What Is Withholding Tax In South Africa

Personal income tax 383 VAT 252 Company income tax 166. As a shareholder in either a company that is resident in South Africa or in a foreign company the shares of which are listed at a South African Exchange you will become liable for the Dividends Tax when a dividend is paid to you.

How Do I Record Or Show Withholding Tax On Sale In

The withholding tax rate was to be 15 on any qualifying fee paid to or for the benefit of any foreign person.

What is withholding tax in south africa. This withholding tax is not a final tax but an advance payment of tax on the sellers actual account of normal tax liability. All legally employed individuals working in South. The following example illustrates how quickly WHT can go wrong.

This withholding tax is not a final tax but an advance payment of tax on the sellers actual account of normal tax liability. The tax rate in South Africa for estate duty is 20 of properties worth up. From years of assessment commencing 1 April 2012 a dividend withholding tax was introduced in South Africa levied at a rate of 15 per cent.

75 if the non-resident seller is an individual 10 if the non-resident seller is a company or 15 if the non-resident seller is a trust. WHT is a tax levied on the payer of an item of income and could if not properly planned have a significant impact on company profit levels. Since 1 September 2007 a withholding tax is levied on the disposal by a non-resident of any immovable property in South Africa in terms of section 35A of the Act.

It is thus very important for any person making any payment. This requires the payor to withhold a prescribed portion from these amounts and to remit this portion to the South African Revenue Service. Any person who pays an amount to a non-resident in respect of the sale of immovable property in South Africa must withhold from the amount payable an amount equal to.

Inheritance tax in South Africa Estate duty is the name for inheritance tax in South Africa which is a property tax payable on all estates with a net worth in excess of R3500000. Withholding taxes with respect to non-residents provide the South African Revenue Service SARS with a collection mechanism saving SARS the trouble of chasing after foreigners who do not pay their South African taxes. Since 1 September 2007 a withholding tax is levied on the disposal by a non-resident of any immovable property in South Africa in terms of section 35A of the Act.

Withholding refers to the percentage of an employees earnings that are automatically withheld meaning they are taken from their paycheck and paid directly into government mandated tax collections. Payments of dividends royalties and interest to certain recipients for instance non-residents of South Africa are subject to withholding tax. The amount to be withheld is 5 of the amount payable where the seller is a natural person 75 where the seller.

The withholding agent should also send you the required. The WTI is a tax charged on interest paid on or after 1 March 2015 by any person to or for the benefit of a foreign person which includes individuals companies etc from a source within South Africa. The shareholder is referred to in the dividends tax.

In those cases where the purchaser of the immovable property is a resident of South Africa the withholding tax is required to be paid within 14 days after the date on which the amount was withheld from the consideration due to the seller. A withholding tax WHT is applicable to the disposal of immovable property by a non-resident to any other person insofar as the immovable property or a right or interest. Payments made to non-resident individuals who were physically present in South Africa for a period exceeding 183 days during the 12-month period preceding payment of the service fee.

The South African Revenue Service or SARS defines withhold practices in South Africa. Non-residents are subject to the. The South African Government was traditionally quite reluctant to impose withholding taxes especially in an attempt to encourage investment into South Africa.

Dividends are subject to a withholding tax of 20 percent and interest paid to non-residents is subject to a withholding tax of 15 percent. However the relevant withholding agent will have to withhold and pay the tax to SARS. Most withholding taxes provide for the personal liability of a person who fails to withhold.

Of late however it seems that it has been realised that withholding taxes is an effective method of collecting taxes especially in the context of non-residents of South Africa deriving their profits from transactions linked to South. Notable exemptions from the proposed withholding tax included. In certain instances it is possible to reduce or eliminate this withholding tax when for example a treaty granting relief from.

In terms of section 64D to 64N of the Income Tax Act the dividend withholding tax is levied on shareholders in respect of dividends paid by any company other than a headquarter company. A South African resident company ABC provides technical services to a resident company in an African. The most common mandatory tax withheld is PAYE and UIF.

South Africa imposes progressive tax rates on a yearly personal income and on income derived by self-employed Taxable income above the threshold is subject to tax at marginal rates ranging from 18 to 45 percent. Constituents of South African taxation receipts for the tax year 201819. However the effects of withholding tax WHT on the profit of the company is not usually one of the things thought of until it is too late.

Manage Withholding Taxes Odoo 14 0 Documentation

Manage Withholding Taxes Odoo 14 0 Documentation

Solved How To Record And Pay Withholding Tax On Supplier

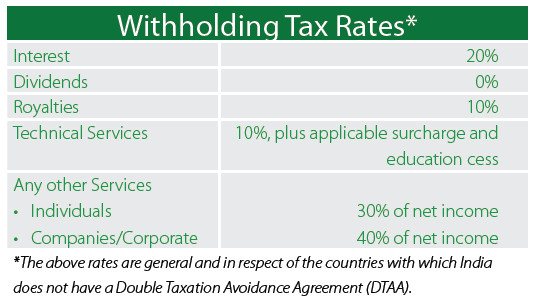

How Do I Configure Withholding Taxes Which We Need

Withholding Tax An Overview Sciencedirect Topics

Solved What Is The Purpose Of Extra Withholding Under The

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Global Corporate And Withholding Tax Rates Tax Deloitte

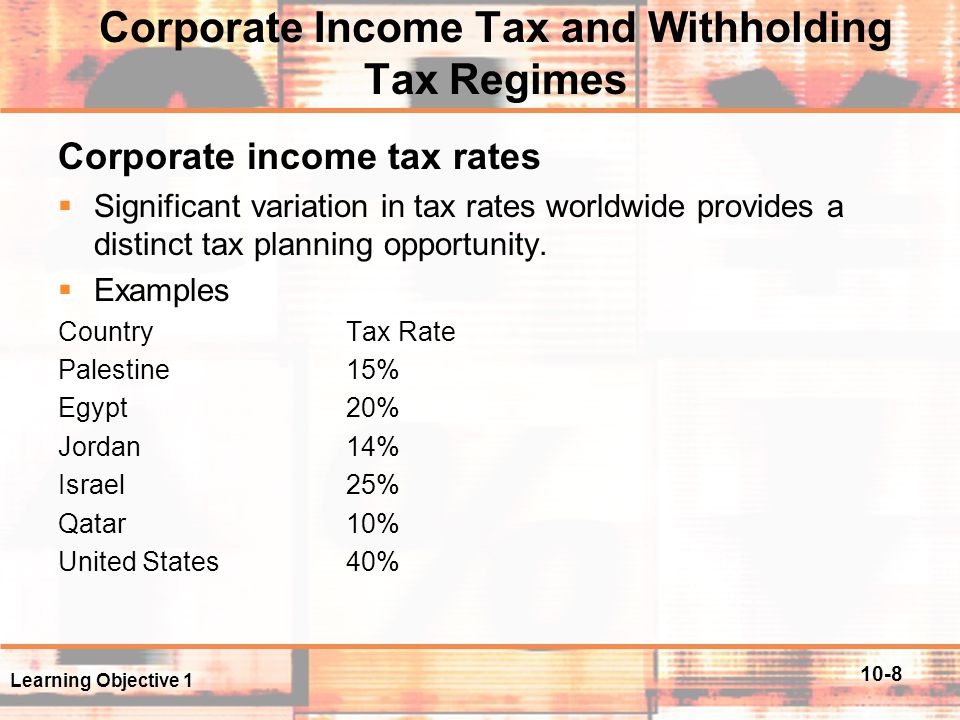

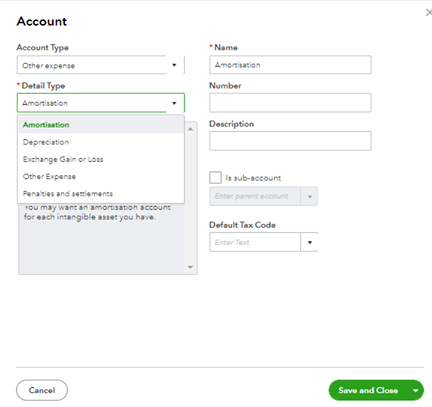

International Taxation Ppt Download

Solved How To Record And Pay Withholding Tax On Supplier

How Do I Configure Withholding Taxes Which We Need

Withholding Tax Sap Help Portal

Solved How To Record And Pay Withholding Tax On Supplier

Manage Withholding Taxes Odoo 14 0 Documentation

Withholding Tax An Overview Sciencedirect Topics

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

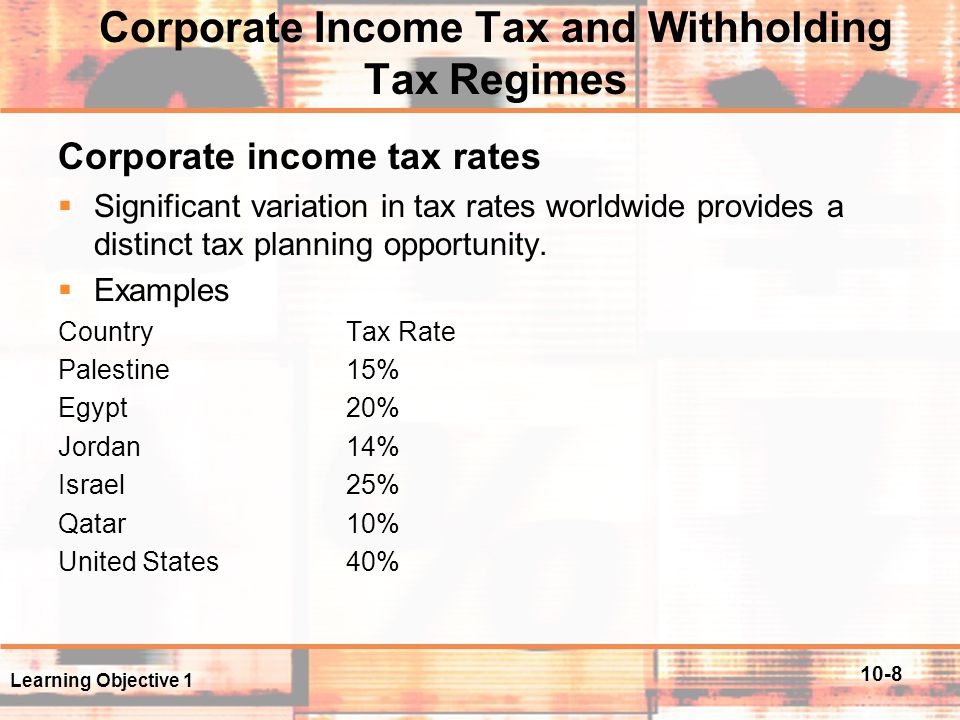

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Post a Comment for "What Is Withholding Tax In South Africa"