Withholding Tax Regime(rates Card) 2019-20

1 7 10 2 07 7 0267 05. Updated Upto 30th June 2017 WHTRatesCardupdated FBR Website July 2017.

Income Tax Slab For Ay 2020 21 Fy 2019 20 Income Tax Income Tax

From 10 to 15 under final tax regime.

Withholding tax regime(rates card) 2019-20. Tax Data Card Nigeria 2019. FBR Withholding Tax Regime Rates Card The Updated Income tax withholding rate card issued by Federal Board of Revenue are available below. Rate of tax for small companies Tax year Rate of tax 2019 24 2020 23 2021 22 2022 21 2023 20 Section 37 Tax on Capital Gains on sale of Securities Holding Period months Tax Year 2018 2019 and 2020 Acq.

Tax base for employees The tax base for employees is calculated as the gross salary increased by the. The purp ose of this document is to summarize activity-wise rates and treatment of withholding income tax taking into account the amendments vide the Finance Act 2019. This Rate Card may be downloaded from Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 3 IMPORTS Section 148 Part II First Schedule.

Federal Board of Revenue FBR has issued updated rate card of withholding tax for Tax Year 2019 incorporating amendments made through Finance Supplementary Act 2018. As such all withholding tax agents disbursing salary are required to implement the revised tax rates from the same date. 721 576 66 7.

Small Company tax rate S 406 20. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2019 updated up to June 30 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

After July 01 2016 Less than 12 15 15 12 to 24 125 More than 24 and security. Guideline for the Taxpayers Tax Collectors Withholding Agents -as per Finance Supplementary Second Amendment Act 2019 updated up to March 09 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. The Act has enhanced the tax rates as follows.

Updated up to June 30 2021. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Agents -as per Finance Supplementary Second Amendment Act 2019 updated up to March 09 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding. The original Statue Income Tax.

2 2019 Tax Data Card Content Page Income Taxes Companies Income Tax 4 Petroleum Profit Tax 10 Capital Gains Tax 12 Personal Income 1Tax 3 Information Technology Tax 16 Tertiary Education Tax 17 Withholding Tax 18 Tax Treaties 19 Indirect Tax and Duties. SrNo Title 1 Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021. From 10 to 5 of the investment effective from tax year 2019.

Profit on debt Existing rate Revised rate. FBR issues updated withholding tax card for Tax Year 2019 Faisal Shah January 13 2019 ISLAMABAD. Applicable July 01 2019 to June 30 2020 as updated vide the Finance Act 2019 WHAT THIS DOCUMENT AIMS AT.

Tax Rate Card 23 Withholding Tax Rates Table 29 Sales Tax Act 1990 47 Federal Excise Act 2005 59. Withholding Taxes regime in one or the other way is part of tax system ever since imposition of direct taxes by the governments and taxpayers on two scores. Withholding Tax Rates Applicable Withholding Tax Rates.

1491 Tax on Salary Income Every person responsible for paying Salary to an employee shall deduct tax. Subscriber of internet and prepaid internet card or sale of units through any electronic. The withholding tax card is updated up to June 30 2018.

Federal Board of Revenue FBR has issued withholding tax card for tax year 20182019 as per the amendments made through Finance Act 2018 to Income Tax Ordinance 2001. As per Finance Act 2019 the salary slabs as well as tax rates have been revised with effect from 01072019. Before July 01 2016 Acq.

On the FBR website the FBR is still displaying Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors and Withholding Tax Agents - as per Finance Act 2019. Personal Income Tax Rate 15 Solidarity tax surcharge 7 Employment andor business taxable income in excess of 48 times the aver-age wage annual income of CZK 1569552 in 2019 is subject to a 7percent solidarity tax. 57.

Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART DIVIDEND IN CASH OR IN SPECIE.

New Budget 2020 Income Tax Regime Vs Old What Is Good For You Check Comparison The Financial Express

Pin By Finfyi On Pan Card Cards Movie Posters Poster

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

How To Save Capital Gains Tax On Property Sale Capital Gains Tax Capital Gain Tax

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 In 2021 Income Tax Taxact Income

New Tax Regime Tax Slabs Income Tax Income Tax

Income Tax Ppt Revised Income Tax Income Tax

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

How To Verify Itr 6 Ways To Verify Your Itr Income Tax Return Tax Income Tax

Interest Under Section 234a Interest Under Section 234b Interest Under Section 234c Income Tax Return Income Tax Taxact Income

What Is Professional Tax Legal Services Tax Tax Accountant

Section 40b Of The Income Tax Act Remuneration To Partners For Ay 2020 21 Income Tax Taxact Income

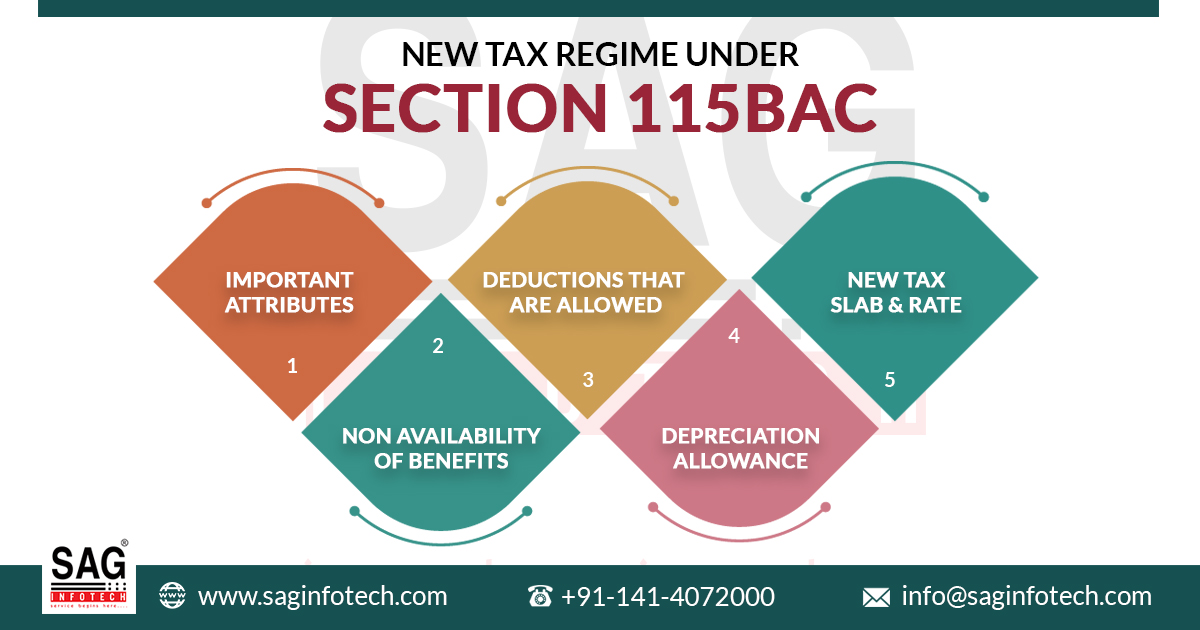

Brief Guide Of New Tax Regime Section 115bac With 10ie Filing

Taxation In India Indirect Tax Financial Management Investing

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Marketing Cost

Old Vs New Tax Regime U S 115 Bac Which Is Better With Automated Income Tax Preparation Excel Based Software All In One For The Govt And Private Employees For The

Tds Return Filing Bookkeeping Services Tax Refund Financial Analysis

Latest Tds Rates Chart For Fy 2017 18 Ay 2018 19 Income Tax Tax Preparation Income Tax Preparation

Post a Comment for "Withholding Tax Regime(rates Card) 2019-20"