What Is Withholding Tax Kenya

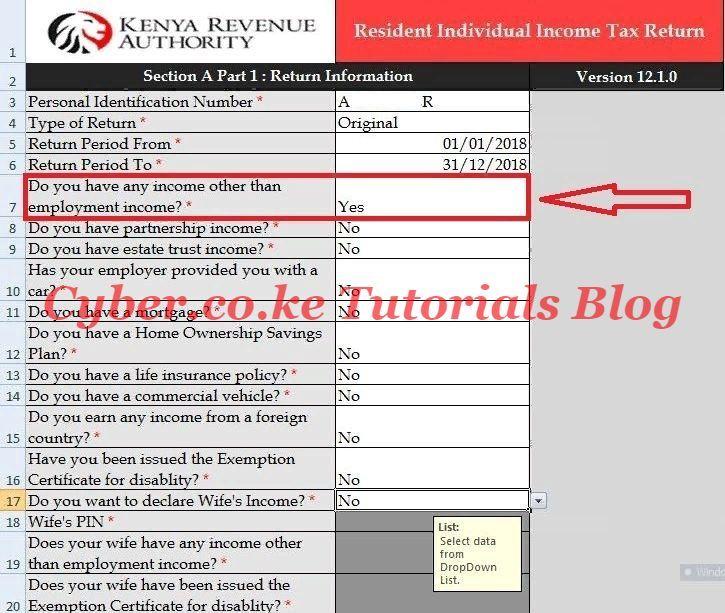

Withholding tax is not a final tax. What is exempt from Withholding Tax.

Withholding Tax Rates To Non Residents Download Table

Calculate withholding tax on invoice in Kenya What is withholding tax.

What is withholding tax kenya. Interests dividends pensionsretirement annuity appearance or performance. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. An example is when marketing companies pay commissions to their marketers the company will withhold some of the commissions and pay to Kenya Revenue Authority as tax on behalf of the marketers.

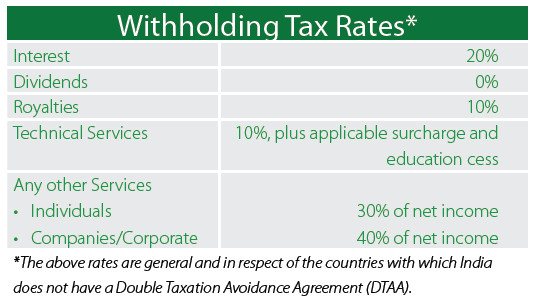

Local supplies are either goods services digital products or software. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125. Withholding Tax The Withholding Tax is levied at varying rates mostly between 3 to 30 percent on a range of payments to both residents and non-residents.

What Is Withholding Tax. Besides employment tax some jurisdictions levy withholding tax on payments of dividends and interest. Capital Gains Tax maintained at 5 Withholding tax on security services transportation of goods.

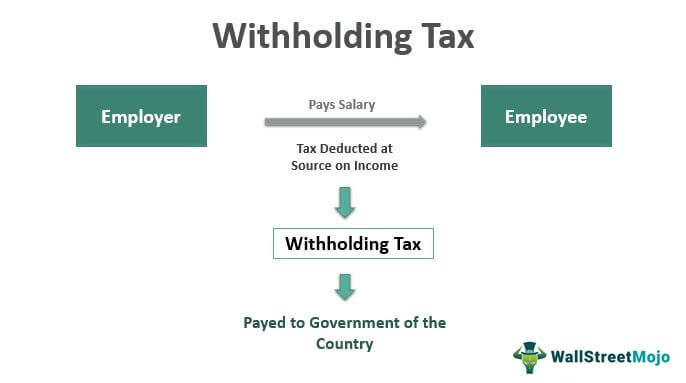

The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA. Resident WHT is either a final tax or creditable against CIT. In Kenya the agents deduct 2 of the VAT and remit it to KRA.

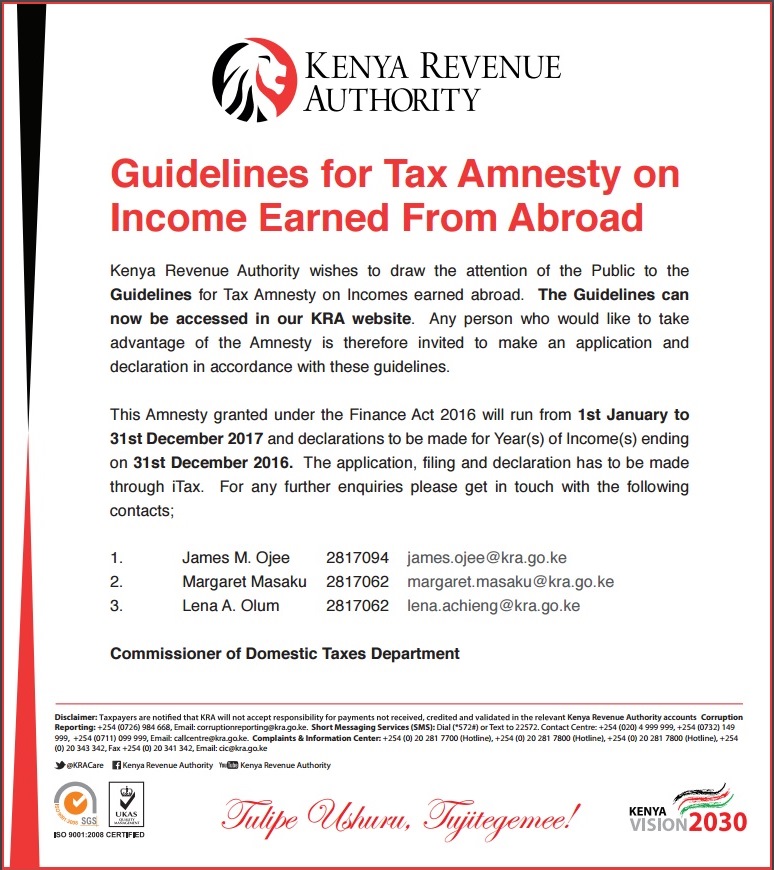

Withholding tax alternatively called retention tax is a standard income tax paid to the state by the income payer in place of the income receiver. Calculate withholding tax on invoice in Kenya When a taxpayer trader supplies and invoices an appointed withholding VAT Agent the payment for supply is made less VAT charged or that which ought to have been charged. Kenya Uganda Tanzania Rwanda and Burundi require that anyone making payments to suppliers for the provision of goods and services whether resident or non-resident should withhold tax at the appropriate rates see Annex 1 and remit this tax to the respective Revenue Authority.

Some of the highlights are. This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA. In simple terms this tax is deducted or withheld from the recipients income before its disbursement.

Payments which are liable to Withholding Tax WHT include but are. Kenya Revenue Authority expects to receive all the withheld income taxes before the end of the 20th day of the consequent month. Withholding VAT Withholding VAT is not a tax but a method of collecting VAT.

Most of the proposals in the Finance Bill have been maintained with a few additions. Deducted and remitted on or before the 20th of the following month. It can be pre-payment or a final tax.

Withholding Tax in Kenya is tax that is deductible from certain classes of income at the point of making a payment to a non-employee. The Withholder is the person who is making payment and withholds some money to remit to the taxman while the withholder is the recipient of the income being withheld. The percentage deducted varies between incomes and is dependent on whether you are a resident or non-.

A portion of the VAT is collected by KRA appointed agents from payments made for local taxable supplies. First 10 years income tax is at the rate of ten per cent 10. Withholding tax is the tax charged on income from the wages of an employee and is paid by the employer directly to the government.

Corporate - Withholding taxes Last reviewed - 01 July 2021 WHT is levied at varying rates 3 to 25 on a range of payments to residents and non-residents. In simple terms this tax is deducted or withheld from the recipients income before its disbursement. Withholding tax alternatively called retention tax is a standard income tax paid to the state by the income payer in place of the income receiver.

The tax is chargeable on. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. 21 Zeilen Withholding tax is not a final tax.

Deducted and remitted on or before the 20th of the following month. Dividends paid by SEZ to non-resident persons are exempt from income tax. The payer rather than the recipient pay it as tax to taxman.

The remaining balance of 14 is paid to the supplier. The amount withheld is credited against the employees taxes payable during the year. Withholding tax on training fees Under the Provisions of Section 10 of the Income Tax Act CAP 470 Laws of Kenya The Act payments made by resident persons or persons having Permanent Establishments in Kenya to any other person in respect of training is deemed as income accrued or derived in Kenya.

Withholding tax is income withheld by a person making payment and remitted to the taxman. Next 10 years income tax is at the rate of fifteen per cent 15. For residents withholding tax is either a final tax or creditable against the CIT while for non-resident the withholding tax is final.

Withholding tax rates on interest management fees and royalties paid to non-residents taxpayers is at the rate of five per cent 5. Advertising and marketing services scrapped.

How To Calculate Withholding Tax On Rent

Tax Training Taxation Of Government Ministries 26 May

Manage Withholding Taxes Odoo 14 0 Documentation

Tax Training Taxation Of Government Ministries 26 May

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Manage Withholding Taxes Odoo 14 0 Documentation

Hansaworld Integrated Erp And Crm

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

Hansaworld Integrated Erp And Crm

Tax Training Taxation Of Government Ministries 26 May

How Much Is Withholding Tax In Kenya Tax Walls

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

Withholding Tax Returns In Kenya 2021 How To File And Current Rates

Countrywise Withholding Tax Rates Chart As Per Dtaa

Withholding Tax Rates To Non Residents Download Table

Understanding Withholding Tax In Zimbabwe Furtherafrica

What You Need To Know On Double Taxation Regulation Between Kenya And Germany Mkenya Ujerumani

Stori Za Ushuru Is Withholding Tax Charged On All Incomes Facebook

Post a Comment for "What Is Withholding Tax Kenya"