Withholding Tax Rates On Services In Pakistan 2020-21

I In case of sportsperson 10 percent. Withholding is an act of deduction or collection of tax at source which has generally been in the nature of an advance tax payment.

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Under the local law for non-residents having no PE in Pakistan withholding taxes WHT are applicable on payments such as Fee for technical service royalties dividends interests insurance premiums fees for digital services etc.

Withholding tax rates on services in pakistan 2020-21. The FBR said that every prescribed person shall collect withholding tax under Section 153 of Income Tax Ordinance 2001 from resident persons and permanent establishment in Pakistan of non-resident. 57. Consequently Act has also provided that depreciation deduction shall be allowed equal to 50 in the year of disposal on assets brought to use in tax year commencing from 1 July 2020.

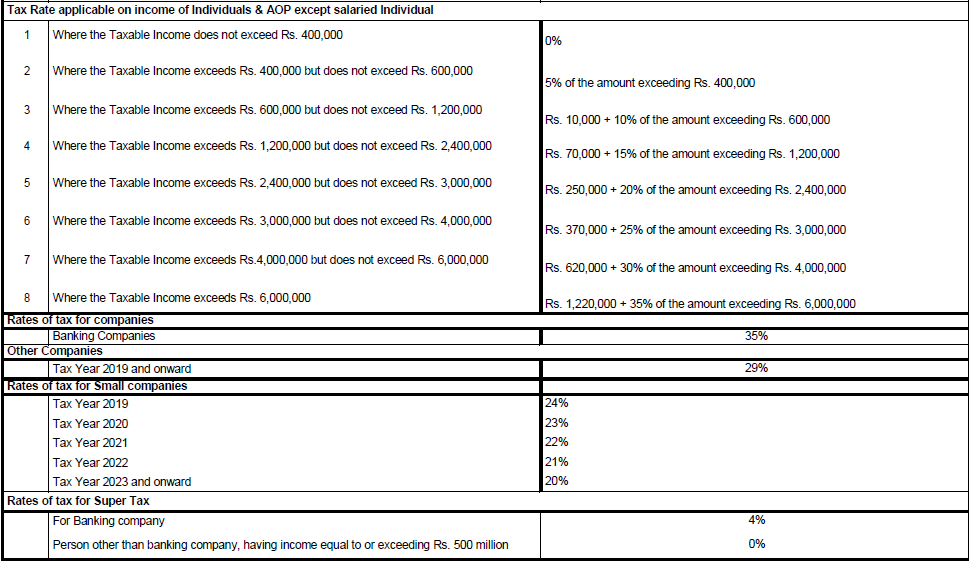

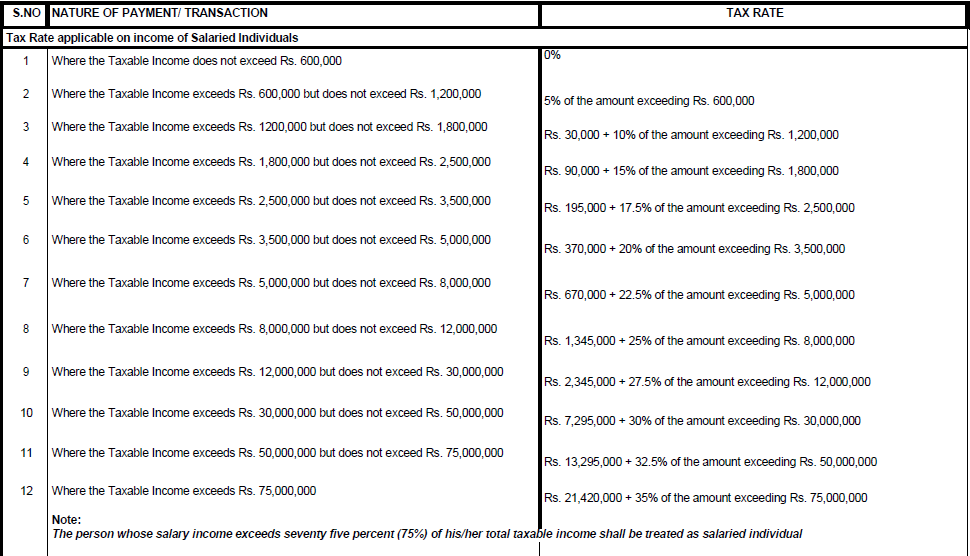

Diligent care was taken in the preparation of this card though error omissions expected. Latest Income Tax Slab Rates in Pakistan. The withholding tax card also included the 100 percent higher tax rates for persons not on the Active Taxpayers List ATL.

Exporters and certain providers of financial services may apply for a Sales Tax suspension. Increase from Rs5 b in 1991 to above Rs 422 b in 2012 speaks of. G orxu ploov dqg h hdohuv dqg vxe ghdohuv ri vxjdu fhphqw dqg hgleoh rlo rqo wkrvh dsshdulqj rq 7 0rwruffoh ghdohuv 6dohv 7d 5hjlvwhuhg q doo rwkhu fdvhv 6hfwlrq dlq lq glvsrvdo ri dvvhwv rxwvlgh 3dnlvwdq.

Calculated at 20 of the sales tax withholding regime there is an anti-fraud measure. Royalty or fee for technical services 15 15 Minimum Tax st Fee for offshore digital services Div 5 10 Contracts or related services 7 14 Insurance or re-insurance premium 5 5 Advertisement services 10 20. And Permanent Establishment in Pakistan of a Non-Resident at the time the amount is actually paid.

Their contribution is about 41 percent of total direct tax revenues. Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan. The Federal Revenue Board FBR revised the rates to 30 June 2019.

Tax collections for the fiscal year 2020-21 will be. Tax Card has been prepared by ZMK Tax department for the Tax Year 2020-21. 500000 15 30 PAYMENTS TO NON-RESIDENTS S152 Div.

Ii In the case of companies. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Furthermore customs duty rates have been reduced 20pc 16pc 11pc and 3pc to 11pc 3pc and 0pc for raw materials and intermediate goods used to manufacture items such as rubber bleaching agents and other products used domestically.

According to the income tax slabs for FY 2021-22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600000- per annum. 721 576 66 7. Imports of some basic foodstuffs and agricultural supplies are exempt from import Sales Tax.

Regardless of the rate of tax on such services iv Services provided in the province of Khyber Pakhtunkhwa by persons from outside the province if such persons are not registered with the Authority and v Services liable to tax under the Act at reduced rate less than the standard rate of 15. The applicable withholding tax rate on such payments ranges from 5 to 20 subject to any relief available under the double tax treaty. Final Tax Others Where yield is above Rs.

The standard sales tax rate in Pakistan is 17. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 1531a sales of goods Every Prescribed Person section 1537 Company 4 of the gross amount Other than company 45 of the gross amount No deduction of tax where payment is less than Rs. The complete list of withholding tax rates for taxation year 2020 is given below.

Business for the first time in a tax year commencing from 1 July 2020. When it announced the budget for Fiscal Year 2020-21 in June 2020 the Pakistan Tehreek-i-Insaf led government had left income taxes unchanged from last year in a bid to avoid placing any. Rate of tax withholding Part I 1 Part II 2 Part III 55 The advance tax collected under section 148 in following cases is now also proposed to be.

Now lets learn more about the latest tax slab rates in Pakistan for the fiscal year 2021-22. 75000-in aggregate during a financial year S1531a 1531b services Every Prescribed Person section. Register for Income Tax.

Change your personal details. Federal Board of Revenue FBR has issued withholding tax rates on payment for goods and services during tax year 20192020 under Section 153 of Income Tax Ordinance 2001. Economic Survey of Pakistan 2019-2020 KEY ECONOMIC INDICATORS.

In general payments made on account of dividend interest royalty and fee for technical services income derived from Pakistan sources are subject to a 15 withholding tax WHT which tax has to be withhelddeducted from the gross amount paid to the recipient. Sales tax rates in Pakistan. It is an effective mechanism and importanttimely source of revenue.

To get the comprehensive rate list of withholding tax for tax year 2020. In case if observed any please use comment box to inform us. Pakistan Tax Card for the Tax Year 2020-21.

1 7 10 2 07 7 0267 05. Every prescribed person shall collect deduct withholding tax from resident person. Previously this salary slab was not included in the income tax deduction bracket.

Amar Associates Income Tax Rates For Tax Year 2021 Facebook

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Financial Management Rate

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Financial Management Rate

Tax Rates 2021 Archives Filer Pk

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax Rates 2021 Archives Filer Pk

Tax Rates 2021 Archives Filer Pk

Tax Rates For The Tax Year Apex Management Consulting Facebook

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Financial Management Rate

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non Salaried Fbr Ty 2020 Youtube

Income Tax Deductions Under Chapter Vi For Ay 2020 21 Fy 2019 20 Sec 80c 80ccc Etc Deduction Tax Deductions Best Money Saving Tips

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Youtube Make Business L Information Change Email

Global Corporate And Withholding Tax Rates Tax Deloitte

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Post a Comment for "Withholding Tax Rates On Services In Pakistan 2020-21"