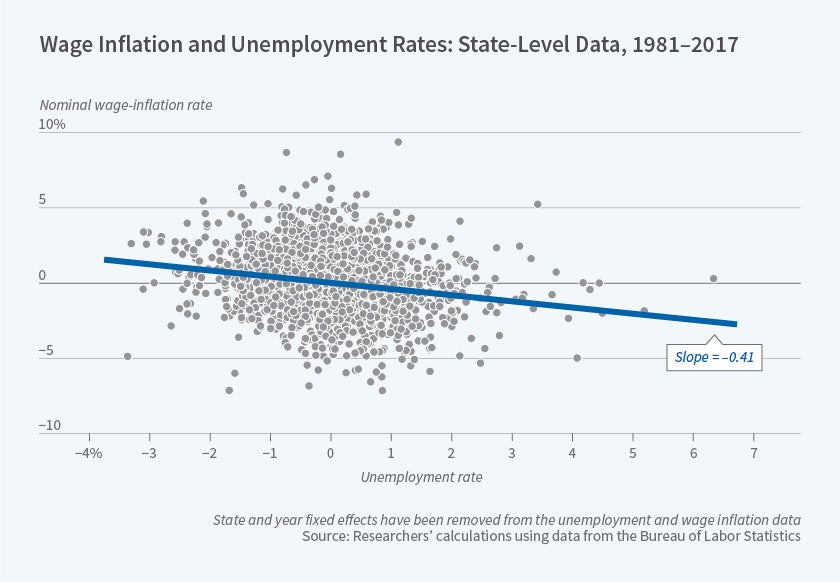

Is The Phillips Curve Still A Useful Guide For Policymakers Nber

Post a Comment for "What Is The Unemployment Tax Rate In Massachusetts"