Withholding Tax Rate Between Malaysia And Hong Kong

Interest on loans given to or guaranteed by the Malaysian government is exempt from tax. To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence.

Https Home Kpmg Com Content Dam Kpmg Pdf 2016 07 Non Resident Withholding Tax Rates For Treaty Countries Pdf

Country Fees for Technical Services Bosnia and Herzegovina.

Withholding tax rate between malaysia and hong kong. There is no withholding tax on dividends paid by Malaysia companies. Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country. Profits tax Persons chargeable - Corporations partnerships trustees and bodies of persons carrying on a trade profession or business in Hong Kong are subject to tax on Hong Kong-source profits excluding profits arising from the sale of capital assets.

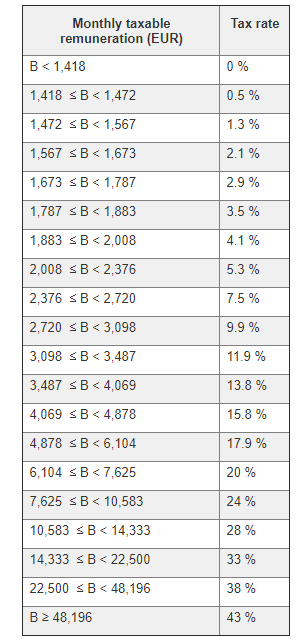

Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals. Hong Kong NIL 10 8 5 22. 1 january 2013 agreement between the government of malaysia and the government of the hong kong special administrative region of the peoples republic of china for the avoidance of double taxation.

Indonesia NIL 10 24. 26 WHT of 20 is. A 366 signed.

Iii Where the rate provided in the ITA 1967 is lower than the DTA rate the lower rate shall apply. Hong Kong Tax Guide 2020 5 Taxation for businesses. However it must be noted that the withholding tax rate of 165 is restricted in its application.

Hong Kongs Tax System. For other cases the WHT rate on the gross royalty income ranges from 2475 when the assessable profits are HKD 2 million or less and the two-tiered tax rates are applicable to 495 in relation to the assessable profits in excess of HKD 2 million when the two-tiered tax rates are applicable or when the two-tiered tax rates are not applicable capped at 3 according to the treaty. This means that taxes are levied on profits.

DTAs are also referred to as tax treaties. 25 april 2012 entry into force. These profits must come from either a trade profession or.

Malaysia and Hong Kong have entered into a Double Taxation Agreement DTA on 25 April 2012The agreement will come into force once it is ratified by Malaysia and Hong Kong. Withholding tax rate of 10 is only applicable for interest payment paid or incurred by an. In the absence of a CDTA Hong Kong residents receiving interest from Malaysia are subject to Malaysian withholding tax which is currently at 15 per cent.

The rate of 5 applies to interest arising from bonds or securities regularly traded on recognised exchanges. The highest rate of 15 applies for a period of two years from the date on which the treaty takes effect. Iran NIL 15 10 25.

I There is no withholding tax on dividends paid by Malaysia companies. 28 december 2012 effective date. When a business or individual makes payments to non-resident entities for services they receive in Hong Kong the portion of payment withheld is called withholding tax.

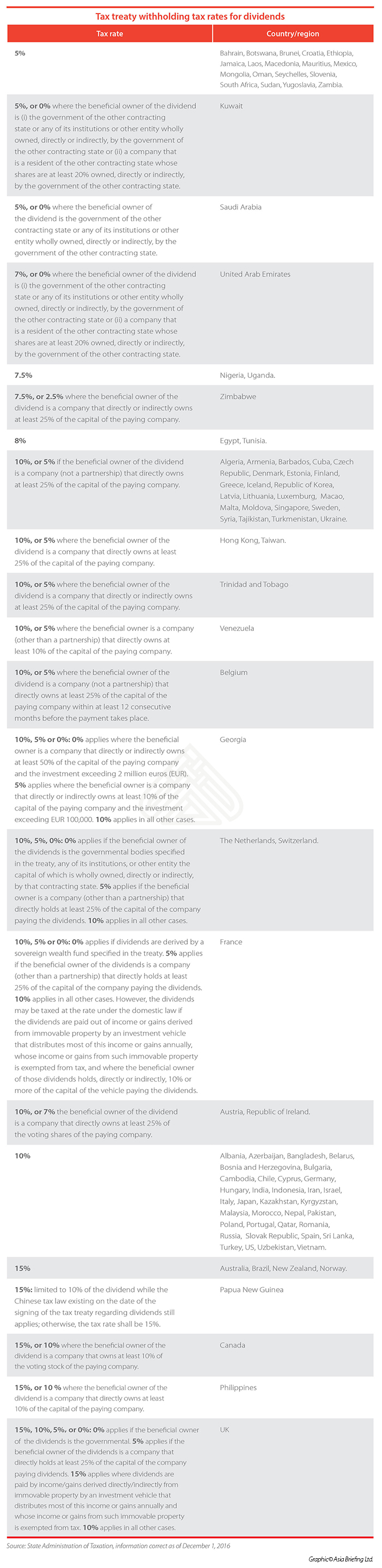

The objective behind levying a 165 withholding tax rate is to prevent taxpayers from minimizing their Hong Kong tax liability by entering into arrangements with associated companies or individuals. The following table shows the maximum rates of tax those countries regions with a Comprehensive Double Taxation Agreement Arrangement with Hong Kong can charge a Hong Kong resident on payments of dividends interest royalties and technical fees. India NIL 10 23.

Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. The rate of 10 applies in other cases.

They prevent double taxation and fiscal evasion and foster cooperation between Hong Kong and other international tax administrations by enforcing their respective tax laws. Under the agreement such withholding tax rate will be capped at 10 per cent. Dta malaysia hong kong 2 pu.

Some treaties provide for a maximum WHT on dividends should Malaysia impose such a WHT in the future. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. 77 rijen Withholding tax is a method of collecting taxes from non-residents who have derived.

Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence. Hong Kong has entered into Comprehensive Double Taxation Agreements Arrangements DTAs with a number of jurisdictions. Hong Kong follows a territorial system.

Where the rate provided in the ITA 1967 is lower than the DTA rate the lower rate shall apply. There is no withholding tax on dividends paid by Malaysia companies. Tax Rates for Dividends Interest Royalties and Technical Fees.

Russia S Double Tax Treaty Agreements Russia Briefing News

Hong Kong S Tax Treaties Update January 2012 Tax Hong Kong

Tax Withholding Rates Taxes Income Tax Tax Rates Tax Updates Business News Economy 2020

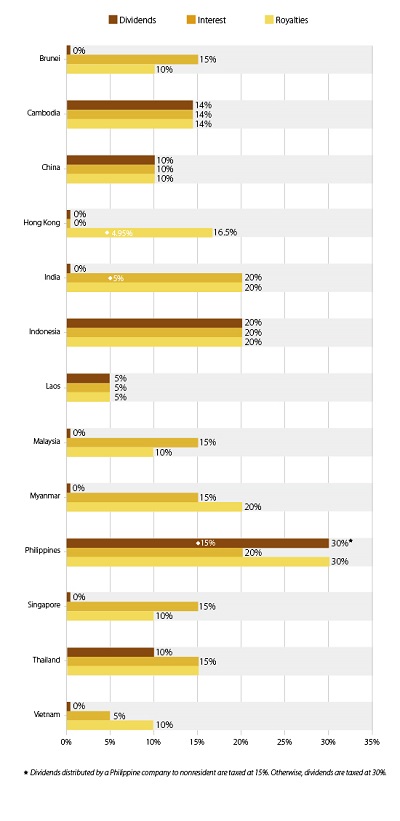

Analysis Of Asia S Tax Rates Part 2 Withholding Tax Asia Business News

Https Assets Ey Com Content Dam Ey Sites Ey Com En Us Topics Financial Services Ey Global Withholding Tax Reporter Pdf

Hong Kong Withholding Tax What You Need To Know

Countrywise Withholding Tax Rates Chart As Per Dtaa

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Tax Treaties Database Global Tax Treaty Information Ibfd

Global Corporate And Withholding Tax Rates Tax Deloitte

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Conditional Withholding Tax On Dividend Payments Proposed Deloitte Netherlands

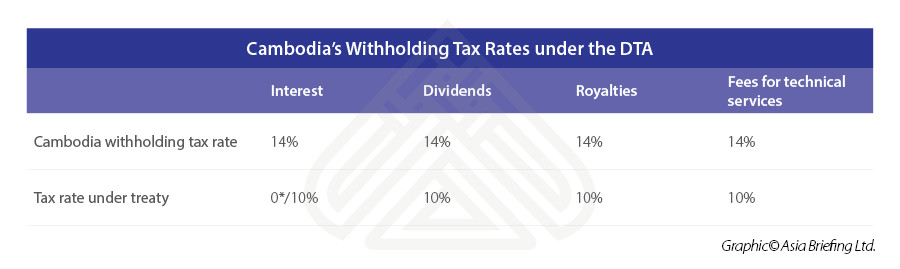

Cambodia S Withholding Tax Rates Under The Dta Asean Business News

Tax Treaties Database Global Tax Treaty Information Ibfd

Mali Selected Issues In Imf Staff Country Reports Volume 2018 Issue 142 2018

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Global Corporate And Withholding Tax Rates Tax Deloitte

Withholding Tax In China China Briefing News

Agreement Reached To Amend The Luxembourg Russia Tax Treaty On Withholding Tax Rates For Dividend And Interest Payments Deloitte Luxembourg Tax News

Post a Comment for "Withholding Tax Rate Between Malaysia And Hong Kong"