How Much Is Withholding Tax In Kenya

Where the rent is payable to a non-resident the tenant is required to withhold 30 of the rent and remit it to the Kenya Revenue Authority. Any amount withheld should be remitted to.

Withholding Tax Rates To Non Residents Download Table

Companies operating in Kenya pay a charge on all their incomes to the KRA.

How much is withholding tax in kenya. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125 or more of the voting power. As shown above the maximum rate of 30 will be. How is income tax calculated in 2021.

Corporate bodies such as Limited companies and cooperatives are charged at a rate of 30 for resident bodies and 375 for non-resident companies. Withholding tax rates on interest management fees and royalties paid to non-residents taxpayers is at the rate of five per cent 5. 21 rijen How do I pay Withholding Tax.

Effective 01 January 2021 the tax rates applicable to taxable income are tabulated as follows. Marketing commissions and residue audit fees paid to foreign agents in respect of export of flowers fruits and vegetables. Payments which are liable to Withholding Tax WHT.

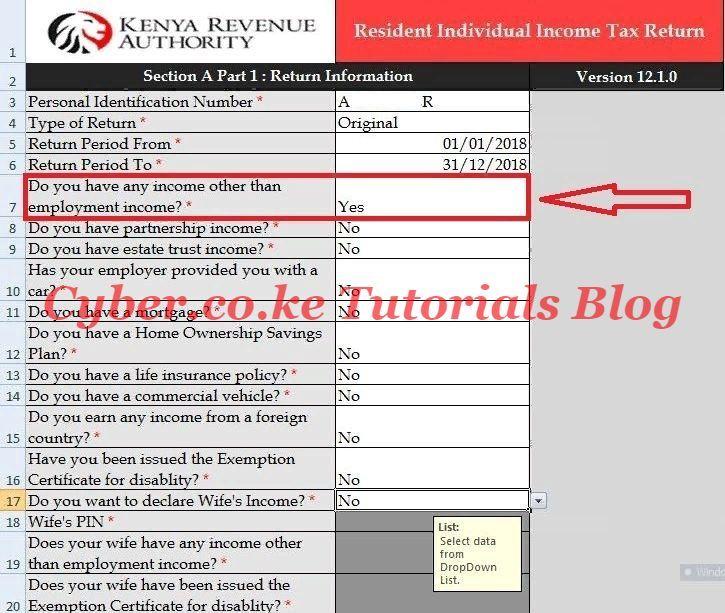

The Withholding tax is withheld at a percentage depending on the income being paid out to both residents and even non-residents. The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA. Withholding Tax Transactions in Kenya.

Resident companies tax rate is 30 while the non-resident corporations part with 375 on all taxable profits. The tax on rental income is a tax arising from the gains and profits for occupation of property. Persons living with disabilities with a valid exemption certificate are exempted from income tax on their taxable income of KSh 150000 per month and up to KSh 1800000 per year.

Withholding Tax is deducted at source from several income like. Royalties are subject to withholding tax at a rate of 5 and 20 when paid to resident and non-resident persons respectively on the gross royalty payment made. The changes have also increased the taxpayer wage bands by 10.

Excise Duty on Betting is chargeable at the rate of 20 of the amount wagered or staked commencing 7th November 2019. The percentage deducted varies between incomes and is dependent on whether you are a resident or non- resident. KRA Withholding Tax rates as of 2020.

8 if the beneficiary holds at least 25 of the capital of the company paying the dividends. Income tax is calculated progressively using income tax bands and personal relief rate came into effect on 1st January 2021. Income tax in Kenya can range from 10 to 30 percent and you need to be sure you are placed in the correct tax brackets.

Capital Gains Tax maintained at 5 Withholding tax on security services transportation of goods. Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. This will yield monthly tax savings ranging from Sh184 to Sh6675 depending on ones salary.

KRA Withholding Tax rates This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA. Kenya Uganda Tanzania Rwanda and Burundi require that anyone making payments to suppliers for the provision of goods and services whether resident or non-resident should withhold tax at the appropriate rates see Annex 1 and remit this tax to the respective Revenue Authority. The tax withheld is a final tax.

A rate of 10 is applicable where the beneficial owner is a company other than a partnership that directly or indirectly holds less than 10 of the capital of the company paying the dividends. Advertising and marketing services scrapped. Most of the proposals in the Finance Bill have been maintained with a few additions.

The ITA provides for various ways of taxing rental income. Dividends paid by SEZ to non-resident persons are exempt from income tax. What is exempt from Withholding Tax.

Next 10 years income tax is at the rate of fifteen per cent 15. No Kenya tax is due if subject to tax in Zambia. Some of the highlights are.

The Income Tax Act CAP 470 3 rd Schedule Section 5 stipulates on incomes that are subject to Withholding tax.

Manage Withholding Taxes Odoo 14 0 Documentation

Hansaworld Integrated Erp And Crm

Hansaworld Integrated Erp And Crm

How Much Is Withholding Tax In Kenya Tax Walls

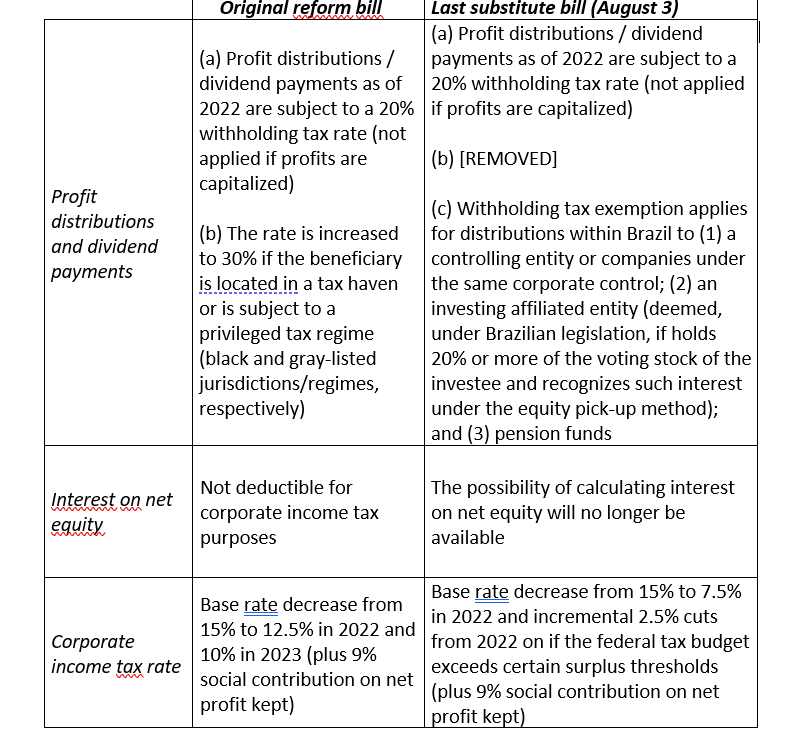

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Stori Za Ushuru Is Withholding Tax Charged On All Incomes Facebook

Tax Training Taxation Of Government Ministries 26 May

Withholding Tax Returns In Kenya 2021 How To File And Current Rates

Hansaworld Integrated Erp And Crm

.webp)

Tax Regulations For Dutch Companies

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

Panama Tax Treaties Tax Panama

Tax Training Taxation Of Government Ministries 26 May

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

Understanding Withholding Tax In Zimbabwe Furtherafrica

How To File And Pay For Withholding Tax In Kenya Anziano Consultants

Post a Comment for "How Much Is Withholding Tax In Kenya"