Withholding Tax Table Canada

197 rows Withholding Tax WHT is a government requirement on the payer of an item to deduct tax prior to payment and remit that tax to the government. This table provides general information and should not replace a careful review of any particular treaty.

The Land Of Maps Map Old Map Oil Pipeline Map

P134247 32 over P5479.

Withholding tax table canada. Withholding tax rates noted are those applied by Canada on certain payments to residents of selected countries with which it has signed international tax treaties. 20 10 for Quebec on amounts over 5000 up to and including 15000. It contains several changes like the tax bracket changes and the tax rate each year combined with the alternative to employ a computational bridge.

The federal withholding tax has seven rates for 2021. 3 Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax. WHT at a rate of 25 is imposed on.

Tax is deductible at the rates prescribed under the Act or under the relevant DTAA whichever is more beneficial for non-residentThis write up provides all such rates as prescribed under various Double Taxation Avoidance Agreements entered into between Indian and various foreign. Via a Canadian partnership please contact your professional advisor as the withholding tax rules for Canadian partnerships are more complicated. If you are a Canadian service provider performing services in the US.

The 2020 Tax Tables and 2020 Tax Brackets are provided below for each Province Territory along with the Federal Tax Brackets for 2020. 30 15 in Quebec on amounts over 15000. Oman Last reviewed 24 June 2021.

4 Dividends subject to Canadian withholding tax include taxable dividends other than capital gains dividends paid by certain entities and capital dividends. 2021 income tax withholding tables The Tax Cuts and Jobs Act of 2017 brought about a number of changes in tax rates and brackets a drastic increase in the standard deduction the elimination of personal exemptions and a new W-4 form. For residents of Canada the rates are.

74 rows Corporate - Withholding taxes. Federal Withholding Tables 2021 Just like any other previous year the freshly altered 2021 Withholding Tax Table was launched by IRS to get ready for this particular years tax time of year. P8219 25 over P1096.

Last reviewed - 18 June 2021. Use the following lump-sum withholding rates to deduct income tax. For funds held in the province of Quebec there will also be provincial tax withheld.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Internationally WHT is used by governments to generate revenue on the activities of foreign entities within the governments jurisdiction. Federal Withholding Tables 2021 Just like any other prior year the freshly altered Federal Income Tax Tables For 2021 was released by IRS to get ready for this particular years tax season.

The following table shows the percentage of withholding tax that is currently required when you make a single lump sum withdrawal. 10 12 22 24 32 35 and 37. 000 20 over P685.

Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. This all depends on whether youre filing as single married jointly or. It includes several changes such as the tax bracket changes and the tax price annually along with the option to use a computational link.

20 10 in Quebec on amounts over 5000 up to including 15000. 30 15 for Quebec on amounts over 15000. Certain exceptions modify the tax withholding rates shown in the table.

Canadian service providers are also commonly referred to as non-resident aliens. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. Alberta Tax Tables 2020 British Columbia Tax Tables 2020 Manitoba Tax Tables 2020 New Brunswick Tax Tables 2020 Newfoundland and Labrador Tax Tables 2020 Northwest Territories Tax Tables 2020 Nova Scotia Tax Tables 2020 Nunavut Tax Tables.

The federal withholding tax rate an employee owes depends on their income level and filing status. 2020 Canada Federal Provicial and Territorial Tax Tables. 2020 Provicial and Territorial Tax Tables.

Withdrawal amount Province other than Quebec Province of Quebec 0 - 5000 10 21 5001 - 15000 20 26. REVISED WITHHOLDING TAX TABLE. A person responsible for making payment to non-resident or foreign company is required to withhold tax.

Of withholding tax varies based on both the amount of your withdrawal and your province of residence. Effective January 1 2018 to December 31 2022. The rates depend on your residency and the amount you withdraw.

10 5 for Quebec on amounts up to and including 5000. 10 5 in Quebec on amounts up to 5000. Withholding Tax Rates 2021.

P35616 30 over P2192. Among other changes effective January 1 2015Article VI of the protocol reduces the Canadian withholding tax rate from 15 to 0 for dividends paid or credited to a pension plan or scheme other than a social security.

Accounting Insight News All Your Accounting News In One Place Brought To You By Accountex Accounting Insight News Chart Of Accounts Accounting Quickbooks

Pin On Grant S Personal Finance Board

Flutter App Development A Revolutionary Step In Mobile Sdks Web Marketing Mobile App Development App Development

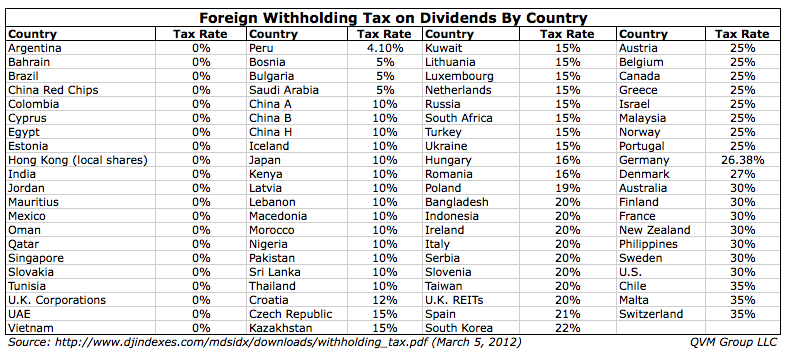

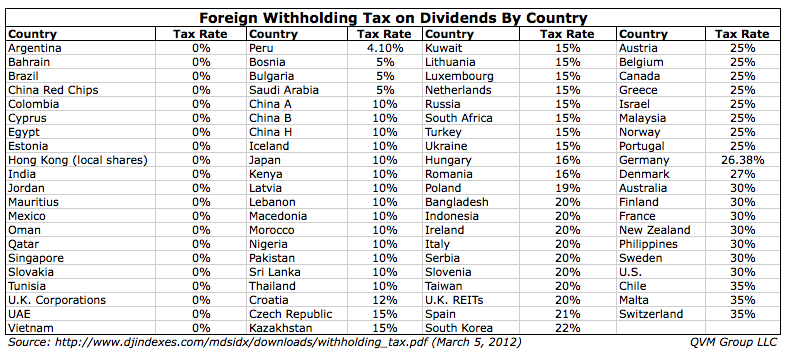

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

Affordable Care Act Aca Compliance Examined The Treasury Inspector General For Tax Administration Tigta Reported That The I Financial Help Irs No Response

Pin On Investing And Retirement

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Excel Business Math 30 Payroll Time Sheets If Function Sheet Reference For Overtime Gross Pay Excel Payroll Math

Tax Season Is One Of The Busiest Times Of The Year For Everyone And When You Have So Much To Tax Time Tax Season Tax Payment

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Blog Page 6 Of 19 Currace Words Containing Quicken Error

Quickbooks Premier Black Friday Sale Black Friday Sale Black Friday Quickbooks

Pin By Sab Auditing Of Accounts On Vat In Uae Digital Tax Accounting Firms Vat In Uae

Excel Formula Income Tax Bracket Calculation Exceljet

1040 A 2016 Irs Form Irs Forms Income Tax Return Tax Return

Tax Me If You Can Good Credit Score Good Credit Chart

Average Canadian Family Spending More On Taxes Study Tax Return Tax Time Deduction

Post a Comment for "Withholding Tax Table Canada"