Withholding Tax Rates Switzerland

Under domestic law no withholding tax is levied on interest. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Additions are expected to be made to this by the end of March 2021.

Withholding tax rates switzerland. A companys shareholder must declare the dividend as income tax. Bank or Swiss company and is directly deducted from the gross amount paid to the recipient. In this way the claim for a refund is triggered automatically.

Employers file tax returns by January 31 of the following year and resident employees must file their returns along with any taxes owed by March. Interest paid to a nonresident on receivables secured by Swiss real estate is subject to tax at source. The tax rate is.

Switch skin Home Global Switzerland confirms 5 withholding tax rate for dividends paid to India expects reciprocity. In general interest and dividend income derived from Swiss sources is subject to a 35 WHT which tax has to be withheld from the paying party eg. Tax is deducted directly from salary on a monthly basis and employers here ETH Zurich forward the taxes to the relevant tax authority in Switzerland.

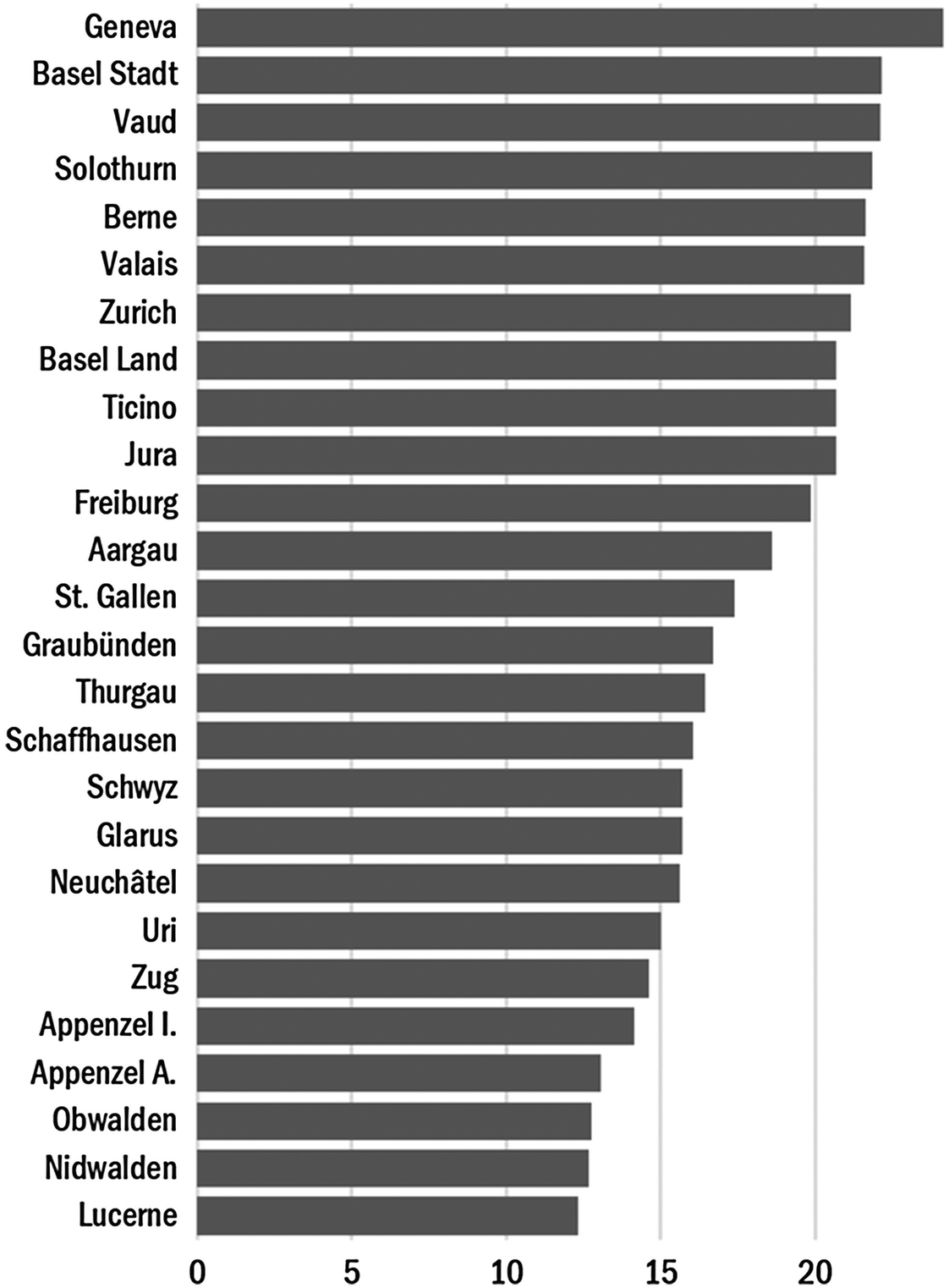

8 on other insurance benefits. The federal Swiss corporate tax rate is a flat rate of 85 but additional cantonal and municipal rates can vary considerably. The employer pays this tax directly to the Swiss tax authorities.

This limit is CHF 120000 for the Confederation only exception Geneva. The tax rate for the corporate withholding tax in Switzerland is 35. The highest taxes in Switzerland levied at communal level can be found in Chancy and Avully and is 51 per cent of basic cantonal tax.

The gross dividend represents the dividend before the deduction of the withholding tax and the net dividend is what remains after the. In addition ELM Standard 50 was published by Swissdec at the end of March 2020. Interest paid to a nonresident on receivables secured by Swiss real estate is.

Exceptions apply to interest derived from deposits with Swiss banks bonds and bond-like loans which are subject to a 35 withholding tax at the federal level. However the municipality of Genthod is 25 per cent. On 12 June 2019 the Swiss Federal Tax Administration FTA published Circular No.

As well as paying their withholding tax employees with a gross annual salary of over 120000 francs also need to fill out a standard tax return each year. While there are no payroll taxes in Switzerland there is an 8 withholding tax. However a range of allowances and deductions means youll usually pay much less.

The tax at source rate differs from canton to canton. The statutory rate of Swiss WHT is 35. The Swiss tax authority confirmed on 13 August that dividends received by an Indian resident from a Switzerland company will be subject to only a 5.

If a tax relief is granted the sum paid for the withholding tax is refunded. The amount varies by canton and can change each year. 18 hours agoThe IndiaSwitzerland tax treaty of 1994 provides for a 10 withholding tax rate in the source country for dividend payments.

Exceptions apply to interest derived from deposits with Swiss banks bonds and bond-like loans which are subject to a 35 withholding tax at the federal level. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. 35 on income from capital and lottery winnings 15 on annuities and pensions and.

Switzerlands tax year is identical to the United States January 1 December 31. Withholding tax on employment income 2021 The 2021 withholding tax reform comes into force on 1 January 2021. The law stipulates that dividends in Switzerland are subject to a 35 withholding tax.

The maximum corporate tax rate including all federal cantonal and communal taxes is between 119 and 216. This tax is called withholding tax. In the case of the withholding tax on dividends Switzerland applies a standard rate of 35 but the payment can be exempted from this tax under the provisions of the Switzerland European Union EU Savings Agreement on which our Swiss law firm can provide more details.

For example the communal tax of Geneva is 455 per cent of basic cantonal tax. The 35 withholding tax and the tax at source levied under domestic law can be reduced. With respect to dividends between qualifying related companies a mere notificationreporting procedure may be requested for the fraction of the Swiss WHT exceeding the.

The Swiss tax authority confirmed on 13 August that dividends received by an Indian resident from a Switzerland company will be subject to only a 5. 45 on Withholding tax on employees earned income from employment. If you are a foreign worker resident in Switzerland for tax purposes and your income exceeds a certain limit a statutory assessment of your whole income and assets will be carried out.

Under domestic law no withholding tax is levied on interest. Withholding tax is refunded if you declare your assets and the revenue they produce in your tax return. In the case of dividends between qualifying related companies a notification or reporting procedure may be requested for the fraction of Swiss withholding tax exceeding the residual withholding tax.

Relief if any is generally granted by refund.

Swiss Withholding Tax Changes Obligations For Employers

How To Avoid Double Taxation In Germany Settle In Berlin

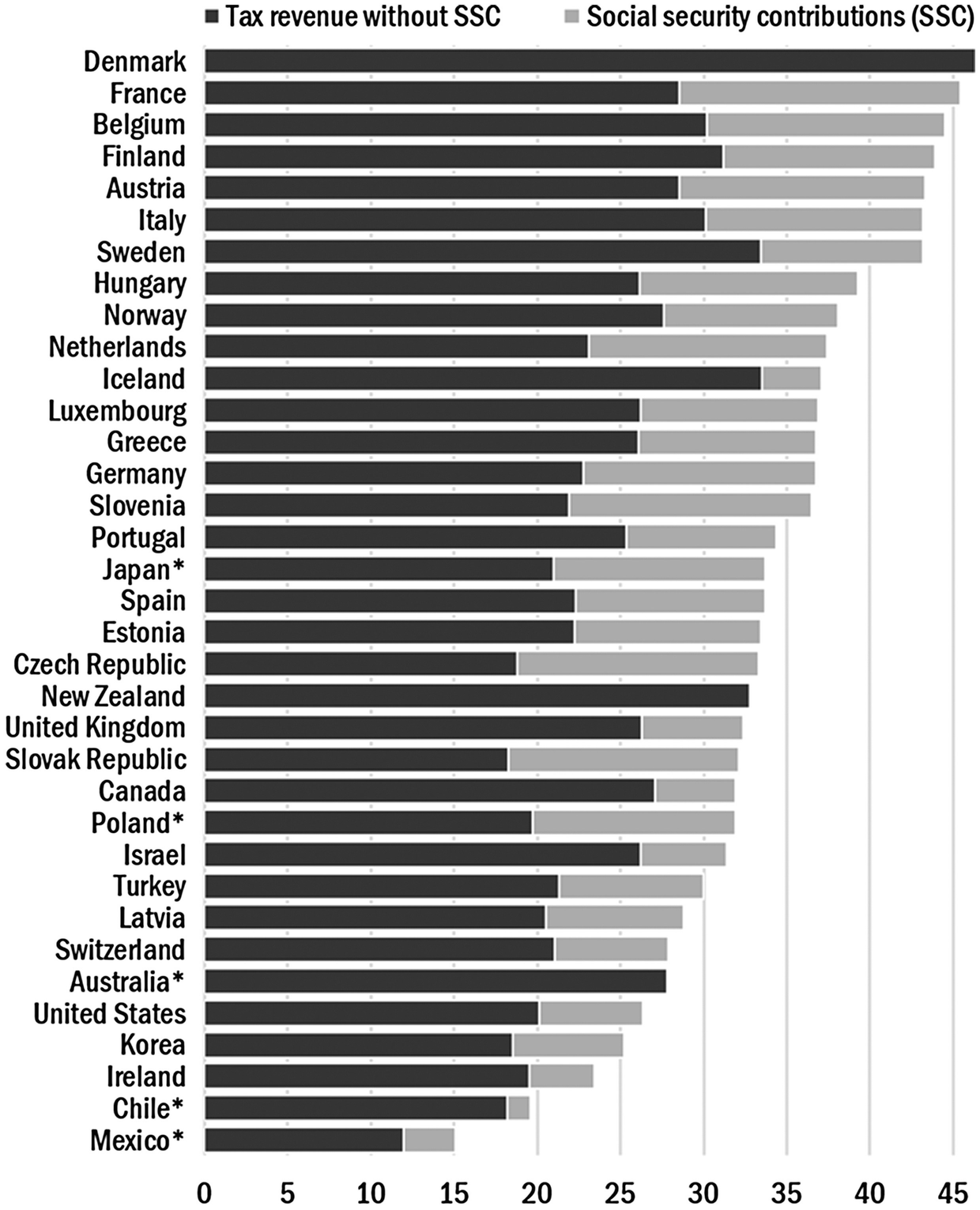

Global Corporate And Withholding Tax Rates Tax Deloitte

German Rental Income Tax How Much Property Tax Do I Have To Pay

The Withholding Tax System In Thailand Lorenz Partners

Taxes In Switzerland Income Tax For Foreigners Academics Com

How Does The Swiss Government Keep Such Low Taxes Why Aren T Switzerland S Voters Not Influenced By High Tax Countries Germany France And Italy Quora

Https Www Loyensloeff Com Media 478079 Fob Pw Update Swiss Lump Sum Taxation Pdf

Tax Power And Tax Competition Springerlink

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

Tax Power And Tax Competition Springerlink

Switzerland Referendum On Swiss Tax Reform Bdo

10 European Countries With The Best Tax Reliefs For Startups

Swiss Withholding Tax Changes Obligations For Employers

Swiss Withholding Tax Changes Obligations For Employers

New Withholding Tax Regulation For Employment Income As Of 2021

Post a Comment for "Withholding Tax Rates Switzerland"