How To Calculate Withholding Tax On Services

For inquiries or suggestions on the Withholding Tax Calculator you may e-mail contact_usbirgovph. If you would like to find more information about United States Tax and Internal Revenue Service IRS visit the official site IRS Website at wwwirsgov.

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

New Rules on Withholding Agents for Purchases of Services and Goods Revenue Regulations No.

How to calculate withholding tax on services. RM100000 01 RM10000. Failing of doing so you may face the potential risks of. In contrast retention tax on an individual is calculated on various regular income as well as lottery betting etc.

The lower rate applies where the recipient holds at least 10 of the shares. Here are the steps to calculate withholding tax. For help with your withholding you may use the Tax Withholding Estimator.

Calculating amount to withhold The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. If you would like to find more information about United States Tax and Internal Revenue Service IRS visit the official site IRS Website at wwwirsgov. The amount of income tax your employer withholds from your regular pay depends on two things.

Calculate withholding tax for service sales Click Accounts payable Journals Payments Payment journal. Because the entire process involves both customers and suppliers Manager supports withholding tax accounting through both its sales invoice and purchase invoice processes though procedures are somewhat different. 10 in any other case.

Ghana has DTTs with the following countries for the relief from double taxation on income arising in Ghana. The amount you earn. For each category of recipients it is calculated differently.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. To access Withholding Tax Calculator click here. August 21 2021 by Trafalgar D.

A registered partnership company and trust and other businesses that make payment to another person for goods or services bought qualify to withhold the tax unless the person is exempted from paying the tax. Alternatively you can use the range of tax tables we produce. The information you give your employer on Form W4.

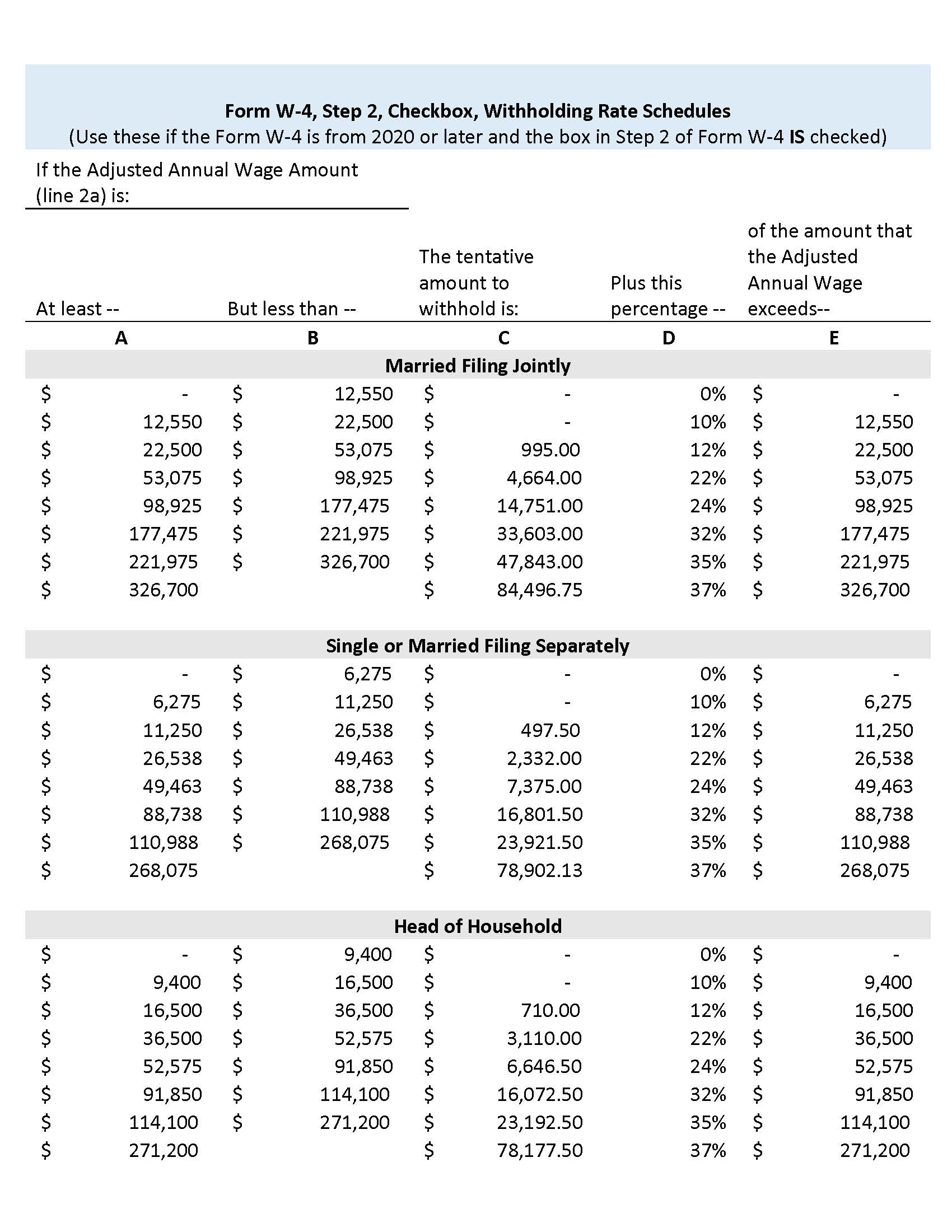

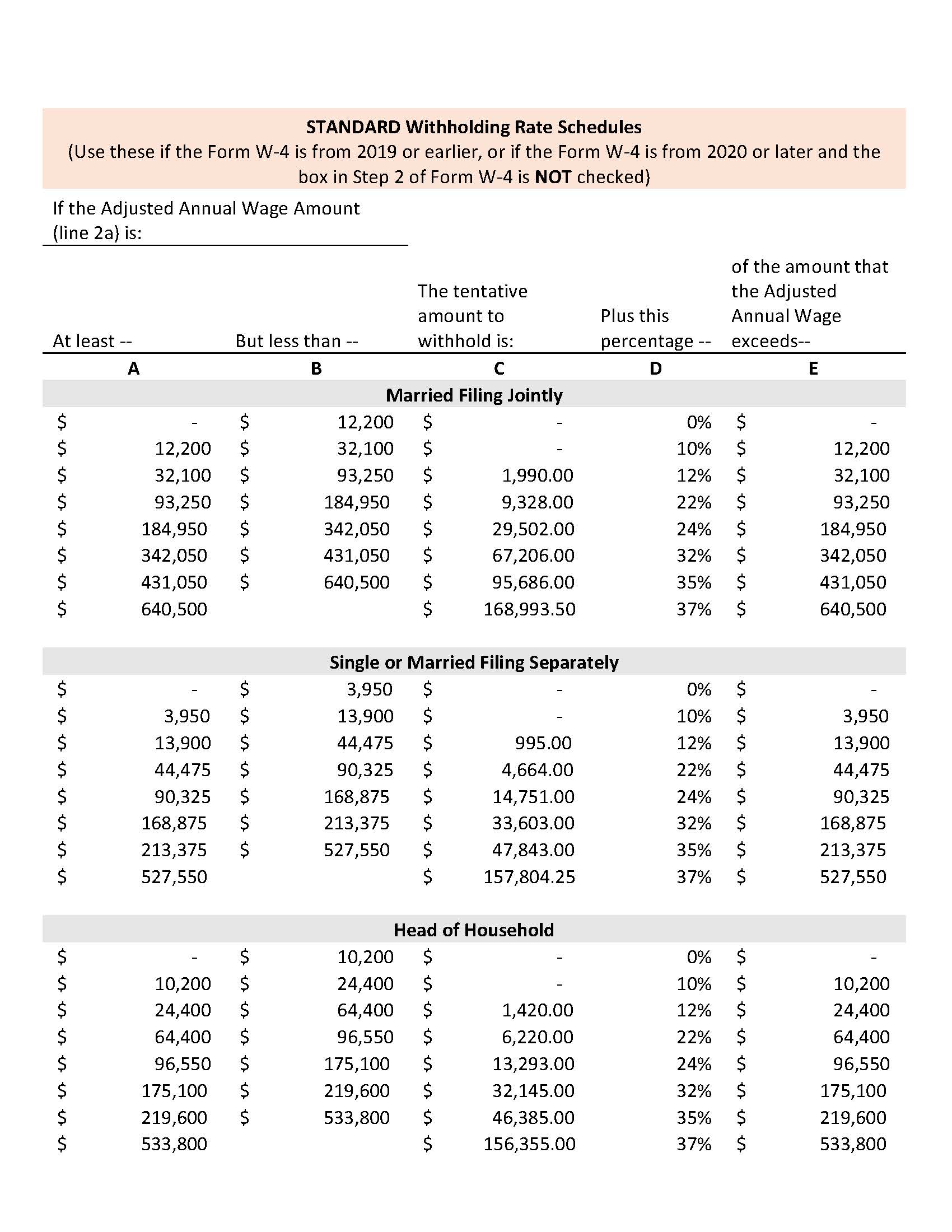

Withholding tax may apply to certain payments in respect of services rendered by a non-resident particularly where the services are rendered in Mozambique subject to reduction under a double taxation treaty where applicable. Federal tax withholding tables 2020 calculator Weekly Federal Tax Withholding Table. Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year.

Deducting 55 Social Security from basic salary Then add all allowances after the 55 social security deduction Deduct applicable personal relief s. The payer must within one month after the date of payment to the non-resident remit the withholding tax to LHDN. These take into account the Medicare levy study and training support loans and tax-free threshold.

5 for non-resident banks. It is a tax which is deducted at source by a withholding agent a person required to deduct tax when making payment to another person and accounted for later to the GRA. 4 70 Exemptions to Sec 83.

All content is public. 9 120 Withholding Tax Base for Construction Works. To estimate the impact of the TRAIN Law on your compensation income click here.

11-2018 This Tax Alert is issued to inform all concerned on the new rules in determining the taxpayers required to withhold on purchases of goods and services other than those covered by other rates of withholding tax. August 24 2021 by Kevin E. The higher rate applies in any other case.

4 80 Application to particular types of persons6 90 Basis for calculation of the withholding payments. Not yet in force. How to calculate weekly federal withholding tax Weekly Federal Tax Withholding Chart.

How to Calculate Withholding Tax To calculate withholding tax the employer first needs to gather relevant information from the W-4 form review any withholding allowances and then use the IRS withholding tables to calculate withholding tax. These are calculated and deducted based on two things the amount of income earned and the details provided by the employee to the employer in term W-4. How to pay Withholding Tax in Malaysia and penalty if not paid.

For example the retention tax on wages is calculated as per the withholding table and publication 15. Withholding tax may be a form of advance payment of income taxes value added taxes goods and service taxes or some combination of these and other types of tax. Last modified 29 Jun 2021.

In the Account field select the customer account that is updated with the withholding tax for services. 11-2018 a new classification of withholding agents is. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 PDF Download Adobe Reader for your employer. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. 7 100 Inclusion of value of benefits and facilities8 110 Withholding Tax Base for Mixed Supplies Goods Services.

Create a payment journal and then click Lines to open the Journal voucher form. At the same time you may prefer to have less tax withheld up front so you receive more in your paychecks and get a smaller refund at tax time. 60 Withholding tax obligations.

Pin By Bianca Kim On W 2 Irs Tax Forms Tax Forms Irs Taxes

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Irs Taxes Tax Debt Relief Tax Debt

What Is Irs Form 1040 In 2021 Income Tax Return Tax Return Irs Forms

Pin By Bianca Kim On W 2 Irs Tax Forms Credit Card Services Tax Forms

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Brazilian Withholding Taxes Bpc Partners

Aba Tax Helps Individuals Get Maximum Tax Refunds 100 Hassel Free Irs Taxes Estimated Tax Payments Irs

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Tiny Tip Tuesday Top 5 Celiac Expense Tax Tips Tax Time Estimated Tax Payments Tax Day

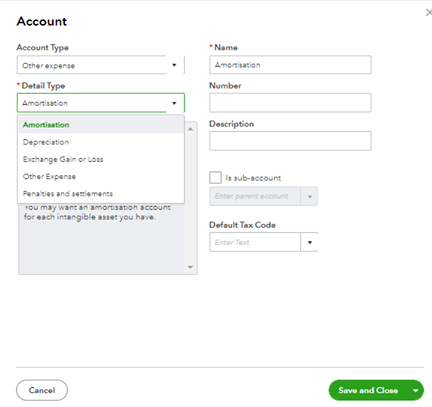

How Do I Record Or Show Withholding Tax On Sale In

Form 1040 Es Estimated Tax For Individuals Estimated Tax Payments Tax Payment Estimate

What Is A Tax Withholding Certificate Freedomtax Accounting Payroll Tax Services

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Irs Tool Helps Small Businesses Calculate Income Tax Withholding Income Tax Small Business Trends Online Business Marketing

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Withholding Tax Using The Percentage Tables Tax Withholding Tax Table Tax Table

Down Payment With Withholding Tax Process Sapspot Down Payment Tax Payment

Post a Comment for "How To Calculate Withholding Tax On Services"