Withholding Tax Rate Between Canada And Us

For a country listed in Appendix B D or F tax should generally be withheld at the rate of 25 unless a tax convention between Canada and that country already exists and the appropriate rate is specified in Appendix A or C. Because the situation is subject to change Canadian taxpayers are advised to consult with the CRA as transactions are carried out.

Is Dividend Withholding Tax Important In Investing Investment Moats

So if you own a US.

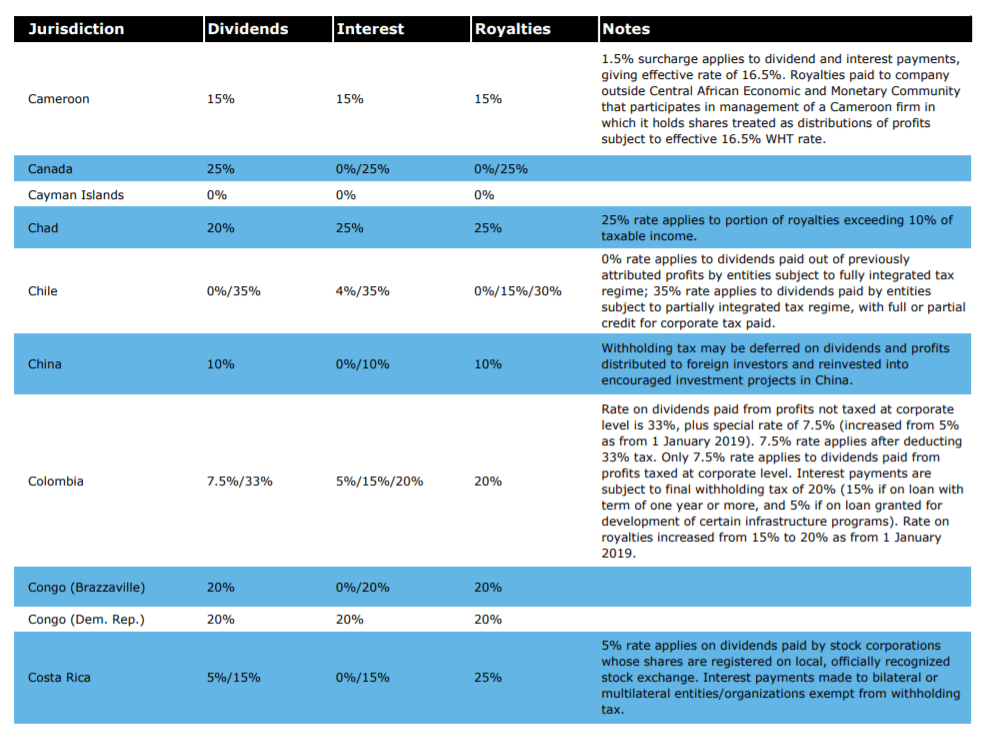

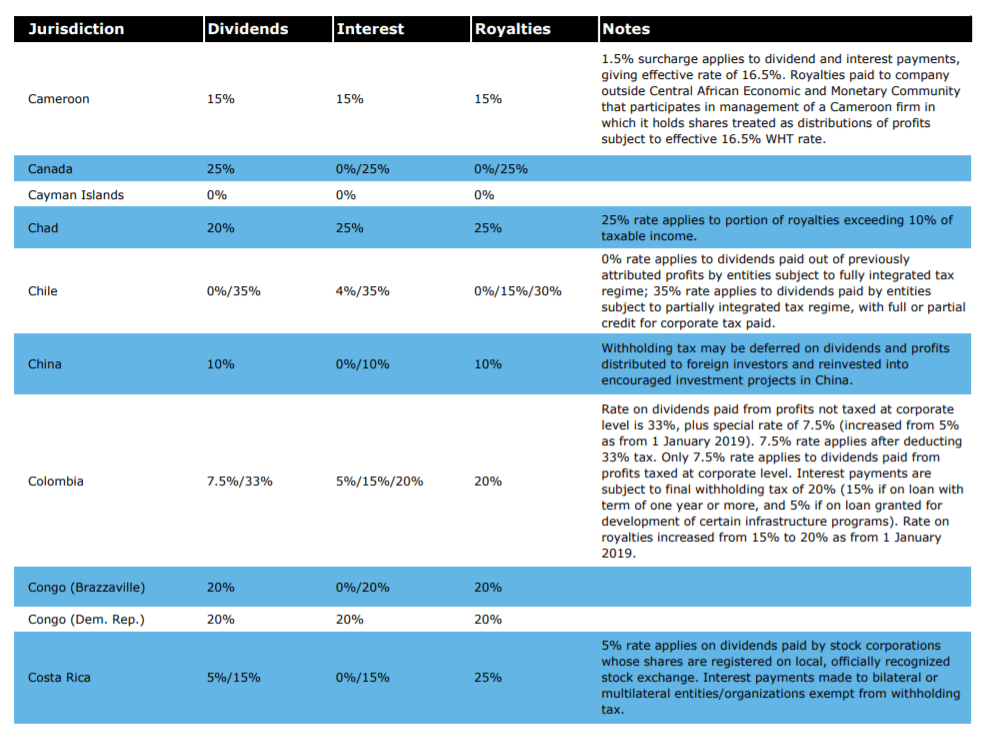

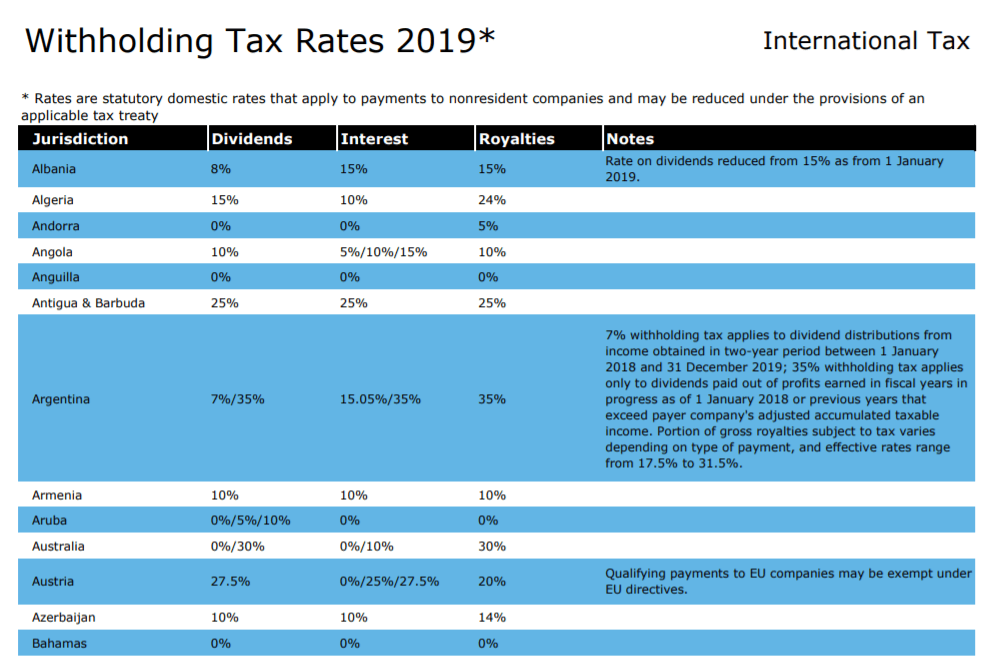

Withholding tax rate between canada and us. 3 Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax. As a result Canada will impose a maximum WHT rate of 25 on dividends interest and royalties until a new treaty enters into force. Withholding tax rates noted are those applied by Canada on certain payments to residents of selected countries with which it has signed international tax treaties.

TurboTax has been serving Canadians since 1993. Withholding tax rate charged to foreign investors on US. There is no withholding tax deducted from dividends received on shares of US.

Canadian withholding taxes 21. Dividends is 30 but this amount is reduced to 15 for taxable Canadian investors by a tax treaty between the US. A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen.

Certain exceptions modify the tax withholding rates shown in the table. Where a Canadian service provider provides services in the US a payor withholding agent generally must withhold 30 per cent on any payments to the service provider unless one of the following exemptions applies and the payor is provided with a properly completed withholding certificate. In that article states.

Corporations even when they are in an RRSP. International tax treaty rates 1 1 This table provides general information and should not replace a careful review of any particular treaty. For other republics that comprise the former USSR the status of the former treaty with the USSR is uncertain.

Corporations held in an RRSP as per the Tax Treaty between Canada and the US Article XXI paragraph 2a. Certain exceptions modify the tax rates. You have to add the US.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. You have to pay the higher Canadian tax rate on the income in full. Withholding tax from your Canadian tax on that income.

It is the 1 selling tax preparation software across the country. 4 Dividends subject to Canadian withholding tax include taxable dividends other than capital gains dividends paid by certain entities and capital dividends. These withholding taxes paid by the.

Taxes were withheld there is not a tax credit to apply against the income. Income to your Canadian tax return and pay Canadian tax on it. Updated to August 1 2015 Country Interest.

All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends interest and royalties. If you own a US. Bond as a Canadian resident there will be 10 withholding.

Canada will tax you on your worldwide income including your US. Introduction The rate of Canadian tax applicable to payments made to non-residents of Canada can vary depending upon factors such as. Withholding tax on interest paid between Canadian and US residents will be eliminated.

See 3 also. For arms-length interest the change will be effective for amounts paid or credited on the first day of the second month after the month in which the Protocol comes into force. Stock as a Canadian resident there will be 15 withholding tax on any dividends earned.

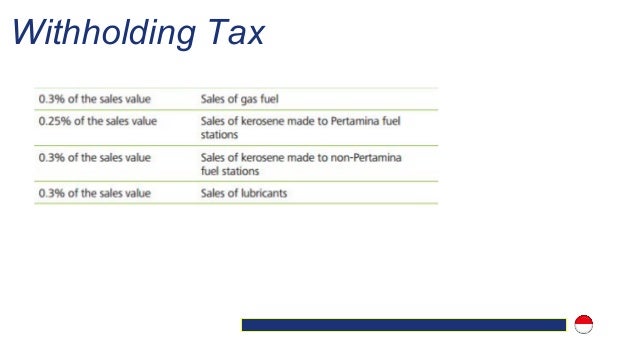

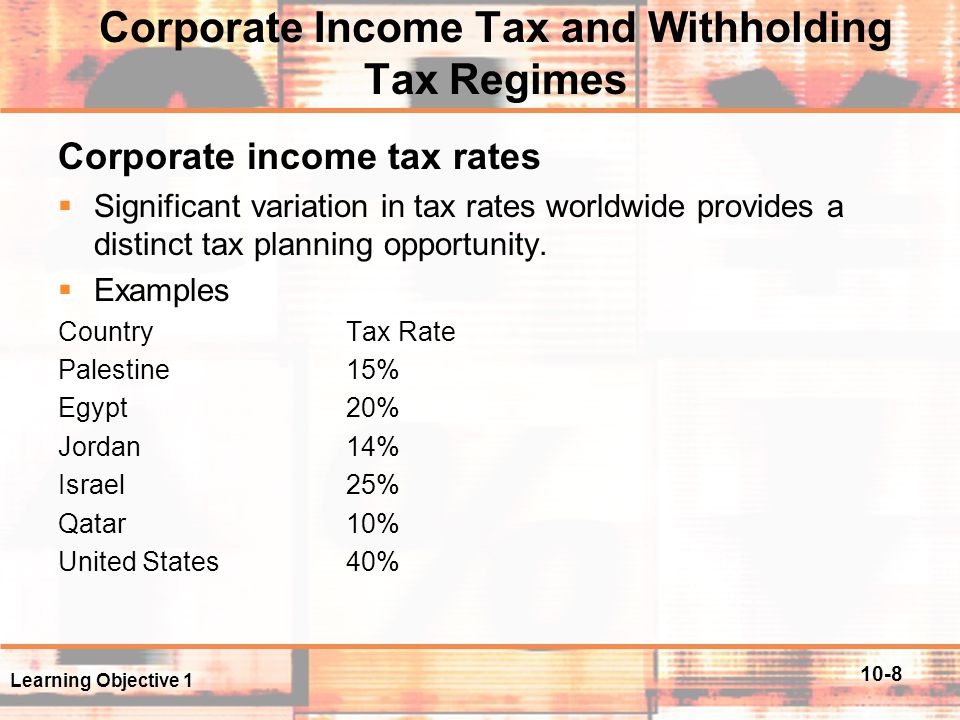

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. The type of payment eg interest dividends or trust income the rate of tax applicable to that type of payment under Canadian. International tax treaty rates 1 1 Withholding tax rates applied by Canada to certain payments to residents of selected countries with which it has signed international tax treaties.

So if you own a US. Stock as a Canadian resident there will be 15. You must meet all of the treaty requirements before the item of income can be exempt from US.

Unfortunately since no US. Feb 2019 This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. As a resident of Canada under the treaty you can claim a reduced withholding rate from the United States on the dividend income 15 rather than 30 and Canada generally allows you to deduct the US.

The treaty requires 15 tax withholding on dividends and 10 tax withholding on interest. Sometimes withholding tax at varying rates depending on the country is deducted from dividends paid by foreign non-US. There will be a phased-in elimination for interest between related persons from the current rate of 10 to 7 for amounts paid.

See the relevant statutory provisions of the Act for specific exemptions from the withholding tax.

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Is Dividend Withholding Tax Important In Investing Investment Moats

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Understanding Us Dividend Withholding Tax In Tfsa Rrsp Youtube

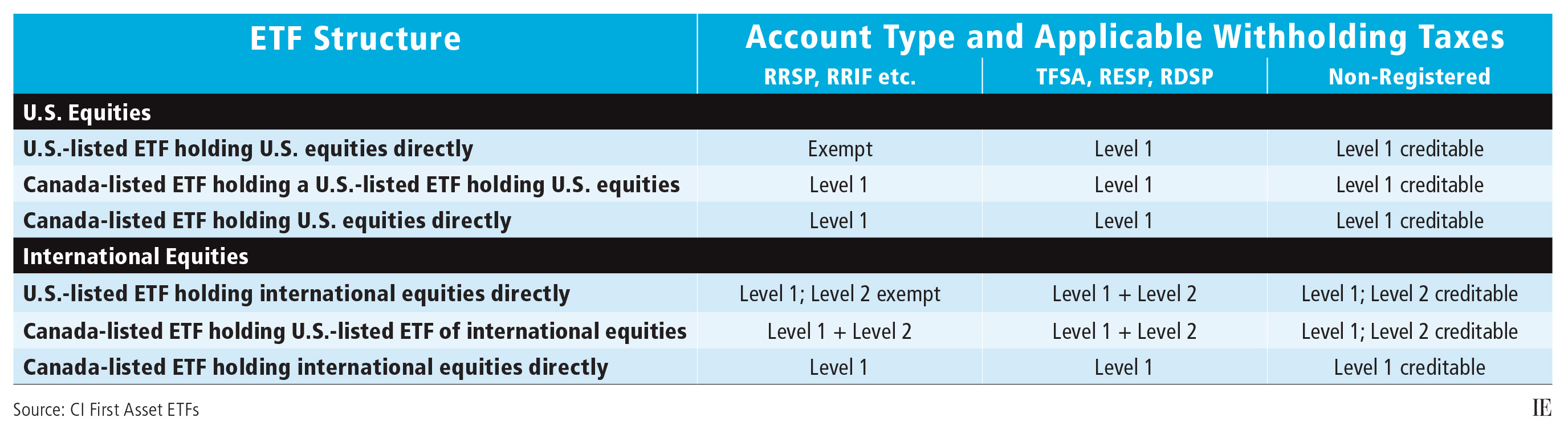

Etfs And Foreign Withholding Taxes Investment Executive

Global Corporate And Withholding Tax Rates Tax Deloitte

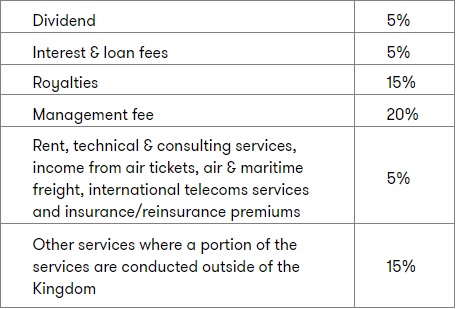

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

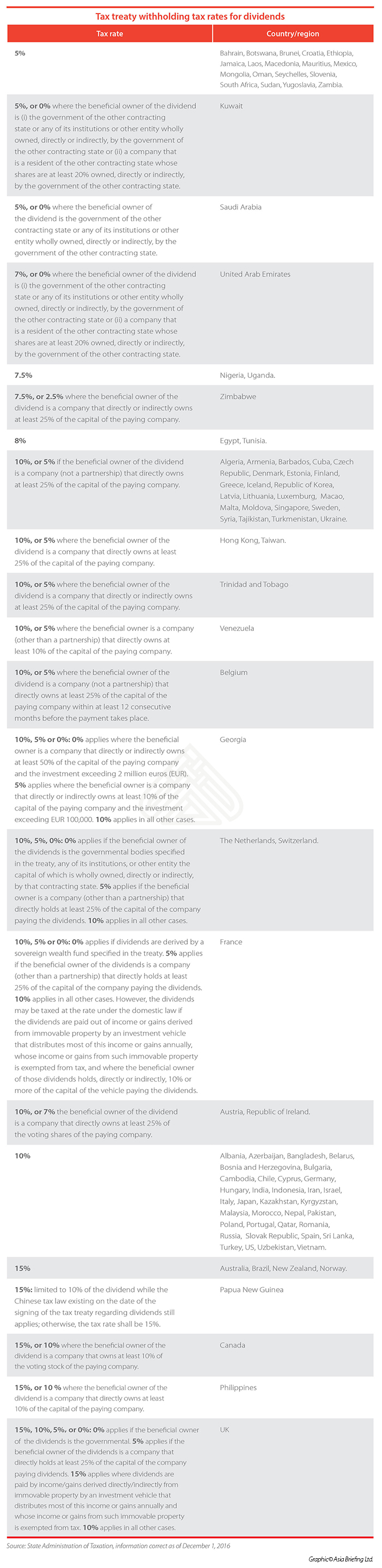

Withholding Tax In China China Briefing News

Global Corporate And Withholding Tax Rates Tax Deloitte

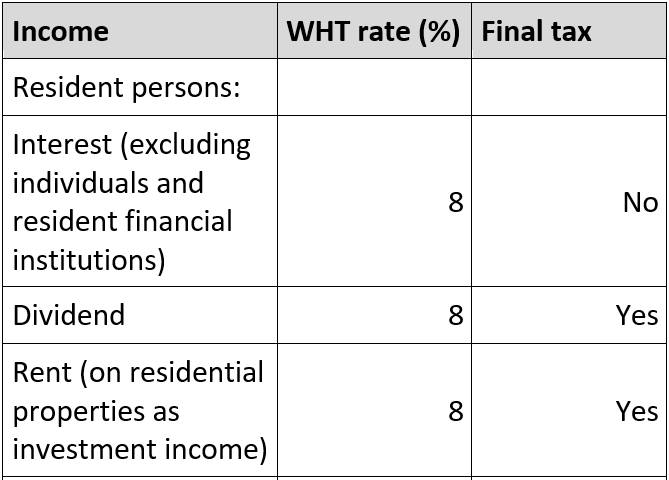

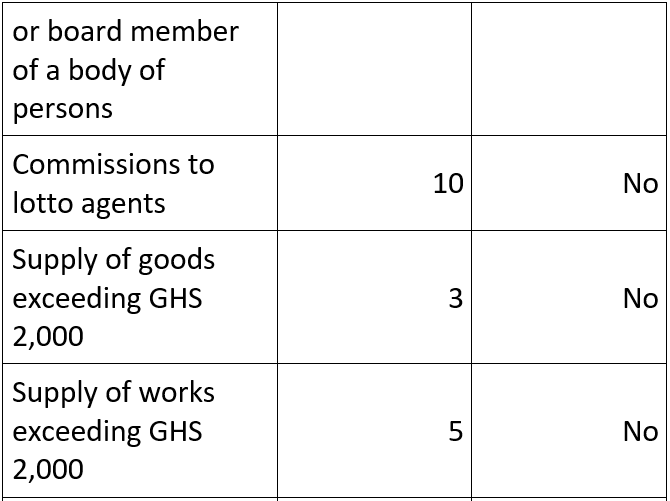

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Countrywise Withholding Tax Rates Chart As Per Dtaa

Panama Tax Treaties Tax Panama

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Post a Comment for "Withholding Tax Rate Between Canada And Us"