Withholding Tax Rates Global

The tax is thus withheld or deducted from the income due to the recipient. Other local-level tax rates in the state of Ohio are quite complex compared against local-level tax rates in other states.

Economic Globalization Since 1790 Structures And Cycles In The Modern World System Global Global Village Global Economy

And 2 the same.

Withholding tax rates global. Though the above table shows that Chile has a 35 withholding tax rate in my personal accounts the depository has deducted only about 22 in taxes on. You can view the complete list of withholding tax rates for every country here. 1042 Annual Withholding Tax Return for US.

The Agreement signed is a protocol of amendment that replaces the Savings Agreement between Switzerland and the European Union which has applied since 1 July 2005. Global tax guide to doing business in Brazil. 13930 Instructions on how to apply for a Central Withholding Agreement.

In other situations withholding agents may apply reduced rates or be exempted from withholding tax WHT at source when there is a tax treaty between the foreign persons country of residence and the United States. If you buy a 6 yielding US REIT after withholding tax its going to be a 4. In terms of grossing up your fees the issue you will face is that this will make you uncompetitive compared to companies providing the same service as you do but who are licensed and have offices and pay taxes in China because they are not subject to withholding tax as they pay business tax and profits tax instead.

Source Income Subject to Withholding. Royalties management or administration fees are subject to withholding income tax at rates varying from 15 to 25 depending of nature of the revenue and the location of the beneficiary. Tax withholding also known as tax retention Pay-as-You-Go Pay-as-You-Earn or a Prlvement la source is income tax paid to the government by the payer of the income rather than by the recipient of the income.

Source Income of Foreign Persons. 1042-S Foreign Persons US. Federal income tax rates are progressive.

Additional tax schedules. 13930-A Application for Central Withholding Agreement Less than 10000. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35.

Switzerland and the European Union EU signed an Agreement regarding the Introduction of the Global Automatic Exchange of Information Standard on 27 May 2015 applicable as of 1 January 2017. Withholding takes place throughout the year so its better to take this step as soon as possible. The entry into force of this new withholding tax collection mechanism planned initially on.

Many employers have an automated system for submitting an employees changes for Form. Tax Withholding in Retirement During your working years you typically have one primary source of income. Depending on local municipalities the total tax rate can be as high as 8.

The Income Tax Act ITA Value-Added Tax VAT Excise Duty Act Tax Procedures Act Miscellaneous Fees and Levies Act and the Kenya Revenue Authority Act. Withholding Tax Code Define Withholding tax code The rates are maintained through tax codes. Out of total Direct Taxes collection of Rs 740b for financial year 2012 Rs 422b with percentage share of 57 came from various Withholding Taxes which are characterized.

Deloitte US Audit Consulting Advisory and Tax Services. However the WHT rate applicable on certain types of passive income such as interest and. In most jurisdictions tax withholding applies to employment income.

In retirement however your income will likely be drawn from multiple sourcesand the tax withholding rules for each may vary says Hayden Adams CPA CFP and director of tax planning at the Schwab Center for Financial Research. The Ohio OH state sales tax rate is currently 575. Withholding Tax Regime is a global phenomenon and in Pakistan the major source of the Federal revenue collected on national level.

The collection as well as dependence on Withholding Taxes is on the rise over the years. Global tax rates 2021 provides corporate income tax historic corporate income tax and domestic withholding tax rates for around 170 jurisdictions. Different tax rates are levied on income in different ranges or brackets depending on the taxpayers filing status.

As you can see some nations are far friendlier to foreign dividend investors than others. Hi Cate withholding tax varies depending upon the service rendered. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15.

The Act makes various changes to the prevailing tax laws in Kenya. For background on the Bill see EY Global Tax Alert Kenya proposes Tax Laws Amendments Bill 2020 dated 16 April 2020. Withholding Tax Configuration Country India Version Maintaining rounding rule for withholding tax types.

If that persons earned income from the primary employer exceeds 12000 or the municipalitys tax collector informs the employer that the employees income has reached 12000 employers restart withholding of the LST by withholding. Article 9 of the. Global tax guide to doing business in Brazil.

1042-T Annual Summary and Transmittal of Forms 1042-S. Use your results from the Tax Withholding Estimator to help you complete a new Form W-4 Employees Withholding Certificate and submit the completed Form W-4 to your employer as soon as possible. 8233 Exemption From Withholding.

The purpose is to maintain the rounding rule during posting. It contains Base withholding tax rate and surcharge on base WHT rate. If the total amount of payments to the same recipient in a given tax year exceeds PLN2 million the payer will be obliged to calculate collect and pay the withholding tax using the standard rates set out in the CIT Act 19 to 20 percent with a right to apply for a tax refund to the tax authority.

In 2020 the top tax rate 37 percent applies to taxable income over 518400 for single filers and over 622050 for married couples filing jointly. As taxable income increases it is taxed at higher rates. Basically you pay withholding tax on all dividends be it from shares ETFs REITs etc.

The following tax laws have been amended. 1 a catch-up lump sum tax equal to the amount of tax that was not withheld from the employee as a result of the exemption.

Primer Zapolneniya Nalogovoj Formy W 8ben Dlya Shuterstok Shutterstock Teachers College Instructional Design State Tax

Invest Or Pay Down Debt Tax Deductions Tax Refund Filing Taxes

Global Corporate And Withholding Tax Rates Tax Deloitte

Global Corporate And Withholding Tax Rates Tax Deloitte

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 2 D Income Tax Filing Taxes Tax Services

Taxes In Switzerland Income Tax For Foreigners Academics Com

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Global Minimum Tax An Easy Fix Kpmg Global

Global Corporate And Withholding Tax Rates Tax Deloitte

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

Global Corporate And Withholding Tax Rates Tax Deloitte

Customs Import Of Goods At Concessional Rate Of Duty Rules 2017 Http Taxguru In Custom Duty Customs Import Goods Concession Custom Rules Direct Indirect

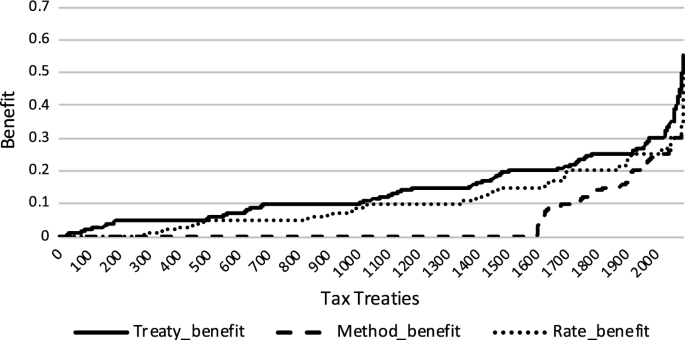

On The Relevance Of Double Tax Treaties Springerlink

Bir 1901 Form Download Form Survey Questions Survey Questionnaire

Post a Comment for "Withholding Tax Rates Global"